The stock of a company represents the original capital paid into the business by its founders and can be purchased in the form of shares.

Learning Objectives

Describe the ownership nature of stock

Key Takeaways

Key Points

- The stock ( capital stock) of a company or business entity is equal to the original capital paid into the business by its founders.

- Stock serves as a security for creditors and investors in the business. While it may fluctuate in value, it is different from the assets and property of a business.

- A shareholder legally owns share of a stock in a public or private corporation, and has certain rights with regards to the company because of share ownership.

Key Terms

- Stock: The stock of a company represents the original capital paid into the business by its founders. It serves as a security for investors.

- shareholder: A shareholder legally owns at least one share of stock in a company and has rights with regards to the company because of this.

The Ownership Nature of Stock

The capital stock (or stock) of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors. Stock is different from the property and assets of a business, both of which may fluctuate in quantity and value. Stock of a company is valued according to market demand and overall business health and this value will fluctuate over time. Ownership of stock represents a stake of ownership in the business entity. The stock is a security that represents equity in the company.

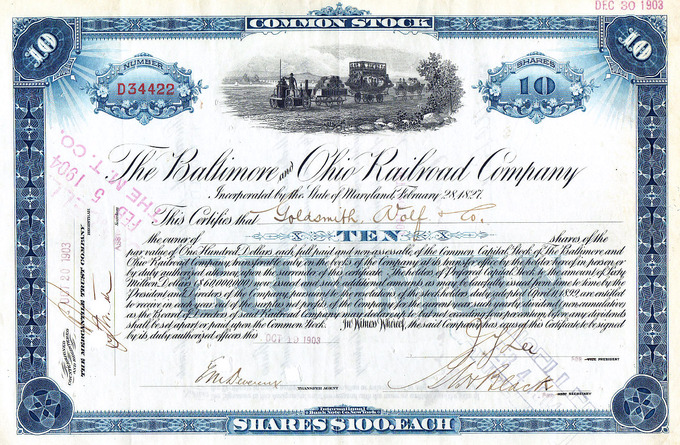

Ownership of shares is documented by issuance of a stock certificate. A stock certificate is a legal document that specifies the amount of shares owned by the shareholder, It also specifies other aspects of the shares like the par value or class of the shares. Other documents will specify what rights come with ownership of certain classes of stock.

Stakeholders

A shareholder or stockholder is an individual or institution (including a corporation) that legally owns a share of stock in a public or private corporation. Stockholders or shareholders are considered by some to be a subset of stakeholders, which may include anyone who has a direct or indirect interest in the business entity. For example, labor, suppliers, customers and the community are typically considered stakeholders because they contribute value and/or are impacted by the corporation.

Control and Preemption

Shareholders have the right of preemption, meaning they have the first chance at buying newly issued shares of stock before the general public.

Learning Objectives

Explain a shareholders’ control and preemption rights

Key Takeaways

Key Points

- Shareholders gain certain rights with regards to a business entity when purchasing stock. These include being able to sell shares, voting rights and dividends.

- Shareholders have the right of preemption, meaning they have the first chance at buying newly issued shares of stock before the general public.

- Even if shareholders do have the option of using their preemptive right, they do not have to exercise it.

Key Terms

- preemptive right: a contractual ability to acquire certain property newly coming into existence before it can be offered to any other person or entity

- Preemption: The right of a shareholder to purchase newly issued shares of a business entity before they are available to the general public so as to protect individual ownership from dilution.

Rights of Stockholders

A shareholder or stockholder is an individual or institution (including a corporation ) that legally owns a share of stock in a public or private corporation. Stockholders are granted special privileges depending on the class of stock. These rights may include:

- The right to sell shares

- The right to vote on directors nominated by the board,

- The right to nominate directors (although this is very difficult in practice because of minority protections) and propose shareholder resolutions

- The right to dividends if they are declared

- The right to purchase new shares issued by the company

- The right to what assets remain after a liquidation

Owners of common and preferred stock generally have to wait until debt-holders receive assets after bankruptcy to see any assets after liquidation.

Control and Preemption

Control and preemption are particular stockholder rights.

A preemption right, or right of preemption, is a contractual right to acquire certain property coming into existence before it can be offered to any other person or entity. This right is frequently applied for shareholders of a business entity as they are usually offered the first chance to buy newly issued shares of stock before it becomes available to the general public. While shareholders are offered the option of early purchase, they do not necessarily have to take it. The incentive to exercise this option is based on the desire to protect individual ownership or stake in a company from dilution. The conditions of preemptive rights will vary from company to company and share type to share type.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- Shareholder. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Stock. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Pre-emption right. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- shareholder. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- Stock. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- B&O RR common stock. Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Pre-emption right. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Shareholder. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Preemption. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- preemptive right. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- B&O RR common stock. Provided by: Wikipedia. License: Public Domain: No Known Copyright

- Shareholder Meeting. Provided by: Wikipedia. License: Public Domain: No Known Copyright