Bonds have some advantages over stocks, including relatively low volatility, high liquidity, legal protection, and a variety of term structures.

Learning Objectives

Discuss the advantages of owning a bond

Key Takeaways

Key Points

- Bonds are a debt security under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon) and or repay the principal at a later date, which is termed the maturity.

- The volatility of bonds (especially short and medium dated bonds) is lower than that of equities ( stocks ). Thus bonds are generally viewed as safer investments than stocks.

- Bonds are often liquid – it is often fairly easy for an institution to sell a large quantity of bonds without affecting the price much.

- Bondholders also enjoy a measure of legal protection: under the law of most countries, if a company goes bankrupt, its bondholders will often receive some money back (the recovery amount).

- There are also a variety of bonds to fit different needs of investors.

Key Terms

- Convertible bonds: A convertible bond is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price.

- Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity.

- inflation-linked bonds: Inflation-indexed bonds (also known as inflation-linked bonds or colloquially as linkers) are bonds where the principal is indexed to inflation. They are thus designed to cut out the inflation risk of an investment.

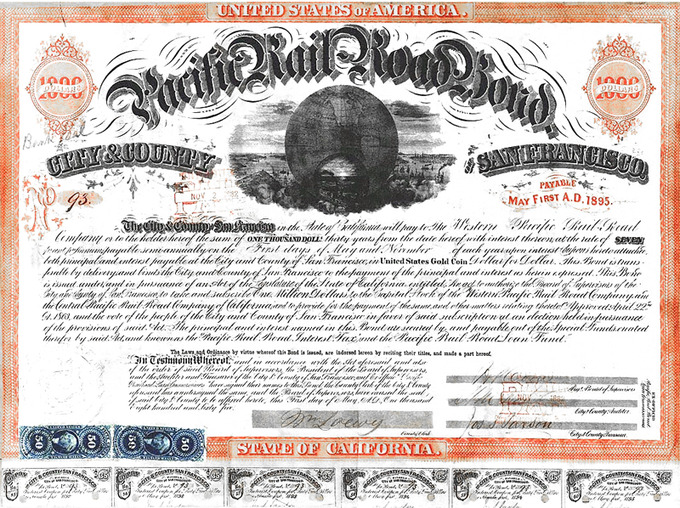

Definition and Purpose of a Bond

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. It is a debt security under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest (the coupon). In addition, the issuer might have to repay the principal at a later date, which is termed the maturity. Interest is usually payable at fixed intervals (semiannual, annual, and sometimes monthly). Very often the bond is negotiable; in other words, the ownership of the instrument can be transferred in the secondary market.

Bonds are bought and traded mostly by institutions like central banks, sovereign wealth funds, pension funds, insurance companies, hedge funds, and banks. Insurance companies and pension funds have liabilities, which essentially include fixed amounts payable on predetermined dates. They buy the bonds to match their liabilities and may be compelled by law to do this. Most individuals who want to own bonds do so through bond funds. Still, in the U.S., nearly 10% of all outstanding bonds are held directly by households.

Advantages of Bonds

Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is lower than that of equities (stocks). Thus bonds are generally viewed as safer investments than stocks. In addition, bonds do suffer from less day-to-day volatility than stocks, and the interest payments of bonds are sometimes higher than the general level of dividend payments.

Bonds are often liquid. It is often fairly easy for an institution to sell a large quantity of bonds without affecting the price much, which may be more difficult for equities. In effect, bonds are attractive because of the comparative certainty of a fixed interest payment twice a year and a fixed lump sum at maturity.

Bondholders also enjoy a measure of legal protection: under the law of most countries, if a company goes bankrupt, its bondholders will often receive some money back (the recovery amount), whereas the company’s equity stock often ends up valueless. Furthermore, bonds come with indentures (an indenture is a formal debt agreement that establishes the terms of a bond issue) and covenants (the clauses of such an agreement). Covenants specify the rights of bondholders and the duties of issuers, such as actions that the issuer is obligated to perform or is prohibited from performing.

There are also a variety of bonds to fit different needs of investors, including fixed rated bonds, floating rate bonds, zero coupon bonds, convertible bonds, and inflation linked bonds.

Disadvantages of Bonds

Bonds are subject to risks such as the interest rate risk, prepayment risk, credit risk, reinvestment risk, and liquidity risk.

Learning Objectives

Discuss the disadvantages of owning a bond

Key Takeaways

Key Points

- A bond is an instrument of indebtedness of the bond issuer to the holders. It is a debt security under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest and possibly repay the principal at a later date, which is termed the maturity.

- Fixed rate bonds are subject to interest rate risk, meaning that their market prices will decrease in value when the generally prevailing interest rates rise.

- Bonds are also subject to various other risks such as call and prepayment risk, credit risk, reinvestment risk, liquidity risk, event risk, exchange rate risk, volatility risk, inflation risk, sovereign risk, and yield curve risk.

- A company’s bondholders may lose much or all their money if the company goes bankrupt. There is no guarantee of how much money will remain to repay bondholders.

- Some bonds are callable. This creates reinvestment risk, meaning the investor is forced to find a new place for his money. As a consequence, the investor might not be able to find as good a deal, especially because this usually happens when interest rates are falling.

Key Terms

- Reinvestment risk: The reinvestment risk is the possibility that the investor might be forced to find a new place for his money. As a consequence, the investor might not be able to find as good a deal, especially because this usually happens when interest rates are falling.

- Exchange rate risk: The exchange rate risk is a financial risk posed by an exposure to unanticipated changes in the exchange rate between two currencies.

Definition and Purpose of a Bond

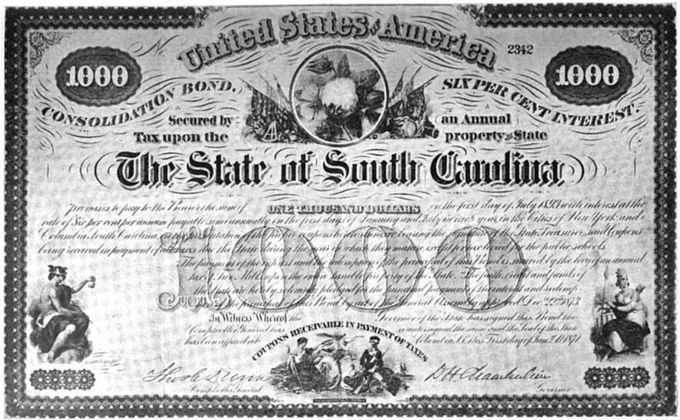

A bond is a debt owed by the enterprise to the bondholder. Commercial bonds are normally issued in units of 1,000 dollars. Bondholders receive regular interest on their investment, depending on the terms of the bond. As a safe security, bonds are widely bought and traded by financial institutions. However, bonds have certain disadvantages.

Fixed rate bonds are subject to interest rate risk, meaning that their market prices will decrease in value when the generally prevailing interest rates rise. Since the payments are fixed, a decrease in the market price of the bond means an increase in its yield. When the market interest rate rises, the market price of bonds will fall, reflecting the ability of investors to get a higher interest rate on their money elsewhere — perhaps by purchasing a newly issued bond that already features the newly higher interest rate.

Disadvantages of Bonds

Bonds are also subject to various other risks such as call and prepayment risk, credit risk, reinvestment risk, liquidity risk, event risk, exchange rate risk, volatility risk, inflation risk, sovereign risk, and yield curve risk.

Price changes in a bond will immediately affect mutual funds that hold these bonds. If the value of the bonds in a trading portfolio falls, the value of the portfolio also falls. This can be damaging for professional investors such as banks, insurance companies, pension funds, and asset managers (irrespective of whether the value is immediately “marked to market” or not). If there is any chance a holder of individual bonds may need to sell his bonds and “cash out”, the interest rate risk could become a real problem.

Bond prices can become volatile depending on the credit rating of the issuer – for instance if credit rating agencies like Standard and Poor’s and Moody’s upgrade or downgrade the credit rating of the issuer. An unanticipated downgrade will cause the market price of the bond to fall. As with interest rate risk, this risk does not affect the bond’s interest payments (provided the issuer does not actually default), but puts at risk the market price, which affects mutual funds holding these bonds, and holders of individual bonds who may have to sell them.

A company’s bondholders may lose much or all their money if the company goes bankrupt. Under the laws of many countries (including the United States and Canada), bondholders are in line to receive the proceeds of the sale of the assets of a liquidated company ahead of some other creditors. Bank lenders, deposit holders (in the case of a deposit taking institution such as a bank) and trade creditors may take precedence. There is no guarantee of how much money will remain to repay bondholders. In a bankruptcy involving reorganization or recapitalization, as opposed to liquidation, bondholders may end up having the value of their bonds reduced, often through an exchange for a smaller number of newly issued bonds.

Some bonds are callable, meaning that even though the company has agreed to make payments plus interest toward the debt for a certain period of time, the company can choose to pay off the bond early. This creates reinvestment risk, meaning the investor is forced to find a new place for his money. As a consequence, the investor might not be able to find as good a deal, especially because this usually happens when interest rates are falling.

Licenses and Attributions

CC licensed content, Shared previously

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC licensed content, Specific attribution

- Bond (finance). Provided by: Wikipedia. Located at: https://en.wikipedia.org/wiki/Bond_(finance). License: CC BY-SA: Attribution-ShareAlike

- inflation-linked bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Convertible bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Zero coupon bonds. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- South Carolina consolidation bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Bond (finance). Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Exchange rate risk. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- Reinvestment risk. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- South Carolina consolidation bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike

- South Carolina consolidation bond. Provided by: Wikipedia. License: CC BY-SA: Attribution-ShareAlike