General price level changes creates distortions in financial statements. Inflation accounting is used in countries with high inflation.

Learning Objectives

Discuss how inflation can impact a company’s financial statements.

General price level changes creates distortions in financial statements. Inflation accounting is used in countries with high inflation.

Discuss how inflation can impact a company’s financial statements.

In most countries, primary financial statements are prepared on the historical cost basis of accounting without regard either to changes in the general level of prices. Accountants in the United Kingdom and the United States have discussed the effect of inflation on financial statements since the early 1900s.

General price level changes in financial reporting creates distortions in financial statements such as:

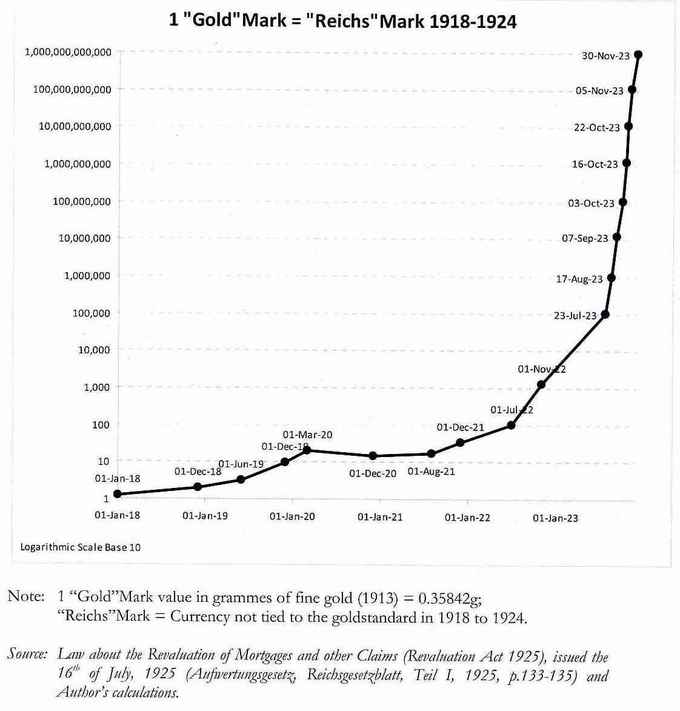

Inflation accounting, a range of accounting systems designed to correct problems arising from historical cost accounting in the presence of inflation, is a solution to these problems. This type of accounting is used in countries experiencing high inflation or hyperinflation. For example, in countries such as these the International Accounting Standards Board requires corporate financial statements to be adjusted for changes in purchasing power using a price index.

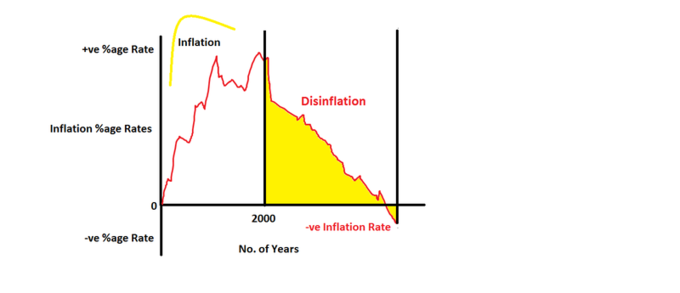

Disinflation is a decrease in the inflation rate; a slowdown in the rate of increase of the general price level of goods, services.

Describe what causes disinflation.

Disinflation is a decrease in the rate of inflation –a slowdown in the rate of increase of the general price level of goods and services in a nation’s gross domestic product over time. Disinflation occurs when the increase in the “consumer price level” slows down from the previous period when the prices were rising. Disinflation is the reduction in the general price level in the economy but for a very short period of time. Disinflation takes place only when an economy is suffering from recession.

If the inflation rate is not very high to start with, disinflation can lead to deflation–decreases in the general price level of goods and services. For example if the annual inflation rate for the month of January is 5% and it is 4% in the month of February, the prices disinflated by 1% but are still increasing at a 4% annual rate. Again, if the current rate is 1% and it is -2% for the following month, prices disinflated by 3% (i.e., 1%-[-2]%) and are decreasing at a 2% annual rate.

The causes of disinflation are either a decrease in the growth rate of the money supply, or a business cycle contraction (recession). If the central bank of a country enacts tighter monetary policy, (i.e., the government start selling its securities ) this reduces the supply of money in an economy. This contraction of the monetary policy is known as a “quantitative tightening technique. ” When the government sell its securities in the market, the supply of money reduces, and money becomes more upscale and the demand for money remains constant. During a recession, competition among businesses for customers becomes more intense, and so retailers are no longer able to pass on higher prices to their customers. The main reason is that when the central bank adopts contractionary monetary policy, its becomes expensive to annex money, which leads to the fall in the demand for goods and services in the economy. Even though the demand for commodities fall, the supply of commodities still remains unaltered. Thus the prices fall over a period of time leading to disinflation.

When the growth rate of unemployment is below the natural rate of growth, this leads to an increase in the rate of inflation; whereas, when the growth rate of unemployment is above the natural rate of growth it leads to a decrease in the rate of inflation also known as disinflation. This happens when people are jobless, and they have a very small portion of money to spend, which indirectly implies reduction in the supply of money in an economy.

Deflation is a decrease in the general price level of goods and services and occurs when the inflation rate falls below 0%.

Explain how deflation can effect a business

In economics, deflation is a decrease in the general price level of goods and services. This occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy. In turn, this allows one to buy more goods with the same amount of money over time.

Economists generally believe that deflation is a problem in a modern economy because they believe it may lead to a deflationary spiral.

In the IS/LM model (Investment and Saving equilibrium/ Liquidity Preference and Money Supply equilibrium model), deflation is caused by a shift in the supply-and-demand curve for goods and services, particularly with a fall in the aggregate level of demand. That is, there is a fall in how much the whole economy is willing to buy, and the going price for goods. Because the price of goods is falling, consumers have an incentive to delay purchases and consumption until prices fall further, which in turn reduces overall economic activity. Since this idles the productive capacity, investment also falls, leading to further reductions in aggregate demand. This is the deflationary spiral.

An answer to falling aggregate demand is stimulus, either from the central bank, by expanding the money supply; or by the fiscal authority to increase demand, and to borrow at interest rates which are below those available to private entities.

In more recent economic thinking, deflation is related to risk: where the risk-adjusted return on assets drops to negative, investors and buyers will hoard currency rather than invest it, even in the most solid of securities. This can produce a liquidity trap. A central bank cannot normally charge negative interest for money, and even charging zero interest often produces less stimulative effect than slightly higher rates of interest. In a closed economy, this is because charging zero interest also means having zero return on government securities, or even negative return on short maturities. In an open economy it creates a carry trade, and devalues the currency. A devalued currency produces higher prices for imports without necessarily stimulating exports to a like degree.

In monetarist theory, deflation must be associated with either a reduction in the money supply, a reduction in the velocity of money or an increase in the number of transactions. But any of these may occur separately without deflation. It may be attributed to a dramatic contraction of the money supply, or to adherence to a gold standard or to other external monetary base requirements.

In mainstream economics, deflation may be caused by a combination of the supply and demand for goods and the supply and demand for money, specifically: the supply of money going down and the supply of goods going up. Historic episodes of deflation have often been associated with the supply of goods going up (due to increased productivity) without an increase in the supply of money, or (as with the Great Depression and possibly Japan in the early 1990s) the demand for goods going down combined with a decrease in the money supply. Studies of the Great Depression by Ben Bernanke have indicated that, in response to decreased demand, the Federal Reserve of the time decreased the money supply, hence contributing to deflation.

The effects of deflation are thus: decreasing nominal prices for goods and services, increasing buying power of cash money and all assets denominated in cash terms, possibly decreasing investment and lending if cash holdings are seen as preferable (aka hoarding), and benefiting recipients of fixed incomes.