Assets on a balance sheet are classified into current assets and non-current assets. Assets are on the left side of a balance sheet.

Learning Objectives

Sketch the asset section of a balance sheet.

Assets on a balance sheet are classified into current assets and non-current assets. Assets are on the left side of a balance sheet.

Sketch the asset section of a balance sheet.

A standard company balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first, and normally, in order of liquidity. On the left side of a balance sheet, assets will typically be classified into current assets and non-current (long-term) assets.

A current asset on the balance sheet is an asset which can either be converted to cash or used to pay current liabilities within 12 months. Typical current assets include cash and cash equivalents, short-term investments, accounts receivable, inventories and the portion of prepaid liabilities which will be paid within a year.

Cash and cash equivalents are the most liquid assets found within the asset portion of a company’s balance sheet. Cash equivalents are assets that are readily convertible into cash, such as money market holdings, short-term government bonds or treasury bills, marketable securities and commercial papers. Cash equivalents are distinguished from other investments through their short-term existence; they mature within 3 months whereas short-term investments are 12 months or less, and long-term investments are any investments that mature in excess of 12 months.

Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit. In most business entities, accounts receivable is typically executed by generating an invoice and either mailing or electronically delivering it to the customer, who, in turn, must pay it within an established timeframe, called credit terms or payment terms.

Most manufacturing organizations usually divide their inventory into:

A deferred expense or prepayment, prepaid expense (plural often prepaids), is an asset representing cash paid out to a counterpart for goods or services to be received in a later accounting period. For example, if a service contract is paid quarterly in advance, at the end of the first month of the period two months remain as a deferred expense. In the deferred expense, the early payment is accompanied by a related, recognized expense in the subsequent accounting period, and the same amount is deducted from the prepayment.

A non-current asset is a term used in accounting for assets and property which cannot easily be converted into cash. This can be compared with current assets such as cash or bank accounts, which are described as liquid assets. Non-current assets include property, plant and equipment (PPE), investment property (such as real estate held for investment purposes), intangible assets, long-term financial assets, investments accounted for by using the equity method, and biological assets, which are living plants or animals.

Property, plant, and equipment normally include items such as land and buildings, motor vehicles, furniture, office equipment, computers, fixtures and fittings, and plant and machinery. These often receive favorable tax treatment (depreciation allowance) over short-term assets.

Intangible assets are defined as identifiable, non-monetary assets that cannot be seen, touched or physically measured. They are created through time and effort, and are identifiable as a separate asset. There are two primary forms of intangibles – legal intangibles (such as trade secrets (e. g., customer lists), copyrights, patents, and trademarks) and competitive intangibles (such as knowledge activities (know-how, knowledge), collaboration activities, leverage activities, and structural activities). The intangible asset ” goodwill ” reflects the difference between the firm’s net assets and its market value; the amount is first recorded at time of acquisition. The additional value of the firm in excess of its net assets usually reflects the company’s reputation, talent pool, and other attributes that separate it from the competition. Goodwill must be tested for impairment on an annual basis and adjusted if the firm’s market value has changed.

Investments accounted for by using the equity method are 20-50% stake investments in other companies. The investor keeps such equities as an asset on the balance sheet. The investor’s proportional share of the associate company’s net income increases the investment (and a net loss decreases the investment), and proportional payment of dividends decreases it. In the investor’s income statement, the proportional share of the investee’s net income or net loss is reported as a single-line item.

The balance sheet contains details on company liabilities and owner’s equity.

Apply the accounting equation to create a balance sheet.

In financial accounting, a liability is defined as an obligation of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets, provision of services or other yielding of economic benefits in the future. A liability is defined by the following characteristics:

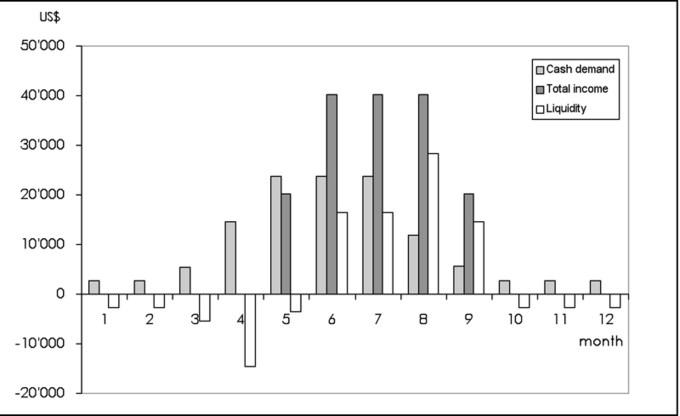

The accounting equation relates assets, liabilities, and owner’s equity: “” The accounting equation is the mathematical structure of the balance sheet.

In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. If liability exceeds assets, negative equity exists. In an accounting context, shareholders ‘ equity (or stockholders ‘ equity, shareholders’ funds, shareholders’ capital, or similar terms) represents the remaining interest in assets of a company, spread among individual shareholders of common or preferred stock.

At the start of a business, owners put some funding into the business to finance operations. This creates a liability on the business in the shape of capital, as the business is a separate entity from its owners. Businesses can be considered, for accounting purposes, sums of liabilities and assets: this is the accounting equation. After liabilities have been accounted for, the positive remainder is deemed the owner’s interest in the business.

In financial accounting, owner’s equity consists of the net assets of an entity. Net assets is the difference between the total assets of the entity and all its liabilities. Equity appears on the balance sheet, one of the four primary financial statements.

The assets of an entity includes both tangible and intangible items, such as brand names and reputation or goodwill. The types of accounts and their description that comprise the owner’s equity depend on the nature of the entity and may include: Common stock, preferred stock, capital surplus, retained earnings, treasury stock, stock options and reserve.

The total changes to equity is calculated as follows:

Equity (end of year balance) = Equity (beginning of year balance) +/- changes to common or preferred stock and capital surplus +/- net income/loss (net profit/loss earned during the period) − dividends. Dividends are typically cash distributions of earnings to stockholders on hand and they are recorded as a reduction to the retained earnings account reported in the equity section.

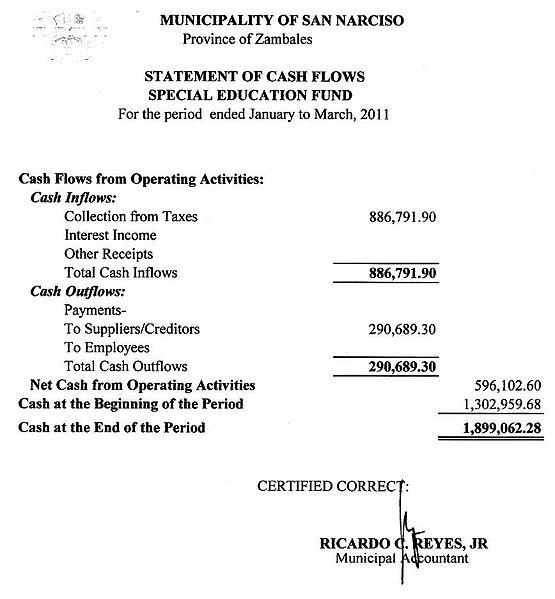

Working capital is a financial metric which represents operating liquidity available to a business, organization and other entity.

Discuss why working capital is an important metric for businesses.

Working capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization or other entity, including a governmental entity. Along with fixed assets, such as plant and equipment, working capital is considered a part of operating capital.

Net working capital is calculated as current assets minus current liabilities. It is a derivation of working capital, that is commonly used in valuation techniques such as discounted cash flows (DCFs). If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit. An increase in working capital indicates that the business has either increased current assets (that it has increased its receivables, or other current assets) or has decreased current liabilities – for example has paid off some short-term creditors.

Current assets and current liabilities include three accounts which are of special importance. These accounts represent the areas of the business where managers have the most direct impact: accounts receivable (current asset), inventories (current assets), and accounts payable (current liability). The current portion of debt (payable within 12 months) is critical, because it represents a short-term claim to current assets and is often secured by long-term assets. Common types of short-term debt are bank loans and lines of credit.

A company can be endowed with assets and profitability but short of liquidity if its assets cannot readily be converted into cash. Decisions relating to working capital and short-term financing are referred to as working capital management. These involve managing the relationship between a firm’s short-term assets and its short-term liabilities. The goal of working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses. The management of working capital involves managing inventories, accounts receivable and payable, and cash.

Inventory management is to identify the level of inventory which allows for uninterrupted production but reduces the investment in raw materials – and minimizes reordering costs – and hence, increases cash flow.

Debtors ‘ management involves identifying the appropriate credit policies, i.e. credit terms which will attract customers, such that any impact on cash flows and the cash conversion cycle will be offset by increased revenue and hence, return on capital.

Short-term financing requires identifying the appropriate source of financing, given the cash conversion cycle: the inventory is ideally financed by credit granted by the supplier; however, it may be necessary to utilize a bank loan (or overdraft).

Cash management involves identifying the cash balance which allows for the business to meet day-to-day expenses, but reduces cash holding costs.

Liquidity, a business’s ability to pay obligations, can be assessed using various ratios: current ratio, quick ratio, etc.

Calculate a company’s liquidity using a variety of methods.

In accounting, liquidity (or accounting liquidity) is a measure of the ability of a debtor to pay his debts when they fall due. A standard company balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity. Money, or cash, is the most liquid asset, and can be used immediately to perform economic actions like buying, selling, or paying debt, meeting immediate wants and needs. Next are cash equivalents, short-term investments, inventories, and prepaid expenses.

Liquidity also refers both to a business’s ability to meet its payment obligations, in terms of possessing sufficient liquid assets, and to such assets themselves. For assets themselves, liquidity is an asset’s ability to be sold without causing a significant movement in the price and with minimum loss of value.

For a corporation with a published balance sheet, there are various ratios used to calculate a measure of liquidity. These include the following:

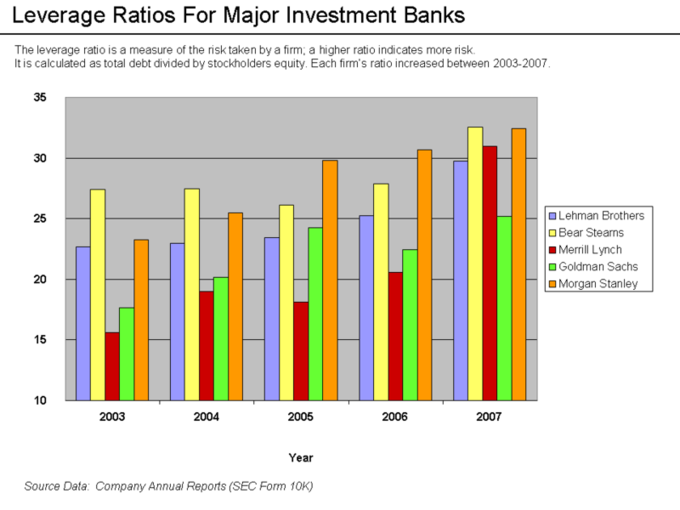

The debt-to-equity ratio (D/E) indicates the relative proportion of shareholder’s equity and debt used to finance a company’s assets.

Identify the different methods of calculating the debt to equity ratio.

The debt-to-equity ratio (D/E) is a financial ratio indicating the relative proportion of shareholders’ equity and debt used to finance a company’s assets. Closely related to leveraging, the ratio is also known as risk, gearing or leverage. The two components are often taken from the firm’s balance sheet or statement of financial position. However, the ratio may also be calculated using market values for both if the company’s debt and equity are publicly traded, or using a combination of book value for debt and market value for equity financially. “”

Preferred stocks can be considered part of debt or equity. Attributing preferred shares to one or the other is partially a subjective decision, but will also take into account the specific features of the preferred shares. When used to calculate a company’s financial leverage, the debt usually includes only the long term debt (LTD). Quoted ratios can even exclude the current portion of the LTD.

Financial analysts and stock market quotes will generally not include other types of liabilities, such as accounts payable, although some will make adjustments to include or exclude certain items from the formal financial statements. Adjustments are sometimes also made, for example, to exclude intangible assets, and this will affect the formal equity; debt to equity (dequity) will therefore also be affected.

The formula of debt/equity ratio: D/E = Debt (liabilities) / equity. Sometimes only interest-bearing long-term debt is used instead of total liabilities in the calculation.

A similar ratio is the ratio of debt-to- capital (D/C), where capital is the sum of debt and equity:D/C = total liabilities / total capital = debt / (debt + equity)

The relationship between D/E and D/C is: D/C = D/(D+E) = D/E / (1 + D/E)

The debt-to-total assets (D/A) is defined asD/A = total liabilities / total assets = debt / (debt + equity + non-financial liabilities)

On a balance sheet, the formal definition is that debt (liabilities) plus equity equals assets, or any equivalent reformulation. Both the formulas below are therefore identical: A = D + EE = A – D or D = A – E

Debt to equity can also be reformulated in terms of assets or debt: D/E = D /(A – D) = (A – E) / E

Book value is the price paid for a particular asset, while market value is the price at which you could presently sell the same asset.

Distinguish between market value and book value.

Market value is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with open market value, fair value, or fair market value. International Valuation Standards defines market value as “the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion. “

In accounting, book value or carrying value is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization, or impairment costs made against the asset. An asset’s initial book value is its its acquisition cost or the sum of allowable costs expended to put it into use. Assets such as buildings, land, and equipment are valued based on their acquisition cost, which includes the actual cash price of the asset plus certain costs tied to the purchase of the asset, such as broker fees. The book value is different from market value, as it can be higher or lower depending on the asset in question and the accounting practices that affect book value, such as depreciation, amortization and impairment. In many cases, the carrying value of an asset and its market value will differ greatly. If the asset is valued on the balance at market value, then its book value is equal to the market value.

Ways of measuring the value of assets on the balance sheet include: historical cost, market value or lower of cost or market. Historical cost is typically the purchase price of the asset or the sum of certain costs expended to put the asset into use. Market value is the asset’s worth if it were to be exchanged in the open market in an arm’s length transaction; it can also be derived based on the asset’s present value of the expected cash flows it will generate. Certain assets are disclosed at lower of cost or market in order to conform to accounting’s conservatism principle, which stresses that assets should never be overstated.

The three limitations to balance sheets are assets being recorded at historical cost, use of estimates, and the omission of valuable non-monetary assets.

Critique the balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, business partnership, corporation, or other business organization, such as an LLC or an LLP. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition. ” Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year. There are three primary limitations to balance sheets, including the fact that they are recorded at historical cost, the use of estimates, and the omission of valuable things, such as intelligence.

Fixed assets are shown in the balance sheet at historical cost less depreciation up to date. Depreciation affects the carrying value of an asset on the balance sheet. The historical cost will equal the carrying value only if there has been no change recorded in the value of the asset since acquisition. Therefore, the balance sheet does not show true value of assets. Historical cost is criticized for its inaccuracy since it may not reflect current market valuation.

Some of the current assets are valued on estimated basis, so the balance sheet is not in a position to reflect the true financial position of the business. Intangible assets like goodwill are shown in the balance sheet at imaginary figures, which may bear no relationship to the market value. The International Accounting Standards Board (IASB) offers some guidance (IAS 38) as to how intangible assets should be accounted for in financial statements. In general, legal intangibles that are developed internally are not recognized, and legal intangibles that are purchased from third parties are recognized. Therefore, there is a disconnect–goodwill from acquisitions can be booked, since it is derived from a market or purchase valuation. However, similar internal spending cannot be booked, although it will be recognized by investors who compare a company’s market value with its book value.

Finally, the balance sheet can not reflect those assets which cannot be expressed in monetary terms, such as skill, intelligence, honesty, and loyalty of workers.