The capital asset pricing model helps investors assess the required rate of return on a given asset by measuring sensitivity to risk.

Learning Objectives

Calculate sensitivity to risk on a theoretical asset using the CAPM equation.

The capital asset pricing model helps investors assess the required rate of return on a given asset by measuring sensitivity to risk.

Calculate sensitivity to risk on a theoretical asset using the CAPM equation.

When considering assets for the diversification of an investment portfolio, investors and financiers use a variety of tools to project the required rate of return and risk of a given investment. All this really means is that investors are on the look out for ways to minimize risk, maximize returns, and invest intelligently in assets that are well-priced. The key assumption here is that the market will self-correct to adjust each investment option’s expected return to the relative risk of investing.

When measuring the ratio between risk and return on a given investment, the capital asset pricing model (CAPM) can be a useful tool. This model focuses on measuring a given asset’s sensitivity to systematic risk (also referred to as market risk) in relation to the expected return compared to that of a theoretical risk-free asset.

This sounds complicated, but it’s simpler than it seems. All this really means is that the CAPM tries to measure the risk the market will offer the asset compared to the risk-free rate, and make sure the expected return will offset that risk. To understand this concept, there are a few variables that are useful to identify up front:

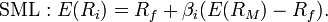

There are quite a few ways to rearrange the relationship between these variables to derive meaningful information. Like all equations, depending on what you know you can solve for what you don’t know as well. For a basic CAPM calculations, you would want to solve for the expected return on a security, which looks like this:

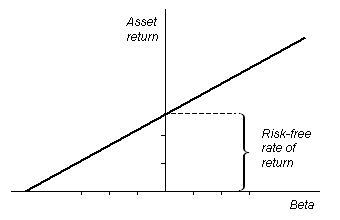

Through rearranging these variables, you can also take a look at the concept of the security market line (SML), which underlines a security’s relationship with systematic risk and respected return in a graphical format. This is written as:

A final application of the CAPM variables in relation to one another is in deriving a ratio that illustrates the relationship between risk and return. On the left side of the equation below, you have an assessment of the overall risk relative to a risk-free asset. On the right side, you have the overall return (similarly relative to a risk-free asset). This can be written as follows:

Investors can utilize the CAPM equation and its various implications to assess a variety of market investment opportunities to diversify a portfolio and identify undervalued assets.

The SML is the graphical representation of CAPM used to determine if an asset is priced to offer a reasonable expected return for the risk.

Analyze assets using the Security Market Line Approach.

The Security Market Line (SML) is the graphical representation of the capital asset pricing model (CAPM), with the x-axis representing the risk (beta), and the y-axis representing the expected return. It graphs the relationship between beta (β) and expected return, i.e. it shows expected return as a function of β. The y-intercept of the SML is equal to the risk-free interest rate, while the slope is equal to the market risk premium (the market’s rate of return minus the risk-free rate). The slope also represents the risk-return tradeoff at a given time. The SML is applicable to any asset.

Individual assets that are correctly priced are plotted on the SML. In the ideal world of CAPM, all assets are correctly priced and thus lie on the SML. In real market scenarios, we are able to use the SML graph to determine if an asset being considered for a portfolio offers a reasonable expected return for the risk. If an asset is priced at a point above the SML, it is undervalued, since for a given amount of risk, it yields a higher return. Conversely, an asset priced below the SML is overvalued, since for a given amount of risk, it yields a lower return.

Another way to think about real market applications of the SML would be in terms of buying and selling securities. If an asset is priced above the SML, and thus undervalued, it should be bought. If an asset is priced below the SML, and thus overvalued, it should be sold.

A discounted cash flow analysis is a highly useful tool for calculating the net present value of a given product, process, asset, or organization.

Translate future projected cash flows into present day dollars, incorporating risk and the time value of money

The discounted cash flow approach is a valuation method investors and organizations can use to assess the net present value (NPV) of an asset, process, product, or the overall organization. NPV analyses using the discounted cash flow approach are widely used across various industries to decide which projects to invest in. They are also used as valuation devices for investors when looking at company performance, using past performance to project future performance.

The discounted cash flow formula focuses on determining the relative time value of money of each projected cash flow (i.e. monthly, quarterly, annually, etc.), bringing each forecast of future value into present value terms. Just as in an NPV analysis, the ultimate end product will be the value of future profits (or losses) in today’s terms. It’s calculated as follows:

In situations of multiple cash flows over multiple periods of time, it is necessary to create a summation that can incorporate variance in both variables:

Sometimes cash flows are considered continuous. In such scenarios, the appropriate adjustment to the equation is:

When considering these formulas, you’ll need to understand your inputs. The inputs for a discounted cash flow analysis are:

Like any projection, the most important thing to keep in mind as either investor or strategist is uncertainty. The primary purpose of a future cash flow analysis is to balance expectations to consider existing and future resources to make the optimal decision (from a profit perspective). As a result, determining ‘r’ (required rate of return due to opportunity cost and risk) is absolutely critical to the success of these calculations.

We can estimate the value of a company’s equity by adding its risk premium to the yield to maturity on the company’s long-term debt.

Describe the process for the bond yield plus risk premium approach

The bond yield plus risk premium (BYPRP) approach is another method we can use to determine the value of an asset, specifically, a company’s publicly traded equity. BYPRP allows us to estimate the required return on an equity by adding the equity’s risk premium to the yield to maturity on company’s long-term debt.

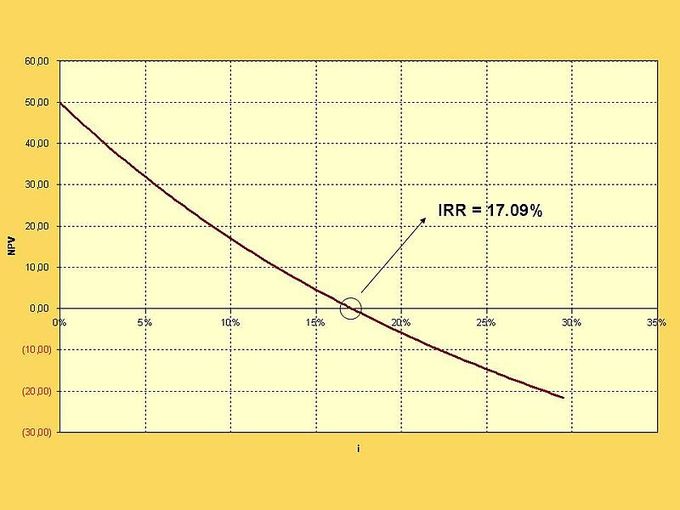

Simply put, the yield on a bond is the rate of return received from the investment. In the BYPRP approach, we use a bond’s yield to maturity, which is the discount rate at which the sum of all future cash flows from the bond (coupon payments and principal payments) are equal to the price of the bond. This is also referred to as the internal rate of return (IRR).

The equity risk premium is essentially the return that stocks are expected to receive in excess of the risk-free interest rate. The normal historical equity risk premium for all equities has been just over 6%. In general, an equity’s risk premium will be between 5% and 7%. Common methods for estimating the equity risk premium include:

Estimating the value of an equity using the bond yield plus risk premium approach has its drawbacks. We can only utilize the BYPRP approach if the entity has publicly traded debt, and it does not produce as accurate an estimate as the capital asset pricing model or discounted cash flow analysis.

Moreover, equity risk premium estimates can be highly inaccurate, while also varying wildly depending on which model is used. It can be very difficult to get an accurate estimate of the risk premium on an equity, having a duration of roughly 50 years, using a risk-free rate of such short duration as a 10-year Treasury bond.