14 Introducing Financial Statements

Defining the Financial Statement

Financial statements report on a company’s income, cash flow and equity.

Learning Objectives

Define the purpose of a financial statement.

Key Points

- Financial statements are formally prepared documents communicating an entity’s financial activities to parties including investors, management and tax officials.

- An entity’s financial statement typically includes four basic components: a balance sheet, income statement, cash flow statement, and statement of changes in equity.

- The balance sheet reports a point-in-time snapshot of the assets, liabilities and equity of the entity.

- An income statement reports on a company’s expenses and profits to show whether the company made or lost money.

- The cash flow statement reports the flow of cash in and out of the business, dividing cash into operating, investing and financing activities.

- A statement of changes in equity explains the changes of the company’s equity throughout the reporting period, including profits or losses, dividends paid and issue or redemption of stock.

Key Terms

- liabilities: an obligation of an entity arising from past transactions or events, including any type of borrowing.

- equity: The residual claim or interest to investors in assets after all liabilities are paid. If liability exceeds assets, negative equity exists and can be purchased through stock.

- Assets: economic resources that represent value of ownership that can be converted into cash (although cash itself is also considered an asset).

A financial statement is a formal report of the financial activities of a business, person, or other entity. Financial statements are a key component of accounting; the process of communicating information about a financial entity. Financial statements are presented in a structured manner with conventions accepted by accounting and regulatory personnel. An entity’s financial statement typically includes four basic components: a balance sheet, income statement, cash flow statement, and statement of changes in equity:

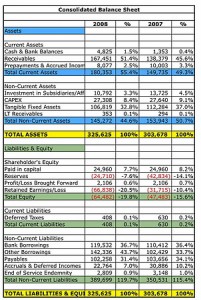

- The company’s balance sheet reports on a company’s assets, liabilities and ownership equity. A balance sheet is often described as a “snapshot of a company’s financial condition” at a single point in time. Balance sheets are usually presented with assets in one section and liabilities and net worth in the other.

- An income statement reports on a company’s expenses and profits to show whether the company made or lost money. It also displays the revenues of a specific period, and the cost and expenses charged against these revenues. In contrast with the balance sheet, which represents a single moment in time, the income statement represents a period of time

- A cash flow statement shows how changes in income affect cash and cash equivalents, breaking the analysis down to operating, investing and financing. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. As an analytical tool, a cash flow statement is useful in determining the short-term viability of a company.

- A statement of changes in equity explains the company’s equity throughout the reporting period. The statement breaks down changes in the owners’ interest in the organization and in the application of retained profit or surplus from one accounting period to the next. Line items typically include profits or losses, dividends paid, redemption of stock, and any other items credited to retained earnings.

For complex entities, financial statements often include an extensive set of notes as an explanation of financial policies. The notes typically describe each item in detail. For example, the notes may explain financial figures or the accounting methods used to prepare the statement.

Uses of the Financial Statement

Financial statements are used to understand key facts about the performance and disposition of a business and may influence decisions.

Learning Objectives

Explain how financial statements are used by different entities.

Key Points

- Owners and managers use financial statements to make important long-term business decisions. For example: whether or not to continue or discontinue part of its business, to make or purchase certain materials, or to acquire or rent/lease certain equipment in the production of its goods.

- Prospective investors use financial statements to perform financial analysis, which is a key component in making investment decisions.

- A lending institution will examine the financial health of a person or organization and use the financial statement to decide whether or not to lend funds.

Key Terms

- financial analysis: Financial analysis (also referred to as financial statement analysis) refers to an assessment of the viability, stability, and profitability of an organization or project.

Financial Statements are used for a Multitude of Different Purposes

Readers of a financial statement are seeking to understand key facts about the performance and disposition of a business. They make decisions about the business based on their reading of the statements. Because financial statements are widely relied upon, they must be straightforward to read and understand.

For large corporations, these statements are often complex and may include an extensive set of notes to the financial statements and explanation of financial policies andmanagement discussion and analysis. The notes typically describe each item on the balance sheet, income statement, and cash flow statement in further detail. Notes to financial statements are considered an integral part of the financial statements.

Owners and managers frequently use financial statements to make important business decisions, for example:

- Whether or not to continue or discontinue part of the business.

- Whether to make or to purchase certain materials.

- Whether to acquire or to rent/lease certain equipment in the production of goods.

The documents are also helpful in making long-term decisions and as a source of historical records.

Other individuals and entities use financial statements too. For example:

- Prospective investors use financial statements to perform financial analysis, which is a key component in making investment decisions.

- A lending institution will examine the financial health of a person or organization and use the financial statement to decide whether or not to lend funds.

- Philanthropies may use financial statements of a non-profit as a component in determining where to donate funds.

- Government entities (tax authorities) need financial statements to ascertain the propriety and accuracy of taxes and other duties declared and paid by a company.

- Vendors who extend credit may use financial statements to assess the creditworthiness of the business.

- Employees also may use reports in making collective bargaining agreements.

Limitations of Financial Statements

Financial statements can be limited by intentional manipulation, differences in accounting methods, and a sole focus on economic measures.

Learning Objectives

Summarize the common limitations found in financial statements

Key Points

- One limitation of financial statements is that they are open to human interpretation and error, in some cases even intentional manipulation of figures to inflate economic performance.

- Another set of limitations of financial statements arises from different ways of accounting for activities across time periods and across companies, which can make comparisons difficult.

- Another limit to financial statements as a window into the creditworthiness or investment attractiveness of an entity is that financial statements focus solely on financial measures. Some argue for a “triple bottom line” including social and environmental measures.

Key Terms

- corporate governance: The roles and relationships between a company’s management, its board, its shareholders and other stakeholders, and the goals for which the corporation is governed. Much of the contemporary interest in corporate governance is concerned with mitigation of the conflicts of interests and the nature and extent of accountability of people in the business.

- audit: The verification of the financial statements of a legal entity intended to enhance the degree of confidence of intended users in the financial statements by providing reasonable assurance that the financial statements are presented fairly.

- GAAP: An acronym for “Generally Accepted Accounting Principles.” The standard framework of guidelines for financial accounting used in any given jurisdiction; generally known as accounting standards or standard accounting practice.

Limitations of Financial Statements

The limitations of financial statements include inaccuracies due to intentional manipulation of figures; cross-time or cross-company comparison difficulties if statements are prepared with different accounting methods; and an incomplete record of a firm’s economic prospects, some argue, due to a sole focus on financial measures.

One limitation of financial statements is that they are open to human interpretation and error, in some cases even intentional manipulation of figures. In the United States, especially in the post-Enron era, there has been substantial concern about the accuracy of financial statements. High-profile cases in which management manipulated figures in financial statements to indicate inflated economic performance highlighted the need to review the effectiveness of accounting standards, auditing regulations, and corporate governance principles.

As a result, there has been renewed focus on the objectivity and independence of auditing firms. An audit of the financial statements of a public company is usually required for investment, financing, and tax purposes, and these are usually performed by independent accountants or auditing firms and included in the annual report. Additionally, in terms of corporate governance, managing officials like the CEO and CFO are personally liable for attesting that financial statements are not untrue or misleading, and making or certifying misleading financial statements exposes the people involved to substantial civil and criminal liability.

Another set of limitations of financial statements arises from different ways of accounting for activities across time periods and across companies. This can make it difficult to compare a company’s finances across time or to compare finances across companies. Different countries have developed their own accounting principles, making international comparisons of companies difficult. However, the Generally Accepted Accounting Principles (GAAP), a set of guidelines and rules, are one means by which uniformity and comparability between financial statements is improved. Recently there has been a push toward standardizing accounting rules made by the International Accounting Standards Board (IASB).

Another limit to financial statements as a window into the creditworthiness or investment attractiveness of an entity is that financial statements focus solely on financial measures of health. Even traditional investment analysis incorporates information outside of the financial statements to make organizational assessments. However, other methods such as full cost accounting (FCA) or true cost accounting (TCA) argue that an organization’s health cannot just be determined by its economic characteristics. Therefore, one needs to collect and present information about environmental, social, and economic costs and benefits (collectively known as the “triple bottom line”) to make an accurate evaluation.

Licenses and Attributions

CC licensed content, Shared previously

CC licensed content, Specific attribution