Reading: HealthCare System in the US

The United States (US) has a population of over 330 million people and is supported by one of the most complex healthcare systems in the world, formed by intertwining relationships between providers, payers, and patients receiving care. The US healthcare system is in a constant state of evolution.

Description of the Healthcare System

Coverage Overview

The US healthcare system does not provide universal coverage and can be defined as a mixed system, where publicly financed government Medicare and Medicaid (discussed here) health coverage coexists with privately financed (private health insurance plans) market coverage. Out-of-pocket payments and market provision of coverage predominate as a means of financing and providing healthcare. As of 2019, around 50% of citizens received private insurance coverage through their employer (group insurance), 6% received private insurance through health insurance marketplaces (nongroup insurance) (discussed here), 20% of citizens relied on Medicaid, 14% on Medicare, and 1% on other public forms of insurance (eg, Veterans Health Administration [VHA] and Military Health Service [MHS]), leaving 9% of Americans uninsured.

Healthcare Financing

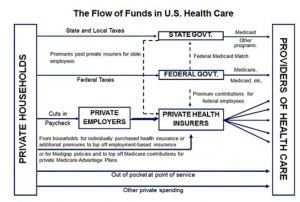

Note that this section is intended to give an overview of how healthcare financing works in the United States. For a more in-depth description of the stakeholders, utilize the hyperlinks to learn more. An overview of the financial flow of the US healthcare system is presented in Figure 1.

Figure 1. Financial Flow of the US Healthcare System (from Reinhardt UE. The Money Flow From Household to Health Care Providers (2011))

Hospital and Physician Financing

Public and private hospitals receive payment from both public and private financing sources. Hospitals are typically paid through a diagnostic-related group (DRG), which assigns a set payment amount for a particular condition or treatment sequence. Inpatient DRGs are widely used by the Centers for Medicare & Medicaid Services (CMS) and by many private payers as a payment scheme for hospitals. Rather than paying the hospital for a line-item list of procedures and medications, Medicare pays the hospital a fixed amount based on the DRG, regardless of the actual cost of treatment. The DRG-based payments cover accommodation costs in a hospital (ie, room and board, facility costs, etc), procedure costs, support staff (nurses, technicians, etc), and drug/medical device costs; however, this system does not include physician fees. In the outpatient setting, Ambulatory Payment Classification (APC) codes are used by the hospital system for billing and reimbursement. These APC codes represent a fee-for-service style of billing, rather than the capitated, cost-based style of DRGs.

Physician fees are not included within DRG (inpatient) or APC (outpatient) codes. When billing for physicians and other clinician fees, Current Procedural Terminology (CPT) codes are used and are billed under the name of the provider rather than the hospital. CPT codes may be used in both the inpatient and outpatient settings and are indicative of a fee-for-service healthcare reimbursement structure.

Private insurers pay hospitals based on DRGs, case rates, per diems, fee-for-service, and/or discounted fee-for-service schemes. On average, these payments exceed the hospital’s costs of providing the underlying services. Conversely, hospitals, on average, are reimbursed less than the costs of services for Medicare, Medicaid, and uninsured patients.

Private Insurance Plans

There are numerous national private health insurance plans, as well as regional and self-insured plans (organized by large companies). In the United States, it is common for employers to contribute to private insurance premiums, usually as monthly premiums to maintain health coverage, either in whole or part for their employees (group insurance). Some individuals also buy private health insurance for themselves (nongroup insurance) through the health insurance marketplace or “exchange.” Patients seeking nongroup insurance can qualify for tax credits based on household income. Insurers pay providers (hospital and clinicians) for health services according to contractually agreed-upon amounts. These payments often constitute large proportions of the total cost of service, especially when considering health insurance plans with low deductibles.

Public Insurance Programs

Public health insurance programs (eg, Medicare, Medicaid, and the Children’s Health Insurance Program [(CHIP]) are operated by CMS and are financed primarily by government taxes. Medicare is the largest single payer in the United States, providing healthcare coverage for those ages 65 years and older, regardless of income or medical history, and those under the age of 65 with permanent disabilities or end-stage renal disease. Medicaid provides care to individuals below the poverty level and to those who cannot afford to pay for healthcare given their eligibility and is jointly funded by both the federal government and individual states. Each state sets its own guidelines regarding eligibility, services, and reimbursement. It is possible to qualify for coverage under both Medicare and Medicaid and such individuals are considered to have dual eligibility. CHIP is a national health insurance program for children under 18 years of age who are not eligible for other insurance plans, including private insurance coverage. In addition to CMS, the VHA and MHS are responsible for providing healthcare coverage to veterans and active military.

Individual Financing

At the individual level, healthcare financing by patients with health insurance often includes copayments (fixed cost for a medical service or product) or coinsurance (a proportion of the total cost of the medical service or product). In addition to copayments or coinsurance, patients often have a deductible—a specified amount of money that the insured must pay before an insurance plan will pay for healthcare—and premiums. These patient costs are considered “out-of-pocket” spending. Patients without health insurance are forced to pay the complete cost for care, including what insurance companies would normally pay, out of pocket. The total out-of-pocket spending in 2019 was $406.5 billion; which correlates to 2019 estimates of roughly $1240 per capita in out-of-pocket spend.