Government Bonds

A government bond is a bond issued by a national government denominated in the country’s domestic currency.

Learning Objectives

Analyze the risks and characteristics of government bonds

Key Takeaways

Key Points

- A government bond is a bond issued by a national government, generally promising to pay a certain amount (the face value) on a certain date, as well as periodic interest payments. Such bonds are often denominated in the country’s domestic currency.

- In the primary market, Government Bonds are often issued via auctions at Stock Exchanges. In the secondary market, government bonds are traded at Stock Exchanges.

- Although, government bonds are usually referred to as risk -free, there are currency, inflation, and default risks for government bondholders.

Key Terms

- purchasing power parity: a theory of long-term equilibrium exchange rates based on relative price levels of two countries

- purchasing power: Purchasing power (sometimes retroactively called adjusted for inflation) is the amount of goods or services that can be purchased with a unit of currency.

A government bond is a bond issued by a national government, generally promising to pay a certain amount (the face value) on a certain date as well as periodic interest payments. Such bonds are often denominated in the country’s domestic currency. Government bonds are sometimes regarded as risk-free bonds because national governments can raise taxes or reduce spending up to a certain point. In many cases, they “print more money” to redeem the bond at maturity. Most developed country governments are prohibited by law from printing money directly, that function having been relegated to their central banks. However, central banks may buy government bonds in order to finance government spending, thereby monetizing the debt.

Bonds issued by national governments in foreign currencies are normally referred to as sovereign bonds. Investors in sovereign bonds denominated in foreign currency have the additional risk that the issuer may be unable to obtain foreign currency to redeem the bonds. For example, in the 2010 Greek debt crisis the debt was held by Greece in Euros. One proposed solution was for Greece to go back to issuing its own Drachma.

In the primary market, Government Bonds are often issued via auctions at Stock Exchanges. There are several different methods of issuing such as auctions, including guarantee, combined auction and guarantee, and others. There are two types of interest rates: fixed and floating. In the secondary market, government bonds are traded at Stock Exchanges. Unlikely equity system, the bond secondary market uses a completely different system with different method of trading. At the secondary market, each bond will be assigned with very own bond code (ISIN code).

Government bonds are usually referred to as risk-free bonds because the government can raise taxes or create additional currency in order to redeem the bond at maturity. Some counter examples do exist where a government has defaulted on its domestic currency debt, such as Russia in 1998 (the “ruble crisis”), although this is very rare (see national bankruptcy). Another example is Greece in 2011. Its bonds were considered very risky, in part because Greece did not have its own currency.

There is currency risk for government bondholders. As an example, in the U.S., Treasury securities are denominated in U.S. dollars. In this instance, the term “risk-free” means free of credit risk. However, other risks still exist, such as currency risk for foreign investors (for example non-U.S. investors of U.S. Treasury securities would have received lower returns in 2004 because the value of the U.S. dollar declined against most other currencies). Secondly, there is inflation risk, in that the principal repaid at maturity will have less purchasing power than anticipated if the inflation rate is higher than expected. Many governments issue inflation-indexed bonds, which protect investors against inflation risk by increasing the interest rate given to the investor as the inflation rate of the economy increases.

Zero-Coupon Bonds

A zero-coupon bond is a bond with no coupon payments, bought at a price lower than its face value, with the face value repaid at the time of maturity.

Learning Objectives

Distinguish zero coupon bonds from other types

Key Takeaways

Key Points

- Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating (“stripping off”) the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately.

- Zero coupon bonds have a duration equal to the bond’s time to maturity, which makes them sensitive to any changes in the interest rates.

- Pension funds and insurance companies like to own long maturity zero-coupon bonds since these bonds’ prices are particularly sensitive to changes in the interest rate and, therefore, offset or immunize the interest rate risk of these firms’ long-term liabilities.

Key Terms

- Pension funds: A pension fund is any plan, fund, or scheme which provides retirement income.

- immunize: In finance, interest rate immunization is a strategy that ensures that a change in interest rates will not affect the value of a portfolio. Similarly, immunization can be used to ensure that the value of a pension fund’s or a firm’s assets will increase or decrease in exactly the opposite amount of their liabilities, thus leaving the value of the pension fund’s surplus or firm’s equity unchanged, regardless of changes in the interest rate.

Zero coupon bonds were first introduced in 1960s, but they did not become popular until the 1980s. A zero-coupon bond (also called a ” discount bond” or “deep discount bond”) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called “coupons,” hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include U.S. Treasury bills, U.S. savings bonds, and long-term zero-coupon bonds.

Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating (“stripping off”) the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately. Investment banks or dealers separate coupons from the principal of coupon bonds, which is known as the “residue,” so that different investors may receive the principal and each of the coupon payments. This creates a supply of new zero coupon bonds. The coupons and residue are sold separately to investors. Each of these investments then pays a single lump sum. This method of creating zero coupon bonds is known as stripping, and the contracts are known as strip bonds. “STRIPS” stands for Separate Trading of Registered Interest and Principal Securities.

Zero coupon bonds may be long- or short-term investments. Long-term zero coupon maturity dates typically start at 10 to 15 years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. The U.S. Treasury bill market is the most active and liquid debt market in the world.

Zero coupon bonds have a duration equal to the bond’s time to maturity, which makes them sensitive to any changes in the interest rates. The impact of interest rate fluctuations on strip bonds is higher than for a coupon bond.

Pension funds and insurance companies like to own long maturity zero-coupon bonds because of the bonds’ high duration. This high duration means that these bonds’ prices are particularly sensitive to changes in the interest rate and, therefore, offset or immunize the interest rate risk of these firms’ long-term liabilities.

Floating-Rate Bonds

Floating rate bonds are bonds that have a variable coupon equal to a money market reference rate (e.g., LIBOR), plus a quoted spread.

Learning Objectives

Describe a floating-rate bond

Key Takeaways

Key Points

- FRBs are typically quoted as a spread over the reference rate. At the beginning of each coupon period, the coupon is calculated by taking the fixing of the reference rate for that day and adding the spread. A typical coupon would look like three months USD LIBOR +0.20%.

- FRBs carry little interest rate risk. A FRB has a duration close to zero, and its price shows very low sensitivity to changes in market rates. As FRBs are almost immune to interest rate risk. The risk that remains is a credit risk.

- Securities dealers make markets in FRBs. They are traded over the counter, instead of on a stock exchange. In Europe, most FRBs are liquid, as the biggest investors are banks. In the United States, FRBs are mostly held to maturity, so the markets aren’t as liquid.

Key Terms

- LIBOR: The London Interbank Offered Rate is the average interest rate estimated by leading banks in London that they would be charged if borrowing from other banks.

- duration: A measure of the sensitivity of the price of a financial asset to changes in interest rates, computed for a simple bond as a weighted average of the maturities of the interest and principal payments associated with it

- floating-rate bond: a debt instruments with a variable coupon.

Floating rate bonds (FRBs) are bonds that have a variable coupon, equal to a money market reference rate, like LIBOR or federal funds rate, plus a quoted spread (i.e., quoted margin). The spread is a rate that remains constant. Almost all FRBs have quarterly coupons (i.e., they pay out interest every three months), though counter examples do exist. At the beginning of each coupon period, the coupon is calculated by taking the fixing of the reference rate for that day and adding the spread. A typical coupon would look like three months USD LIBOR +0.20%.

In the United States, government sponsored enterprises (GSEs), such as the Federal Home Loan Banks, the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac), are important issuers. In Europe, the main issuers are banks.

There are many variations of floating-rate bonds. For instance, some FRBs have special features, such as maximum or minimum coupons, called “capped FRBs” and “floored FRBs. ” Those with both minimum and maximum coupons are called collared FRBs. Perpetual FRBs are another form of FRBs that are also called irredeemable or unrated FRBs and are akin to a form of capital. FRBs can also be obtained synthetically by the combination of a fixed rate bond and an interest rate swap. This combination is known as an “asset swap. ”

FRBs carry little interest rate risk. A FRB has a duration close to zero, and its price shows very low sensitivity to changes in market rates. When market rates rise, the expected coupons of the FRB increase in line with the increase in forward rates, which means its price remains constant. Thus, FRBs differ from fixed rate bonds, whose prices decline when market rates rise. As FRBs are almost immune to interest rate risk, they are considered conservative investments for investors who believe market rates will increase. The risk that remains is credit risk.

Securities dealers make markets in FRBs. They are traded over the counter, instead of on a stock exchange. In Europe, most FRBs are liquid, as the biggest investors are banks. In the United States, FRBs are mostly held to maturity, so the markets aren’t as liquid. In the wholesale markets, FRBs are typically quoted as a spread over the reference rate.

Other Types of Bonds

Other bonds include register vs. bearer bonds, convertible bonds, exchangeable bonds, asset-backed securities, and foreign currency bonds.

Learning Objectives

Classify the different types of bonds

Key Takeaways

Key Points

- Bonds directly linked to interest rates include fixed rate bonds, floating rate bonds, and zero coupon bonds.

- Convertible bonds are bonds that let a bondholder exchange a bond to a number of shares of the issuer ‘s common stock. Exchangeable bonds allows for exchange to shares of a corporation other than the issuer.

- Asset -backed securities are bonds whose interest and principal payments are backed by underlying cash flows from other assets.

- Subordinated bonds are those that have a lower priority than other bonds of the issuer in case of liquidation.

- Foreign currency bonds are issued by companies, banks, governments, and other sovereign entities in foreign currencies, as it may appear to be more stable and predictable than their domestic currency.

Key Terms

- LIBOR: The London Interbank Offered Rate is the average interest rate estimated by leading banks in London that they would be charged if borrowing from other banks.

- tranches: One of a number of related securities offered as part of the same transaction.

- gross domestic product: A measure of the economic production of a particular territory in financial capital terms over a specific time period.

General Categorization

Based on coupon interest rates, bonds can be classified into

- Fixed rate bonds

- Floating rate bonds

- Zero-coupon bonds

Fixed rate bonds have a coupon that remains constant throughout the life of the bond. A variation is a stepped-coupon bonds, whose coupon increases during the life of the bond.

Floating rate notes (FRNs, floaters) have a variable coupon that is linked to a reference rate of interest, such as LIBOR or Euribor. For example the coupon may be defined as three month USD LIBOR + 0.20%. The coupon rate is recalculated periodically, typically every one or three months.

Zero-coupon bonds pay no regular interest. They are issued at a substantial discount to par value, so that the interest is effectively rolled up to maturity (and usually taxed as such). The bondholder receives the full principal amount on the redemption date. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating (“stripping off”) the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately.

Additional Types

There are additional special classes of bonds, including:

Inflation linked bonds (linkers) are those in which the principal amount and the interest payments are indexed to inflation. It is one type of floating rate bond. The interest rate is normally lower than for fixed rate bonds, with a comparable maturity. However, as the principal amount grows, the payments increase with inflation. Treasury Inflation-Protected Securities (TIPS) and I-bonds are examples of inflation linked bonds issued by the U.S. government. There are also other indexed bonds. For example equity-linked notes and bonds indexed on a business indicator (income, added value) or on a country’s gross domestic product (GDP).

Convertible bonds are bonds that let a bondholder exchange a bond for a number of shares of the issuer’s common stock. Exchangeable bonds allows for exchange to shares of a corporation other than the issuer.

Asset-backed securities are bonds whose interest and principal payments are backed by underlying cash flows from other assets. Examples of asset-backed securities are mortgage-backed securities (MBS’s), collateralized mortgage obligations (CMOs), and collateralized debt obligations (CDOs).

Subordinated bonds are those that have a lower priority than other bonds of the issuer in case of liquidation. In case of bankruptcy, there is a hierarchy of creditors. First the liquidator is paid, then government taxes, etc. The first bond holders in line to be paid are those holding what is called senior bonds. After they have been paid, the subordinated bond holders are paid. As a result, the risk is higher. Therefore, subordinated bonds usually have a lower credit rating than senior bonds. The main examples of subordinated bonds can be found in bonds issued by banks and asset-backed securities. The latter are often issued in tranches. The senior tranches get paid back first, the subordinated tranches later.

Perpetual bonds are also often called perpetuities or “perps. ” They have no maturity date. The most famous of these are the UK Consols, which are also known as Treasury Annuities or Undated Treasuries.

A registered bond is a bond whose ownership (and any subsequent purchaser) is recorded by the issuer or by a transfer agent. It is the alternative to a bearer bond. Interest payments, and the principal upon maturity, are sent to the registered owner. On the contrary, a bearer bond is an official certificate issued without a named holder. In other words, the person who has the paper certificate can claim the value of the bond. Often they are registered by a number to prevent counterfeiting, but may be traded like cash. Bearer bonds are very risky because they can be lost or stolen. Especially after federal income tax began in the United States, bearer bonds were seen as an opportunity to conceal income or assets.

A serial bond is a bond that matures in installments over a period of time. In effect, a $100,000, 5-year serial bond would mature in a $20,000 annuity over a 5-year interval.

Some companies, banks, governments, and other sovereign entities may decide to issue bonds in foreign currencies because it may appear to be more stable and predictable than their domestic currency. Issuing bonds denominated in foreign currencies also gives issuers the ability to access investment capital available in foreign markets. Some examples include:

- Eurodollar bond – U.S. dollar-denominated bond issued by a non-U.S. (European) entity.

- U.S. Yankee bond – a US dollar-denominated bond issued by a non-U.S. entity in the U.S. market.

- Samurai bond – a Japanese yen-denominated bond issued by a non-Japanese entity in the Japanese market.

- Bulldog bond – a pound-sterling-denominated bond issued in England by a foreign institution or government.

- Kimchi bond – a Korean won-denominated bond issued by a non-Korean entity in the Korean market.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- Government debt. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Government bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- purchasing power parity. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- purchasing power. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

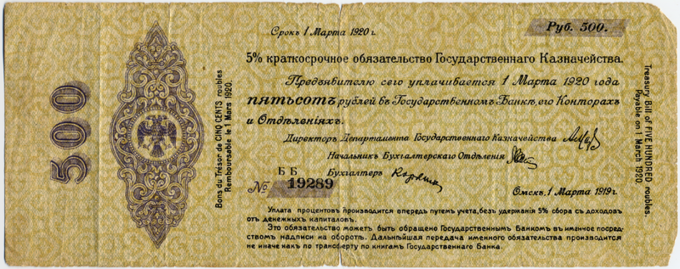

- Russia-Kolchak-1919-Bonds-500-Obverse. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- Bond (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Zero-coupon bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Pension funds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- immunize. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Russia-Kolchak-1919-Bonds-500-Obverse. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- SMAC bond Sarafov. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- Floating-rate bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Floating rate note. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- duration. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- LIBOR. Provided by: Wikipedia. Located at: https://en.wikipedia.org/wiki/LIBOR. License: CC BY-SA: Attribution-ShareAlike

- Russia-Kolchak-1919-Bonds-500-Obverse. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- SMAC bond Sarafov. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

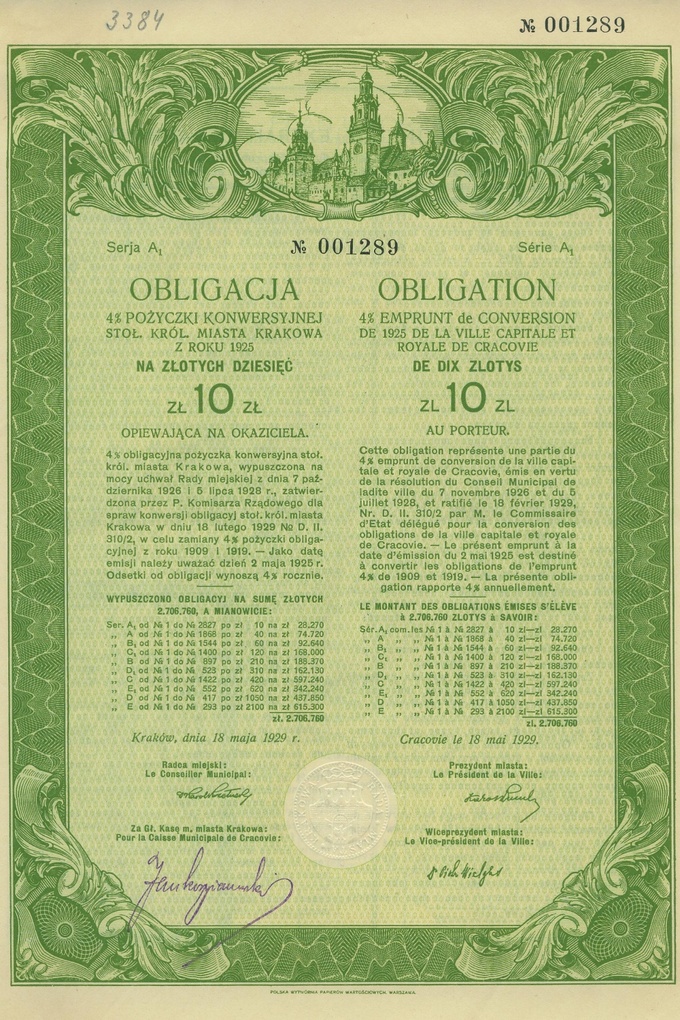

- Obligacja1929Krakow10. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- gross domestic product. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- Bond (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- tranches. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- LIBOR. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Russia-Kolchak-1919-Bonds-500-Obverse. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- SMAC bond Sarafov. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike

- Obligacja1929Krakow10. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Bond of National Loan issued by Polish National Government 1863. Provided by: Wikimedia. License: CC BY-SA: Attribution-ShareAlike