Overview of How to Assess Stand-Alone Risk

Total Beta is a measure used to determine risk of a stand-alone asset, as opposed to one that is a part of a well-diversified portfolio.

Learning Objectives

Describe different ways to assess stand-alone risks

Key Takeaways

Key Points

- Appraisers frequently value assets or investments, such as closely held corporations, as stand-alone assets.

- In terms of finance, the coefficient of variation allows investors to determine how much volatility ( risk ) they are assuming in relation to the amount of expected return from an investment.

- A lower coefficient of variation indicates a higher expected return with less risk.

Key Terms

- correlation coefficient: Any of the several measures indicating the strength and direction of a linear relationship between two random variables.

- probability distribution: A function of a discrete random variable yielding the probability that the variable will have a given value.

Stand-Alone Risk

Recall that Beta is a number describing the correlated volatility of an asset or investment in relation to the volatility of the market as a whole. However, appraisers frequently value assets or investments, such as closely held corporations, as stand-alone assets. Total Beta is a measure used to determine the risk of a stand-alone asset, as opposed to one that is a part of a well-diversified portfolio. It is able to accomplish this because the correlation coefficient, R, has been removed from Beta. Total Beta can be found using the following formula:

Total Beta =

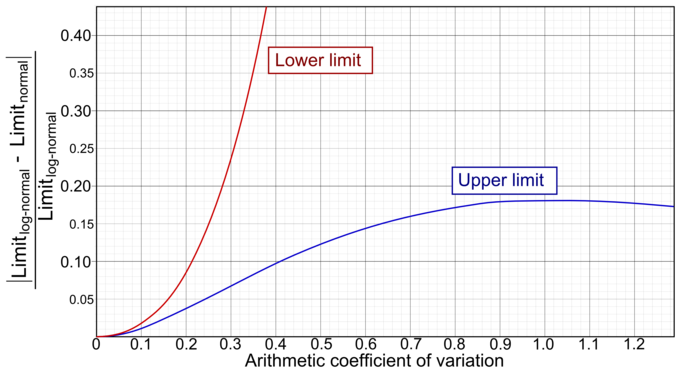

Another statistical measure that can be used to assess stand-alone risk is the coefficient of variation. In probability theory and statistics, the coefficient of variation is a normalized measure of dispersion of a probability distribution. It is also known as unitized risk or the variation coefficient. In terms of finance, the coefficient of variation allows investors to determine how much volatility (risk) they are assuming in relation to the amount of expected return from an investment. Volatility is measured in the form of the investment’s standard deviation from the mean return, thus the coefficient of variation is this standard deviation divided by expected return. A lower coefficient of variation indicates a higher expected return with less risk.

The coefficient of variation is a dimensionless number, meaning it is independent of the unit in which the measurement has been taken. For this reason, it becomes useful to us in finance to measure the risk of an investment in a way that it is not dependent upon other types of risk, such as that of the overall market.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- probability distribution. Provided by: Wiktionary. Located at: https://en.wiktionary.org/wiki/probability_distribution. License: CC BY-SA: Attribution-ShareAlike

- correlation coefficient. Provided by: Wiktionary. License: CC BY-SA: Attribution-ShareAlike

- Beta (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Coefficient of variation. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Diagram of coefficient of variation versus deviation in reference ranges erroneously not established by log-normal distribution. Provided by: Wikimedia. License: CC BY: Attribution