The Securities Act of 1933 ensures investors receive complete and accurate information before they invest.

Learning Objectives

Describe how the Securities Act of 1933 regulates stock markets.

The Securities Act of 1933 ensures investors receive complete and accurate information before they invest.

Describe how the Securities Act of 1933 regulates stock markets.

The Securities Act of 1933 (also known as the ’33 Act) is essentially a consumer protection law for “retail” investors (i.e. not money managers, foundations, pensions, etc.)

The Act’s objectives are to provide investors with material, financial, and other corporate information about issuers of public securities (i.e. stocks and bonds), and to prevent fraud in the offering of such securities. The primary purpose of the ’33 Act is to ensure that buyers of securities receive complete and accurate information before they invest.

Unless they qualify for an exemption, securities offered or sold to the public in the U.S. must be registered by filing a registration statement with the SEC. Although the law is written to require registration of securities, it is more useful as a practical matter to consider the requirement to be that of registering offers and sales. If person A registers a sale of securities to person B, and then person B seeks to resell those securities, person B must still either file a registration statement or find an available exemption.

Many transactions are exempt from regulation under the Securities Act. Section 4 of the Act limits its application to public offerings (according to SEC guidelines, more than 25 offerees) by issuers and their underwriters (i.e. investment banks ). This means that the Act primarily applies to companies offering securities to the public, and not to transactions between investors or to sales of stock to small groups of investors (i.e. private placements. )

The prospectus, which is the document through which an issuer’s securities are marketed to a potential investor, is included as part of the registration statement. The SEC prescribes the relevant forms on which an issuer’s securities must be registered. Among other things, registration forms call for:

For public offerings, the main requirement of the Securities Act is registration. An issuer must prepare an extensive statement describing the securities to be offered and detailing the nature of the issuer’s business. Once this statement is registered with and approved by the SEC, its data and forecasts are placed in a prospectus for potential investors. Any offering of the securities by the issuer or underwriter must thereafter be accompanied by the prospectus.

Rule 144, promulgated by the SEC under the 1933 Act, permits, under limited circumstances, the sale of restricted and controlled securities without registration. In addition to restrictions on the minimum length of time for which such securities must be held and the maximum volume permitted to be sold, the issuer must agree to the sale. If certain requirements are met, Form 144 must be filed with the SEC. Often, the issuer requires that a legal opinion be given indicating that the resale complies with the rule. The amount of securities sold during any subsequent three-month period generally does not exceed any of the following limitations:

Regulation S is a “safe harbor” that defines when an offering of securities is deemed to be executed in another country and therefore not be subject to the registration requirement under section 5 of the 1933 Act. The regulation includes two safe harbor provisions: an issuer safe harbor and a resale safe harbor. In each case, the regulation demands that offers and sales of the securities be made outside the United States and that no offering participant (which includes the issuer, the banks assisting with the offer, and their respective affiliates) engage in “directed selling efforts. ” In the case of issuers for whose securities there is substantial U.S. market interest, the regulation also requires that no offers and sales be made to U.S. persons (including U.S. persons physically located outside the United States).

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities, financial markets and their participants.

Define how the Securities Exchange Act of 1934 regulates the US securities markets.

The Securities Exchange Act of 1934 (also called the Exchange Act, ’34 Act, or Act of ’34) is a law governing the secondary trading of securities, including stocks, bonds, and debentures, in the United States of America. It was a sweeping piece of legislation. The Act and related statutes form the basis for the regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

While the Securities Act is very limited in scope, the Securities Exchange Act (also known as the Exchange Act or 1934 Act) is much broader. It regulates stock exchanges, brokers, dealers, and even private traders.

Companies raise billions of dollars by issuing securities in what is known as the primary market. In contrast with the Securities Act of 1933, which regulates these original issues, the Securities Exchange Act of 1934 regulates the secondary trading of those securities between persons often unrelated to the issuer, in most cases through brokers or dealers. Trillions of dollars are made and lost each year through trading in the secondary market.

One area subject to 34 Act regulation is the actual securities exchange — the physical place where people purchase and sell securities (stocks, bonds, notes of debenture). Some of the well known exchanges include the New York Stock Exchange, the American Stock Exchange, and regional exchanges like the Cincinnati Stock Exchange, Philadelphia Stock Exchange and Pacific Stock Exchange. At those places, agents of the exchange or specialists, act as middlemen for the competing interests to buy and sell securities. An important function of the specialist is to inject liquidity and price continuity into the market. Given that people come to the exchange to easily acquire securities or to easily dispose of a portfolio of securities, the specialist’s role is important to the exchange.

The ’34 Act also regulates broker-dealers without a status for trading securities. A telecommunications infrastructure was developed and allows for for trading without a physical location. Previously these brokers would find stock prices through newspaper printings and conduct trades verbally by telephone. Today, a digital information network connects these brokers. This system is called NASDAQ, standing for the National Association of Securities Dealers Automated Quotation System.

In 1938, the Exchange Act was amended by the Maloney Act, which authorized the formation and registration of national securities associations to supervise the conduct of their members subject to the oversight of the SEC. That amendment led to the creation of the National Association of Securities Dealers, Inc. – the NASD, which is a Self-Regulatory Organization (or SRO). The NASD had primary responsibility for the oversight of brokers and brokerage firms, and later, the NASDAQ stock market.

In the last 30 years, brokers have created two additional systems for trading securities. The alternative trading system, or ATS, is a quasi exchange where stocks are commonly purchased and sold through a smaller, private network of brokers, dealers, and other market participants. The ATS is different from exchanges and associations in that the volumes for ATS trades are comparatively low, and the trades tend to be controlled by a small number of brokers or dealers. ATS acts as a niche market, a private pool of liquidity. Reg ATS, an SEC regulation issued in the late 1990s, requires these small markets to 1) register as a broker with the NASD, 2) register as an exchange, or 3) operate as an unregulated ATS, staying under low trading caps.

While the ’33 Act recognizes that timely information about the issuer is vital to effective pricing of securities, the Act’s disclosure requirement (the registration statement and prospectus) is a one-time affair. The ’34 Act extends this requirement to securities traded in the secondary market. Provided that the company has more than a certain number of shareholders and has a certain amount of assets (500 shareholders, above $10 million in assets, per sections 12, 13, and 15 of the Act), the ’34 Act requires that issuers regularly file company information with the SEC on certain forms (the annual 10-K filing and the quarterly 10-Q filing).

While the ’33 Act contains an antifraud provision (Section 17), when the ’34 Act was enacted, questions remained about the reach of that antifraud provision and whether a private right of action—that is, the right of an individual citizen to sue an issuer of stock or related market actor, as opposed to government suits—existed for purchasers.

The 1975 amendments are to establish a national market system for the nationwide clearance and settlement of securities transactions.

Define how the Securities Act Amendments of 1975 regulate U.S. stock markets.

The 1975 amendments, also called the National Exchange Market System Act, directed the securities and exchange commission to work with the industry toward establishing a national market system together with a system for the nationwide clearance and settlement of securities transactions.

A national market system plan (or NMS plan) is a structured method of transmitting securities transactions in real-time. In the United States, national market systems are governed by section 11A of the Securities Exchange Act of 1934.

In addition to processing the transactions themselves, these plans also show the price and volume data for these transactions. Information on each securities trade is sent to a central network at the Securities Industry Automation Corporation (SIAC) where it is then distributed and consolidated with other trades on the same “tape”.

The Securities Industry Automation Corporation (SIAC) is a subsidiary of the NYSE Euronext. Its purpose is to provide technical services for the exchanges themselves, members and other financial institutions. In this role, SIAC provides the computers and other systems required to run the exchanges. It also owns communication lines and hardware that provide real-time quotes and transaction information to all market participants from the Consolidated Tape/Ticker System (CTS), Consolidated Quotation System (CQS), and Options Price Reporting Authority (OPRA).

The National Market System (NMS) is the national system for trading equities in the United States.

Regulation NMS (or Reg NMS — Regulation National Market System) is a regulation promulgated and defined by the United States Securities and Exchange Commission ( SEC ) as “a series of initiatives designed to modernize and strengthen the national market system for equity securities. ” It was established in 2007 and seeks to foster both “competition among individual markets and competition among individual orders” in order to promote efficient and fair price formation across securities markets. In 1972, before the SEC began its pursuit of a national market system, the market for securities was quite fragmented. The same stock sometimes traded at different prices at different trading venues, and the NYSE ticker tape did not report transactions of NYSE-listed stocks that took place on regional exchanges or on other over-the-counter securities markets. This fragmentation made it difficult for traders to compare prices of stocks. In 1975, Congress authorized the SEC to facilitate a national market system.

In 2005, the rules promoting the national market system were consolidated into REG NMS. Some of the more notable rules include:

The order protection rule has generated controversies since it requires traders to transact on a trading venue at the lowest price rather than on a venue that offers the quickest execution or the most reliability. Thus, some have described it as an improper government intervention into private business affairs. Defenders of the rule argue that it really just requires what brokers should be doing if they are acting in their customer’s best interests. Still, others have argued that the rule is too lax because it only protects the quotes at the top of the book.

The Sarbanes–Oxley Act is to set new or enhanced standards for all U.S. public company boards, management, and public accounting firms.

Identify the responsibilities imposed on companies by the Sarbanes-Oxley Act of 2002.

The Sarbanes–Oxley Act of 2002 is a federal law that set new or enhanced standards for all public company boards, management, and public accounting firms in the United States. It is also known as the Public Company Accounting Reform and Investor Protection Act (in the Senate) and Corporate and Auditing Accountability and Responsibility Act (in the House) and more commonly called Sarbanes–Oxley, Sarbox or SOX. It It is named after sponsors U.S. Senator Paul Sarbanes (D-MD) and U.S. Representative Michael G. Oxley (R-OH). As a result of SOX, top management must now individually certify the accuracy of financial information. In addition, penalties for fraudulent financial activity are much more severe. SOX also increased the independence of the outside auditors who review the accuracy of corporate financial statements, and increased the oversight role of boards of directors.

The bill was enacted as a reaction to a number of major corporate and accounting scandals including those affecting Enron, Tyco International, Adelphia, Peregrine Systems, and WorldCom. These scandals, which cost investors billions of dollars when the share prices of affected companies collapsed, shook public confidence in the nation’s securities markets.

In response to the perception that stricter financial governance laws are needed, SOX-type laws have been subsequently enacted in Japan, Germany, France, Italy, Australia, India, South Africa, and Turkey.

Title I provides independent oversight of public accounting firms providing audit services (auditors). It also creates a central oversight board tasked with registering auditors, defining the specific processes and procedures for compliance audits, inspecting and policing conduct and quality control, and enforcing compliance with the specific mandates of SOX.

Title II consists of nine sections and establishes standards for external auditor independence, to limit conflicts of interest. It also addresses new auditor approval requirements, audit partner rotation, and auditor reporting requirements. It restricts auditing companies from providing non-audit services (e.g., consulting) for the same clients.

Title III consists of eight sections and mandates that senior executives take individual responsibility for the accuracy and completeness of corporate financial reports. It enumerates specific limits on the behaviors of corporate officers and describes specific forfeitures of benefits and civil penalties for non-compliance.

Title IV describes enhanced reporting requirements for financial transactions, including off-balance-sheet transactions, pro-forma figures and stock transactions of corporate officers. It requires internal controls for assuring the accuracy of financial reports and disclosures, and mandates both audits and reports on those controls.

Title V consists of only one section, which includes measures designed to help restore investor confidence in the reporting of securities analysts. It defines the codes of conduct for securities analysts and requires disclosure of knowable conflicts of interest.

Title VI defines practices to restore investor confidence in securities analysts. It also defines the SEC ‘s authority to censure or bar securities professionals from practice and defines conditions under which a person can be barred from practicing as a broker, advisor, or dealer.

Title VII consists of five sections and requires the Comptroller General and the SEC to perform various studies and report their findings.

Title VIII describes specific criminal penalties for manipulation, destruction or alteration of financial records or other interference with investigations, while providing certain protections for whistle-blowers.

Title IX increases the criminal penalties associated with white-collar crimes and conspiracies. It recommends stronger sentencing guidelines and specifically adds failure to certify corporate financial reports as a criminal offense.

Title X consists of one section. Section 1001 states that the Chief Executive Officer should sign the company tax return.

Title XI consists of seven sections. Section 1101 recommends a name for this title as “Corporate Fraud Accountability Act of 2002”. It identifies corporate fraud and records tampering as criminal offenses and joins those offenses to specific penalties. It also revises sentencing guidelines and strengthens their penalties. This enables the SEC to resort to temporarily freezing transactions or payments that have been deemed “large” or “unusual”.

Debate continues over the perceived benefits and costs of SOX. Opponents of the bill claim it has reduced America’s international competitive edge against foreign financial service providers, saying SOX has introduced an overly complex regulatory environment into U.S. financial markets. Proponents of the measure say that SOX has been a “godsend” for improving the confidence of fund managers and other investors with regard to the veracity of corporate financial statements.

The Global Settlement was an enforcement agreement to address issues of conflict of interest within the SEC and other big investment companies.

Describe how the Global Research Settlement addressed conflicts of interest in the market.

The Global Settlement was an enforcement agreement reached on April 28, 2003 between the Securities and Exchange Commission (SEC), National Association of Securities Dealers (NASD), New York Stock Exchange (NYSE), and ten of the United States’s largest investment firms. The agreement was meant to address issues of conflict of interest within their businesses.

The central issue at hand that had previously been decided in court was the conflict of interest between the investment banking and analysis departments of ten of the largest investment firms in the United States. The investment firms involved in the settlement had all engaged in actions and practices that had aided and abetted the inappropriate influence of their research analysts by their investment bankers seeking lucrative fees. A typical violation addressed by the settlement was the case of CSFB and Salomon Smith Barney, which were alleged to have engaged in inappropriate spinning of “hot” IPOs and issued fraudulent research reports in violation of various sections within the Securities Exchange Act of 1934. Similarly, UBS Warburg and Piper Jaffray were alleged to have received payments for investment research without disclosing such payments in violation of the Securities Act of 1933.

As part of the settlement decision published on December 20, 2002, several regulations designed to prevent abuse stemming from pressure by investment bankers on analysts to provide “favorable” appraisals were put in place. Most importantly, these firms would have to literally insulate their banking and analysis departments from each other physically and with Chinese walls. In addition, budget allocation to management in research departments will be independent of investment departments. Research analysts will also be prohibited from going on pitches and roadshows with bankers during advertising and promotion of IPOs. Similarly, the Global Settlement also increased the IPO “quiet period” from 25 days to 40 days. Finally, research analysts’ historical ratings must be disclosed and made available.

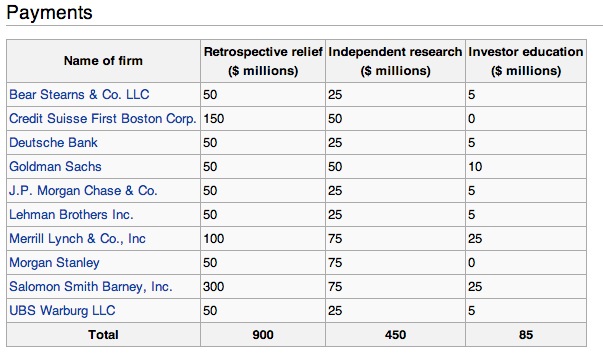

Other than these regulatory actions, the firms involved in the settlement were required to pay fines to their investors, to fund investor education, and to pay for independent third-party market research. A total fine of $1.435 billion was assessed and is described in the table below.