266 Reading: New Classical Economics and Rational Expectations

New Classical Economics and Rational Expectations

Much of the difficulty policy makers encountered during the decade of the 1970s resulted from shifts in aggregate supply. Keynesian economics and, to a lesser degree, monetarism had focused on aggregate demand. As it became clear that an analysis incorporating the supply side was an essential part of the macroeconomic puzzle, some economists turned to an entirely new way of looking at macroeconomic issues.

These economists started with a focus on individuals and their decisions. Keynesian economics employed aggregate analysis and paid little attention to individual choices. Monetarist doctrine was based on the analysis of individuals’ maximizing behavior with respect to money demand, but it did not extend that analysis to decisions that affect aggregate supply. The new approach aimed at an analysis of how individual choices would affect the entire spectrum of economic activity.

These economists rejected the entire framework of conventional macroeconomic analysis. Indeed, they rejected the very term. For them there is no macroeconomics, nor is there something called microeconomics. For them, there is only economics, which they regard as the analysis of behavior based on individual maximization. The analysis of the determination of the price level and real GDP becomes an application of basic economic theory, not a separate body of thought. The approach to macroeconomic analysis built from an analysis of individual maximizing choices is called new classical economics.

New Classical Economics

Like classical economic thought, new classical economics focuses on the determination of long-run aggregate supply and the economy’s ability to reach this level of output quickly. But the similarity ends there. Classical economics emerged in large part before economists had developed sophisticated mathematical models of maximizing behavior. The new classical economics puts mathematics to work in an extremely complex way to generalize from individual behavior to aggregate results.

Because the new classical approach suggests that the economy will remain at or near its potential output, it follows that the changes we observe in economic activity result not from changes in aggregate demand but from changes in long-run aggregate supply. New classical economics suggests that economic changes don’t necessarily imply economic problems.

New classical economists pointed to the supply-side shocks of the 1970s, both from changes in oil prices and changes in expectations, as evidence that their emphasis on aggregate supply was on the mark. They argued that the large observed swings in real GDP reflected underlying changes in the economy’s potential output. The recessionary and inflationary gaps that so perplexed policy makers during the 1970s were not gaps at all, the new classical economists insisted. Instead, they reflected changes in the economy’s own potential output.

Rational Expectations

Two particularly controversial propositions of new classical theory relate to the impacts of monetary and of fiscal policy. Both are implications of the rational expectations hypothesis, which assumes that individuals form expectations about the future based on the information available to them, and that they act on those expectations.

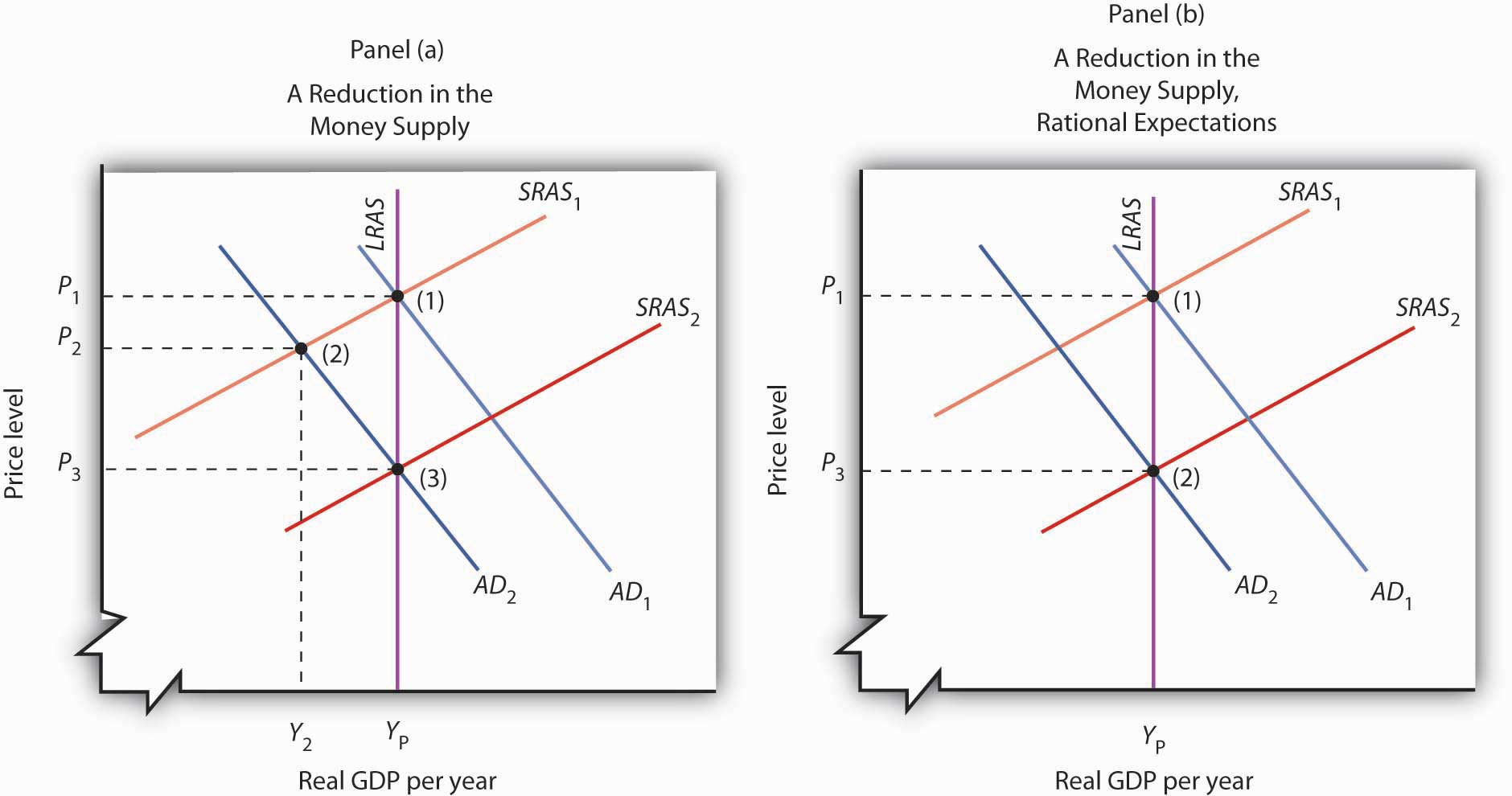

The rational expectations hypothesis suggests that monetary policy, even though it will affect the aggregate demand curve, might have no effect on real GDP. This possibility, which was suggested by Robert Lucas, is illustrated in Figure 17.9 “Contractionary Monetary Policy: With and Without Rational Expectations.” Suppose the economy is initially in equilibrium at point 1 in Panel (a). Real GDP equals its potential output, YP. Now suppose a reduction in the money supply causes aggregate demand to fall to AD2. In our model, the solution moves to point 2; the price level falls to P2, and real GDP falls to Y2. There is a recessionary gap. In the long run, the short-run aggregate supply curve shifts to SRAS2, the price level falls to P3, and the economy returns to its potential output at point 3.

The new classical story is quite different. Consumers and firms observe that the money supply has fallen and anticipate the eventual reduction in the price level to P3. They adjust their expectations accordingly. Workers agree to lower nominal wages, and the short-run aggregate supply curve shifts to SRAS2. This occurs as aggregate demand falls. As suggested in Panel (b), the price level falls to P3, and output remains at potential. The solution moves from (1) to (2) with no loss in real GDP.

In this new classical world, there is only one way for a change in the money supply to affect output, and that is for the change to take people by surprise. An unexpected change cannot affect expectations, so the short-run aggregate supply curve does not shift in the short run, and events play out as in Panel (a). Monetary policy can affect output, but only if it takes people by surprise.

The new classical school offers an even stronger case against the operation of fiscal policy. It argues that fiscal policy does not shift the aggregate demand curve at all! Consider, for example, an expansionary fiscal policy. Such a policy involves an increase in government purchases or transfer payments or a cut in taxes. Any of these policies will increase the deficit or reduce the surplus. New classical economists argue that households, when they observe the government carrying out a policy that increases the debt, will anticipate that they, or their children, or their children’s children, will end up paying more in taxes. And, according to the new classical story, these households will reduce their consumption as a result. This will, the new classical economists argue, cancel any tendency for the expansionary policy to affect aggregate demand.

Self Check: New Classical Economics and Rational Expectations

Answer the question(s) below to see how well you understand the topics covered in the previous section. This short quiz does not count toward your grade in the class, and you can retake it an unlimited number of times.

You’ll have more success on the Self Check if you’ve completed the Reading in this section.

Use this quiz to check your understanding and decide whether to (1) study the previous section further or (2) move on to the next section.

https://assessments.lumenlearning.com/assessments/575