Funding global processes or organizations is a complex financial process with a variety of options, each with varying rates of risk and return.

Learning Objectives

Differentiate between funding options for global organizations, and consider the differences between startups and larger established firms

Key Takeaways

Key Points

- Often enough, global organizations have significant capital needs. Procuring capital at a lower weighted average cost of capital (WACC) than the expected return is key to success.

- Equity and debt are the primary borrowing devices for most business, including taking out loans, issuing bonds, and releasing company shares for public trade.

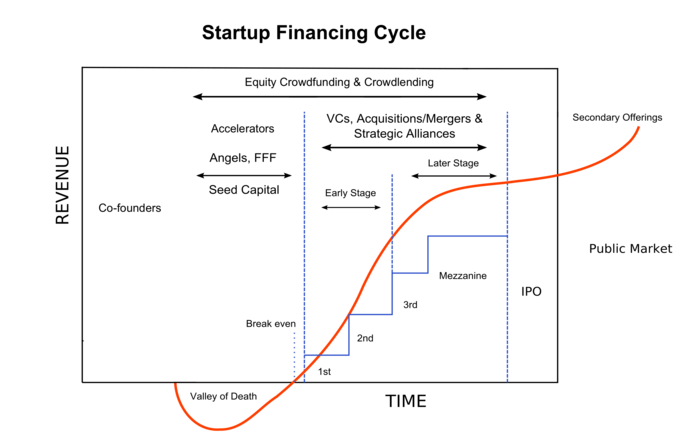

- Startups engage in a wide variety of interesting funding initiatives, such as pursuing venture capital, angel investors, and crowd-sourced funding.

- Procuring funding to start an international business is easier now than ever, with the wide variety of speculators (i.e. venture capitalists) and the high volume of crowd-sourcing platforms.

Key Terms

- Venture Capital (VCs): A funding option in which groups of speculative investors pursue small, promising entrepreneurial ventures to fund (and thus gain some ownership in).

International businesses often have high capital needs, as global trade can be resource intensive (though it’s worth noting that the digital age has changed this significantly for many industries). Procuring funding in the modern economy can be highly diversified, from borrowing debt from banks to pursuing angel investors to crowd-sourcing funding for a small startup project.

Determining Risk and Return

Understanding the financial needs of the organization and measuring the overall weighted average cost of capital (WACC) for a venture is important in determining the appropriate level of risk and the expected level of return on that risk. Models such as the discounted cash flow analysis to determine a net present value (NPV) of the project being funded is key to successful financial sourcing.

Organizations looking to procure funding should provide prospective investors with a business plan, complete with an assessment of expected demand, estimated profit, and required rates of return. By balancing the expected profit with the cost of getting funded, potential international operations can ensure that the return on investment will justify the expenses involved in global trade.

Funding Sources

International businesses have the same funding sources as most organizations, for larger organizations this primarily revolves around debt and equity. For small organizations, debt and equity are often accompanied by venture capital and crowd-sourcing (particularly in the startup world).

Larger Organizations

From the perspective of larger organizations, formal analyses of projected cash flows (as discussed above) coupled with traditional forms of funding is the most common approach to international business funding. This includes:

- Loans – Bank loans are a form of debt, often with a relatively low cost of capital. Loans granted over a given lending period and paid back in installments. In the case of bankruptcy, these debts are among the first repaid upon liquidation of assets (hence the lower risk and lower cost of capital).

- Issuing Bonds – Organizations can also issue bonds, which are another form of debt. Bonds debt securities investors can purchase which will mature over time. The rate of return and time to maturation can vary. These are also lower costs of capital as they are paid out before equity in the case of a bankruptcy.

- Equity (shares) – Issuing shares is another funding source, particularly for larger and publicly traded organizations. By issuing equity, organizations can essentially sell small fractions of organizational ownership as an asset for investors, who are betting on the success of the organization. These are riskier, most costly and less reliable sources of income compared to debt.

Startups

While smaller organizations have access to debt as well, they generally have less collateral available and therefore very little financial leverage. In these situations, procuring funding for a global venture is exceptionally difficult. The startup world is full of interesting options to procure capital, including:

- Venture Capital (VCs) – A popular term in the Silicon Valley and other technology hubs, VCs accumulate capital from a number of speculative investors and seek strong business opportunities still in the startup phase. Winning capital from a VC can be quite lucrative, as the amount of capital invested can be high (high enough to justify international operations). VCs would generally be represented by a board who would assess the viability of the business as an investment, and determine terms (ownership by investors) and returns.

- Angel Investors – Angel investors are similar to VCs, but can actually be quite varied in format and motivations. Angel investors are more often individuals with capital to spare who have taken an interest in a particular business or product. They may act as advisers or objective investors, they may simply love the product, or they may have investment incentives (most commonly both).

- Crowd-sourcing – Websites like Kickstarter and Indiegogo are unique and modern formats, where potential business ideas can garner capital and support prior to producing a given product or service. This interesting model allows a high number of people to invest a small amount of capital, which cumulatively may be enough to ‘kickstart’ a venture (international or otherwise). Reimbursement in the form of credits, t-shirts, early access to the product, and other incentives are often used to motivated small investments.

The world of business investing is changing and evolving, and reliance on big banks is decreasing for smaller, entrepreneurial ventures. With the barriers to globalization constantly lowered, the capacity to take a relatively small amount of seed capital and offer services digitally across the world is more feasible than ever. Understanding options like crowd-sourcing can substantially lower the risk of borrowing, and enable small organizations to grow.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- Funding. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Trade finance. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Angel investor. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Venture capital. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- International business. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Crowdfunding. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Commercial finance. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Debt. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Finance. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Global sourcing. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Credit (finance). Provided by: Wikipedia. Located at: https://en.wikipedia.org/wiki/Credit_(finance). License: CC BY-SA: Attribution-ShareAlike

- Equity (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Startup_Financing_Cycle.png. Provided by: Wikipedia. Located at: https://upload.wikimedia.org/wikipedia/commons/e/e3/Startup_Financing_Cycle.png. License: CC BY-SA: Attribution-ShareAlike