The Nature of Bonds

A bond is an instrument of indebtedness of the bond issuer to the holders.

Learning Objectives

Distinguish the various types of bonds from other types of securities

Key Takeaways

Key Points

- A bond is an instrument of indebtedness of the bond issuer to the holders. The issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon) and/or to repay the principal at a later date, termed the maturity.

- Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure.

- Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in the company (i.e. they are owners), whereas bondholders have a creditor stake in the company (i.e. they are lenders).

Key Terms

- municipal bonds: A municipal bond is a bond issued by an American city or other local government, or their agencies.

- corporate bonds: A corporate bond is a bond issue by a corporation. It is a bond that a corporation issues to raise money effectively in order to expand its business.

- Treasury bonds: A United States Treasury bond is a government debt issued by the United States Department of the Treasury through the Bureau of the Public Debt, with a maturity of 20 years to 30 years.

Nature of Bonds

A bond is an instrument of indebtedness of the bond issuer to the holders, as such it is often referred to as a debt instrument. A bond is a debt security, under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon) and/or repay the principal at a later date, termed the maturity. Interest is usually payable at fixed intervals (semiannual, annual, sometimes monthly).

Bonds are issued by public authorities, credit institutions, companies, and supranational institutions in the primary market. Both individuals and companies can purchase bonds.

However, very often the bond is negotiable, i.e. the ownership of the instrument can be transferred in the secondary market.

Types of Bonds

The main categories of bonds are corporate bonds, municipal bonds, and U.S. Treasury bonds, notes, and bills, which are collectively referred to simply as “Treasuries. ” Two features of a bond – credit quality and duration – are the principal determinants of a bond’s interest rate. Bond maturities range from a 90-day Treasury bill to a 30-year government bond. Corporate and municipal bonds are typically in the three to 10-year range.

Overview of the Instrument

A bond is a form of loan: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. Certificates of deposits (CDs), or short term commercial papers, are considered to be money market instruments and not bonds: the main difference is in the instruments length of term.

Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in the company (they are owners), whereas bondholders have a creditor stake in the company (they are lenders). Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely. An exception is an irredeemable bond, such as Consols, which is a perpetuity, that is, a bond with no maturity.

Duration

Duration is the weighted average of the times until fixed cash flows of a financial asset are received.

Learning Objectives

Define the different types of duration

Key Takeaways

Key Points

- A good approximation for bond price changes due to yield is the duration, a measure for interest rate risk.

- The Macaulay duration is the name given to the weighted average time until cash flows are received and is measured in years. It really makes sense only for an instrument with fixed cash flows.

- The modified duration is the name given to the price sensitivity and is the percentage change in price for a unit change in yield. It really makes sense only for an instrument with fixed cash flows.

- The modified duration is a derivative (rate of change) or price sensitivity and measures the percentage rate of change of price with respect to yield. The concept of modified duration can be applied to interest-rate sensitive instruments with non-fixed cash flows.

Key Terms

- Convexity: As interest rates change, the price does not change linearly, but rather is a convex function of interest rates. Convexity is a measure of the curvature of how the price of a bond changes as the interest rate changes. Specifically, duration can be formulated as the first derivative of the price function of the bond with respect to the interest rate in question, and the convexity as the second derivative.

- Yield to maturity: The yield to maturity (YTM) of a bond or other fixed-interest security, such as gilts, is the internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity and that all coupon and principal payments will be made on schedule.

Duration

In finance, the duration of a financial asset that consists of fixed cash flows, for example a bond, is the weighted average of the times until those fixed cash flows are received. When an asset is considered as a function of yield, duration also measures the price sensitivity to yield, the rate of change of price with respect to yield, or the percentage change in price for a parallel shift in yields. Since cash flows for bonds are usually fixed, a price change can come from two sources: The passage of time (convergence towards par) which is predictable and a change in the yield.

The yield-price relationship is inverse and investors would ideally wish to have a measure of how sensitive the bond price is to yield changes. A good approximation for bond price changes due to yield is the duration, a measure for interest rate risk. For large yield changes convexity can be added to improve the performance of the duration. A more important use of convexity is that it measures the sensitivity of duration to yield changes.

Types of Durations

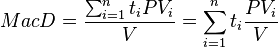

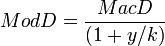

The dual use of the word “duration” in the Macaulay duration and the modified duration, as both the weighted average time until repayment and as the percentage change in price, often causes confusion. The Macaulay duration is the name given to the weighted average time until cash flows are received and is measured in years.

Where: i indexes the cash flows, PVi is the present value of the cash payment from an asset, ti is the time in years until the payment will be received, and V is the present value of all cash payments from the asset.

The Modified duration is the name given to the price sensitivity and is the percentage change in price for a unit change in yield.

Where: k is the compounding frequency per year (1 for annual, 2 for semi-annual, 12 for monthly, 52 for weekly, and so on), y is the is the yield to maturity for an asset.

When yields are continuously-compounded the Macaulay duration and the modified duration will be numerically equal. When yields are periodically-compounded the Macaulay duration and the modified duration will differ slightly and in this case there is a simple relation between the two. The modified duration is used more than the Macaulay duration.

The Macaulay duration and the modified duration are both termed “duration” and have the same (or close to the same) numerical value, but it is important to keep in mind the conceptual distinctions between them. The Macaulay duration is a time measure with units in years and really makes sense only for an instrument with fixed cash flows. For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond.

The modified duration, on the other hand, is a derivative (rate of change) or price sensitivity and measures the percentage rate of change of price with respect to yield. The concept of modified duration can be applied to interest-rate sensitive instruments with non-fixed cash flows and can thus be applied to a wider range of instruments than can the Macaulay duration. For everyday use, the equality (or near-equality) of the values for the Macaulay duration and the modified duration can be a useful aid to intuition.

Indenture

A bond indenture is a legal contract issued to lenders that defines commitments and responsibilities of the seller and the buyer.

Learning Objectives

Review the rights and responsibilities of parties to a bond

Key Takeaways

Key Points

- Terms of indentures include the interest rate, maturity date, repayment dates, convertibility, pledge, promises, representations, covenants, and other terms of the bond offering.

- A bond indenture is held by a trustee. If the company fails to live up to the terms of the bond indenture, the trustee may bring legal action against the company on behalf of the bondholders.

- The offering memorandum, also known as a prospectus, is a document that describes a financial security for potential buyers.

Key Terms

- convertibility: Quality of a bond that allows the holder to convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price.

- indenture: a document, written as duplicates separated by indentations, specifying such a contract

- public debt offerings: A public debt offering is the offering of debt securities of a government, a company or a similar corporation to the public.

A bond indenture (also called a trust indenture or deed of trust) is a legal contract issued to lenders. The specifications given within the bond indenture define the responsibilities and commitments of the seller as well as those of the buyer by describing key terms such as the interest rate, maturity date, repayment dates, convertibility, pledge, promises, representations, covenants, and other terms of the bond offering. Failure to meet the payment requirements calls for drastic penalties, including liquidation of the issuer ‘s assets.

Because it would be impractical for the corporation to enter into a direct agreement with each of the many bondholders, the bond indenture is held by a trustee – usually a commercial bank or other financial institution – appointed by the issuing firm to represent the rights of the bondholders. The issuer of a bond will use the indenture to describe detail about the issuer and the bond trustee for interested investors to research the background of the bond issue. This is to ensure that the bondholder has a clear idea of when to expect interest payments, as well as whom to contact if he or she has questions or concerns. If the company fails to live up to the terms of the bond indenture, the trustee may bring legal action against the company on behalf of the bondholders.

When the offering memorandum is prepared in advance of marketing a bond, the indenture will typically be summarized in the “description of notes” section. This offering memorandum, also known as a prospectus, is a document that describes a financial security for potential buyers. A prospectus commonly provides investors with material information about mutual funds, stocks, bonds, and other investments, such as a description of the company’s business, financial statements, biographies of officers and directors, detailed information about their compensation, any litigation that is taking place, a list of material properties, and any other material information.

In the United States, public debt offerings in excess of $10 million require the use of an indenture of trust under the Trust Indenture Act of 1939. The rationale for this is that it is necessary to establish a collective action mechanism under which creditors can collect in a fair, orderly manner if default takes place (like that which occurs during bankruptcy).

Ratings

Bond credit rating agencies assess and report the credit worthiness of a corporation’s or government’s debt issues.

Learning Objectives

Use the ratings system to assess the risk associated with different bonds

Key Takeaways

Key Points

- Ratings play a critical role in determining how much companies and other entities that issue debt, including sovereign governments, have to pay to access credit markets; for example, the amount of interest they pay on their issued debt.

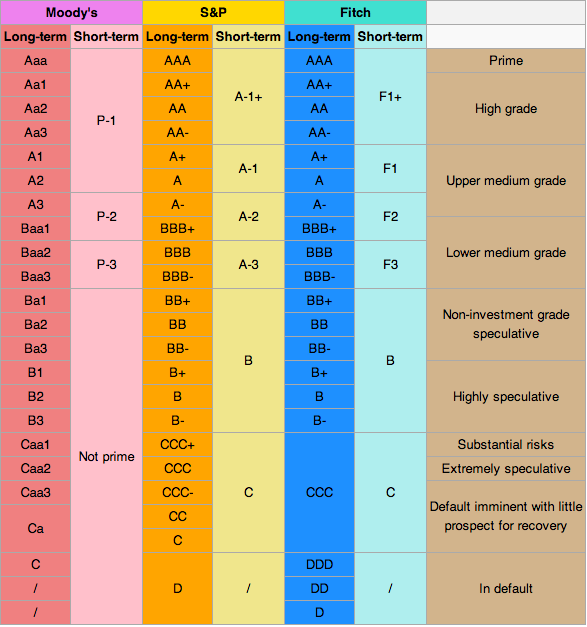

- The ratings are assigned by credit rating agencies such as Moody’s, Standard & Poor’s, and Fitch. Ratings to have letter designations (such as AAA, B, CC), which represent the quality of a bond.

- A bond is considered investment -grade (IG) if its credit rating is BBB- or higher by Standard & Poor’s, or Baa3 or higher by Moody’s, or BBB(low) or higher by DBRS. Bond ratings below BBB/Baa are not considered to be investment grade; such bonds are called junk bonds.

Key Terms

- credit rating agencies: A credit rating agency (CRA) is a company that assigns credit ratings to issuers of certain types of debt obligations, as well as to the debt instruments themselves.

Ratings Overview

In investment, the bond credit rating assesses the credit worthiness of a corporation ‘s or government’s debt issue. The credit rating is analogous to a credit rating for individuals. The “quality” of the issue refers to the probability that the bondholders will receive the amounts promised on the due dates.

The credit rating is a financial indicator to potential investors of debt securities, such as bonds. Ratings play a critical role in determining the amount that companies (and other entities that issue debt, including sovereign governments) have to pay to access credit markets; for example, the amount of interest that must be paid on issued debt. The ratings are assigned by credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch Ratings, and are given in letter designations (AAA, B, CC), which represent the quality of a bond. Generally they are bonds that are judged by the rating agency as likely enough to meet payment obligations; banks are thus allowed to invest in them. “”

Investment-grade Bonds

A bond is considered investment-grade, or IG, if its credit rating is BBB- or higher by Standard & Poor’s, or Baa3 or higher by Moody’s, or BBB(low) or higher by DBRS.

Bond ratings below BBB/Baa are not considered to be investment-grade; these bonds are called junk bonds. Junk bonds are also called high- yield bonds. These are bonds that are rated below investment grade by the credit rating agencies. As these bonds are more risky than investment grade bonds, investors expect them to earn a higher yield. The threshold between investment-grade and speculative-grade ratings has important market implications for issuers ‘ borrowing costs.

The risks associated with investment-grade bonds (or investment-grade corporate debt) are considered significantly higher than those associated with first-class government bonds. The difference between rates for first-class government bonds and investment-grade bonds is called “investment-grade spread. ” The range of this spread is an indicator of the market’s belief in the stability of the economy. The higher these investment-grade spreads (or risk premiums) are, the weaker the economy is considered.

Rating Agency Criticism

Until the early 1970s, bond credit ratings agencies were paid for their work by investors who wanted impartial information on the credit worthiness of securities issuers and their particular offerings. Starting in the early 1970s, the “Big Three” ratings agencies (S&P, Moody’s, and Fitch) began to receive payment for their work by the securities issuers for whom they issued ratings, which led to current charges that these ratings agencies can no longer always be impartial when issuing ratings for securities issuers. Securities issuers have been accused of “shopping” for the best ratings from S&P, Moody’s, and Fitch, in order to attract investors, until at least one of the agencies delivers favorable ratings.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- Bond (finance). Provided by: Wikipedia. Located at: https://en.wikipedia.org/wiki/Bond_(finance). License: CC BY-SA: Attribution-ShareAlike

- Treasury bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- municipal bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- corporate bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Vereinigte Ostindische Compagnie bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Duration (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Convexity. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Yield to maturity. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Vereinigte Ostindische Compagnie bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Bond indenture. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Prospectus (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- public debt offerings. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- indenture. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- convertibility. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Vereinigte Ostindische Compagnie bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Indenture 1723. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- Bond rating. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Bond (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- credit rating agencies. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Vereinigte Ostindische Compagnie bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Duration (finance). Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Indenture 1723. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- Bond rating. Provided by: Wikipedia. License: Public Domain: No Known Copyright