The income statement, or profit and loss statement (P&L), reports a company’s revenue, expenses, and net income over a period of time.

Learning Objectives

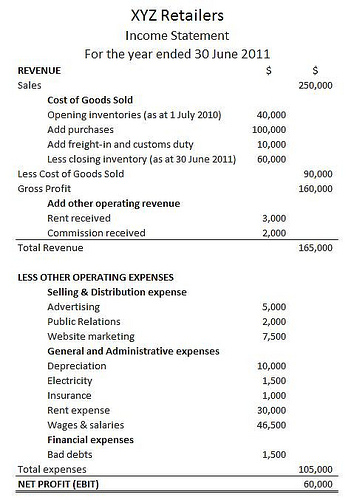

Construct a complete income statement.

The income statement, or profit and loss statement (P&L), reports a company’s revenue, expenses, and net income over a period of time.

Construct a complete income statement.

The income statement is a financial statement that is used to help determine the past financial performance of the enterprise, predict future performance, and assess the capability of generating future cash flows. It is also known as the profit and loss statement (P&L), statement of operations, or statement of earnings.

The income statement consists of revenues (money received from the sale of products and services, before expenses are taken out, also known as the “top line”) and expenses, along with the resulting net income or loss over a period of time due to earning activities. Net income (the “bottom line”) is the result after all revenues and expenses have been accounted for. The income statement reflects a company’s performance over a period of time. This is in contrast to the balance sheet, which represents a single moment in time.

The income statement can be prepared in one of two methods: single or multi-step.

The Single Step income statement totals revenues, then subtracts all expenses to find the bottom line.

The more complex Multi-Step income statement (as the name implies) takes several steps to find the bottom line. First, operating expenses are subtracted from gross profit. This yields income from operations. Then other revenues are added and other expenses are subtracted. This yields income before taxes. The final step is to deduct taxes, which finally produces the net income for the period measured.

The operating section includes revenue and expenses. Revenue consists of cash inflows or other enhancements of the assets of an entity. It is often referred to as gross revenue or sales revenue. Expenses consist of cash outflows or other using-up of assets or incurrence of liabilities.

Elements of expenses include:

The non-operating section includes revenues and gains from non- primary business activities (such as rent or patent income); expenses or losses not related to primary business operations (such as foreign exchange losses); gains that are either unusual or infrequent, but not both; finance costs (costs of borrowing, such as interest expense); and income tax expense.

In essence, if an activity is not a part of making or selling the products or services, but still affects the income of the business, it is a non-operating revenue or expense.

Certain items must be disclosed separately in the notes if it is material (significant). This could include items such as restructurings, discontinued operations, and disposals of investments or of property, plant and equipment. Irregular items are reported separately so that users can better predict future cash flows.

The “bottom line” of an income statement—often, literally the last line of the statement—is the net income that is calculated after subtracting the expenses from revenue. It is important to investors as it represents the profit for the year attributable to the shareholders. For companies with shareholders, earnings per share (EPS) are also an important metric and are required to be disclosed on the income statement.

Income statements have several limitations stemming from estimation difficulties, reporting error, and fraud.

Demonstrate how the limitations of the income statement can influence valuation.

Income statements are a key component to valuation but have several limitations: items that might be relevant but cannot be reliably measured are not reported (such as brand loyalty); some figures depend on accounting methods used (for example, use of FIFO or LIFO accounting); and some numbers depend on judgments and estimates. In addition to these limitations, there are limitations stemming from the intentional manipulation of finances.

One of the limitations of the income statement is that income is reported based on accounting rules and often does not reflect cash changing hands. This could be due to the matching principle, which is the accounting principle that requires expenses to be matched to revenues and reported at the same time. Expenses incurred to produce a product are not reported in the income statement until that product is sold. Another common difference across income statements is the method used to calculate inventory, either FIFO or LIFO.

In addition to good faith differences in interpretations and reporting of financial data in income statements, these financial statements can be limited by intentional misrepresentation. One example of this is earnings management, which occurs when managers use judgment in financial reporting and in structuring transactions to alter financial reports in a way that usually involves the artificial increase (or decrease) of revenues, profits, or earnings per share figures.

The goal with earnings management is to influence views about the finances of the firm. Aggressive earnings management is a form of fraud and differs from reporting error. Managers could seek to manage earnings for a number of reasons. For example, if a manager earns his or her bonus based on revenue levels at the end of December, there is an incentive to try to represent more revenues in December so as to increase the size of the bonus.

While it is relatively easy for an auditor to detect error, part of the difficulty in determining whether an error was intentional or accidental lies in the accepted recognition that calculations are estimates. It is therefore possible for legitimate business practices to develop into unacceptable financial reporting.

GAAP’s assumptions, principles, and constraints can affect income statements through temporary (timing) and permanent differences.

Apply the four basic GAAP principles when preparing financial statements.

Although most of the information on a company’s income tax return comes from the income statement, there often is a difference between pretax income and taxable income. These differences are due to the recording requirements of GAAP for financial accounting (usually following the matching principle and allowing for accruals of revenue and expenses) and the requirements of the IRS’s tax regulations for tax accounting (which are more oriented to cash).

Such timing differences between financial accounting and tax accounting create temporary differences. For example, rent or other revenue collected in advance, estimated expenses, and deferred tax liabilities and assets may create timing differences. Also, there are events, usually one time, which create “permanent differences,” such as GAAP, which recognizes as an expense an item that the IRS will not allow to be deducted.

To achieve basic objectives and implement fundamental qualities, GAAP has four basic principles:

Noncash items, such as depreciation and amortization, will affect differences between the income statement and cash flow statement.

Identify noncash items that can affect the income statement.

Noncash Items

Noncash items that are reported on an income statement will cause differences between the income statement and cash flow statement. Common noncash items are related to the investing and financing of assets and liabilities, and depreciation and amortization. When analyzing income statements to determine the true cash flow of a business, these items should be added back in because they do not contribute to inflow or outflow of cash like other gains and expenses.

Fixed assets, also known as a non- current asset or as property, plant, and equipment (PP&E), is an accounting term for assets and property. Unlike current assets such as cash accounts receivable, PP&E are not very liquid. PP&E are often considered fixed assets: they are expected to have relatively long life, and are not easily changed into another asset. These often receive a more favorable tax treatment than short-term assets in the form of depreciation allowances.

Broadly speaking, depreciation is a way of accounting for the decreasing value of long-term assets over time. A machine bought in 2012, for example, will not be worth the same amount in 2022 because of things like wear-and-tear and obsolescence.

On a more detailed level, depreciation refers to two very different but related concepts: the decrease in the value of tangible assets (fair value depreciation) and the allocation of the cost of tangible assets to periods in which they are used (depreciation with the matching principle). The former affects values of businesses and entities. The latter affects net income.

In each period, long-term noncash assets accrue a depreciation expense that appears on the income statement. Depreciation expense does not require a current outlay of cash, but the cost of acquiring assets does. For example, an asset worth $100,000 in year 1 may have a depreciation expense of $10,000, so it appears as an asset worth $90,000 in year 2.

Amortization is a similar process to deprecation but is the term used when applied to intangible assets. Examples of intangible assets include copyrights, patents, and trademarks.