6

6.1 Introduction

LEARNING OBJECTIVES

- Define international law.

- Understand sovereignty and the principles of international jurisdiction.

- Know what types of laws apply to businesses operating internationally.

- Understand the types of international jurisdiction.

According to the Small Business Association, 96 percent of the world’s customers live outside of the United States. The international market is lucrative but the international legal environment is different from the US legal environment. Therefore, it is important to be familiar with the basic concepts of doing business in the global economy.

Any business that operates across a national border is an International Business Entity (IBE). IBEs may be large, such as Samsung, or they may be small, such a souvenir stand that sells products across the border at Niagara Falls. When an IBE conducts business in another nation, it must comply with applicable laws in its nation of origin, in all nations where it does business, and applicable international laws. For example, if the Molson Coors Brewing Company, which is headquartered in Colorado, wants to sell its products in Mexico, it would need to comply with all applicable US, Mexican, and international laws, such as the US-Mexico-Canada Agreement (USMCA). This includes local and state laws within both the US and Mexico.

| US Laws | Foreign Laws | International Laws |

|

|

|

International law consists of rules and principles that apply to the conduct of nations, international organizations, and individuals across borders. There are two types of international law: public and private.

Public international law governs the relations among governments and international organizations. It includes the law of war, the acquisition of territory, and the settlement of disputes among nations. Public international law also includes agreements governing property rights, trade, outer space, and natural resources, such as the seas and mineral rights. For businesses, public international law is important because it defines human rights, such as the prohibition against child labor, slavery, and trafficking in people and stolen goods.

Private international law applies to private parties engaged in international commercial and legal transactions. Essentially, private international law identifies what law applies to an agreement and how the parties will settle any disputes with parties in other nations.

6.2 The Nature of International Law

A sovereign state is a political entity that governs the affairs of its own territory without being subjected to an outside authority. Nations are sovereign states. Sovereign states have sovereign immunity, which is the principle that courts of one nation lack the jurisdiction to hear cases against foreign governments. In the US, this principle is enacted in the Foreign Sovereign Immunities Act (FSIA) which prohibits US courts from hearing cases against foreign governments. Two exceptions are: (1) when the foreign government waives its right to immunity and agrees to the jurisdiction of the US court; and (2) when the foreign government is engaged in commercial, not political, activity.

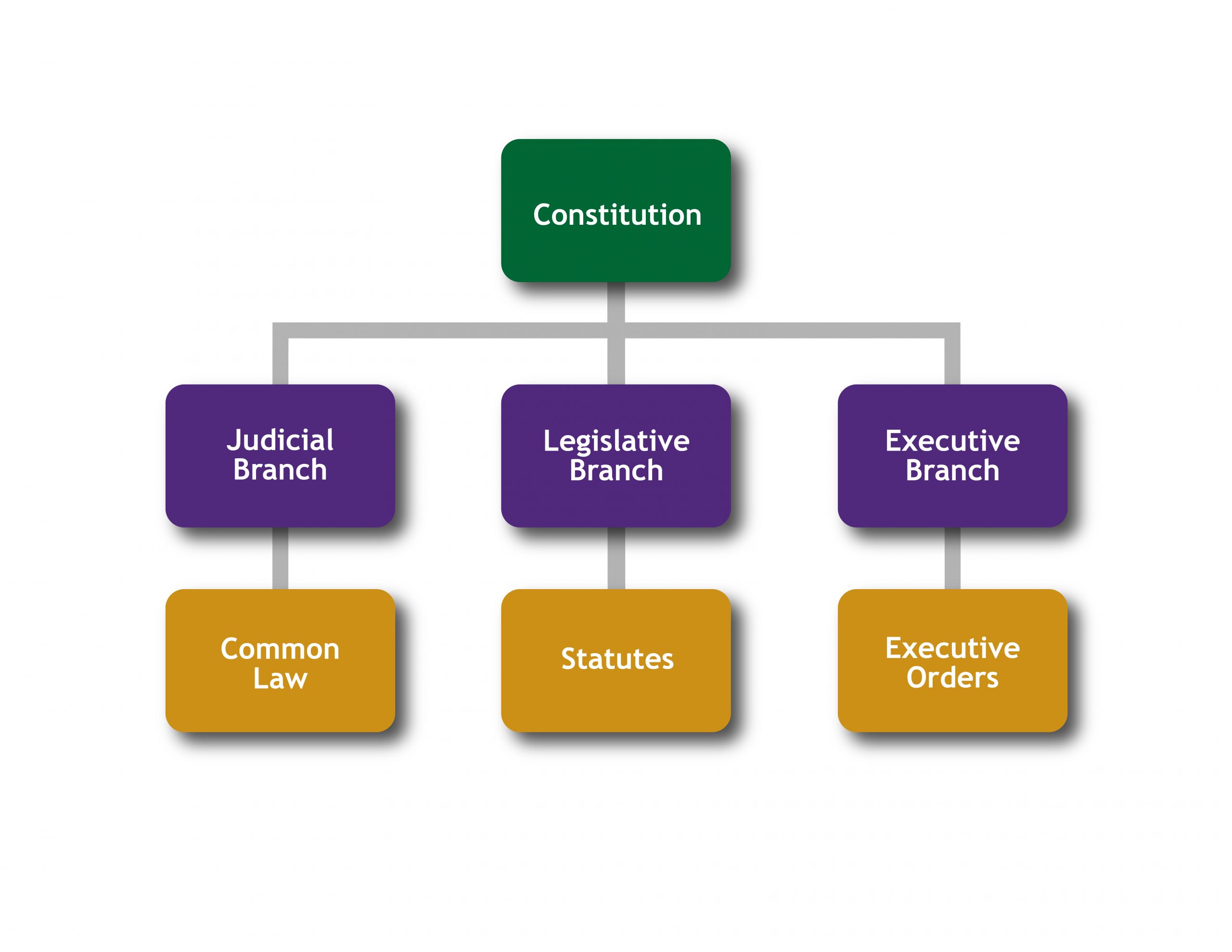

In domestic law, or law that is applicable within the nation where it is created, some authority has the power to create, apply, and enforce a rule of law system. There is a legitimate law-creating authority at the “top,” and the people to be governed at the “bottom.” This is a vertical structure of law, because there is some “higher” authority that imposes a rule of law on the people. In the United States, laws are made by the legislative branch (statutory law), by the judicial branch (common law), and by the executive branch (executive orders, rules, and regulations). This authority is derived from the US Constitution.

Figure 6.1 Vertical Nature of Domestic Law

It’s important to note, however, that not all law can be conceived as a vertical structure. Some, such as international laws, are best thought of as a horizontal structure. Treaties have a horizontal structure because sovereign nations are parties to international treaties. Since each nation is sovereign, that means that one nation is not legally dominant over another.

Figure 6.2 Horizontal Nature of International Law

If a party to a treaty has breached the agreement, enforcement can be difficult because no overarching power “above” the parties to a treaty exists. For this reason, many horizontal laws, like treaties, contain provisions that require the parties to submit to a treaty-created dispute resolution panel or other neutral tribunal, such as the International Court of Justice (ICJ).

Another common challenge in international law is that the laws are applicable only to parties who voluntarily choose to participate in them. This means that a sovereign nation cannot generally be compelled to submit to the authority of the international law if it chooses not to participate. Compare this with domestic law. Everyone within the United States is subject to the jurisdiction of certain state and federal courts, whether they voluntarily choose to submit to the jurisdiction or not. This is why fleeing criminals can legally be caught and brought to justice through extradition.

6.3 Sources of International Law

There are two main sources of international law: customary international law and treaties. It is important for all companies to understand the laws that apply to their activities so they can avoid criminal and civil liability.

Customary International Law

A custom is a widely accepted way of doing something. Before treaties and conventions started to become common during the 1900s, custom was the primary way international law was created. Customary international law is a body of international rules that has become binding through the pattern of consistent, long-standing behavior through a sense of legal obligation. For example, granting diplomatic immunity to visiting heads of state is customary international law. Historically, customary international law governed the rules of war, treatment of prisoners of war, and human rights. After World War II, many areas of customary law became the basis for UN Conventions. While customary international law still exists, the modern trend is to reduce legal obligations to writing and have nations expressly agree to their terms.

Treaties

A treaty is an agreement between two or more nations governed by international law. In essence, a treaty is a contract between sovereign nations. A bilateral treaty is an agreement between two nations. A multilateral treaty is an agreement between three or more nations. A convention is a multilateral treaty on a specific issue that concerns issues of worldwide importance, such as human rights, property rights, and international trade rules. For businesses, one of the most important conventions is the UN Convention on Contracts for the International Sale of Goods (CISG). This convention sets the global standard for international trade.

Treaties are adopted when the parties agree to its final form. Then the treaty needs to be ratified by the nations’ governments. To take effect in the US, treaties must be approved by two-thirds of the Senate. At that point, the treaty becomes part of US law. Finally, a treaty enters into force when it becomes legally binding on the parties. This may be a specific date identified in the treaty or when it is ratified by the parties.

Although many treaties may impact businesses, a few are particularly important to international trade.

GATT

The General Agreement on Tariffs and Trade (GATT) is a multilateral treaty to promote international trade by reducing or eliminating trade barriers, such as tariffs and quotas, between the member nations. GATT has been negotiated on and off since the 1940s as nations have sought to grow their economies through global commerce. In 1995, GATT members created the World Trade Organization (WTO) to stimulate international commerce and resolve trade disputes.

GATT and WTO are founded on three principles:

- Free trade. The major purpose of the treaty is to reduce trade barriers to increase global trade.

- Most Favored Nation Status. Member nations agree to treat every other member nation equally. If one nation receives a special discount on customs duties, then the discount must be extended to all other member nations.

- National Treatment. Member nations agree to treat imported goods the same as domestic ones after they have entered the nation. In other words, members cannot discriminate against foreign goods by imposing additional taxes after being subject to import taxes and duties.

The WTO resolves trade disputes between member nations and has the power to impose trade sanctions for non-compliance with GATT. If a member nation refuses to comply with a WTO ruling, affected members may retaliate by imposing punitive tariffs or other sanctions. For example, in the famous “banana battle,” the US and four Latin American nations filed a complaint with the WTO alleging that the European Union (EU) placed unfair restrictions on imported bananas and showed favoritism to their former colonies by buying bananas from them in violation of GATT. The WTO agreed and granted the US and the Latin American nations the right to impose sanctions on EU imports to their nations. The banana battle ended in 2009 after 20 years of trade restrictions.

CISG

The United Nations Convention on Contracts for the International Sale of Goods (CISG) promotes international trade by making sales law uniform and predictable across international boundaries. The US and most of its trading partners (except the United Kingdom) have adopted CISG, which results in the convention governing over two-thirds of the world’s trade. Some of its provisions include:

- CISG applies to contracts for the sale of commercial goods between merchants. It does not apply to the sale of goods to consumers for personal use.

- CISG applies automatically to contracts between parties located in different signatory nations. The convention does not depend on nationality; it depends on location.

- Contract parties can opt out. Parties can contract to be governed by a nation’s laws instead of CISG but they must expressly state their intention to not be bound by CISG.

- CISG does not require a written contract.

- CISG requires parties to negotiate in good faith and to modify contracts in the case of unforeseen circumstances.

- A buyer can avoid payment only after giving the seller notice and an opportunity to remedy the problem.

Regional Trade Agreements

Regional trade agreements promote international commerce by reducing trade barriers among member nations that are located near each other. One of the most famous is the European Union (EU) but more than half of international trade is covered by regional trade agreements throughout the world. An important trade bloc agreement is the Association of South East Asian Nations (ASEAN), which is a ten-nation trade bloc in Southeast Asia. ASEAN + 3 includes the ASEAN nations, as well as China, Japan and South Korea.

The US is part of the United States-Mexico-Canada Agreement (USMCA), which was formerly the North American Free Trade Agreement (NAFTA). USMCA reduces trade barriers among the three nations and updated NAFTA provisions, especially as it relates to e-commerce, labor, and intellectual property rights. These agreements create tremendous opportunities for businesses because they lower the costs associated with importing and exporting within the region.

Trade Regulations

Companies wishing to export or import products are subject to federal trade regulations. To export simply means to transport products to another nation. Export controls prohibit or restrict certain products from leaving a nation.

Companies wishing to import products are also subject to import controls. Import controls take many forms including tariffs, quotas, bans and restrictions. The US Department of Homeland Security Customs and Border Protection Agency (CBA) has a primary role in import control administration and regulation. For example, it inspects imports to classify them and to establish their tariff schedule.

Tariffs are import taxes that apply to certain goods imported from other nations. They make the imported product more expensive and keep the cost of domestic products attractive to consumers. CBA customs officers classify the imported goods, which determines the applicable tariff. The importer is responsible for complying with all import laws.

Quotas are simply limits on the quantity of particular imported goods. To protect domestic industries, a nation may limit the number of a competitor’s goods that are sold within the nation.

Bans apply to goods that are illegal to be imported, because they are dangerous to public safety, health, the environment, or national interests. For example, it is illegal to import items of cultural heritage from other nations without permission.

Along with the CBA, the US International Trade Commission investigates import injuries to the United States, such as dumping and subsidized imports. Dumping occurs when a foreign producer sells products for less than the cost of manufacturing. Subsidized imports are produced overseas for which a government has provided financial assistance. When dumping or subsidized imports materially injure or threaten to injure domestic producers, the United States may impose a countervailing duty for subsidized products or anti-dumping duty for dumped products. These duties, which are particular types of tariffs, reduce the negative impact that such practices could have on US companies. Safeguards are limited duration growth restrictions that are imposed when domestic markets are threatened or injured from imports. This allows for domestic markets to adjust to the surge from the import market. For example, the United States imposed safeguards on Chinese textiles in response to actual or threatened market disruption of the US textile industry.

6.4 US Laws that Apply to US Nationals Abroad

Extraterritoriality is the power of a nation’s laws to reach activities outside of its physical borders. In other words, it is the power of a nation to impose its laws in other nations. Congress expressly applies several important laws to US nationals working abroad.

US citizens working for US companies overseas are protected by US federal employment laws, such as Title VII of the Civil Rights Act and the Americans with Disabilities Act. This means that US companies may not illegally discriminate against US employees because those employees happen to work for the company on foreign soil rather than within the United States.

Business practices abroad are also regulated by the US government. For example, price-fixing conducted abroad by US companies is a violation of the Sherman Antitrust Act. Similarly, the Alien Torts Claims Act allows non-citizens to bring suit in US federal court against US businesses or citizens that have committed torts or human rights violations in foreign nations.

The Foreign Corrupt Practices Act

The Foreign Corrupt Practices Act (FCPA) is an anti-corruption law that prohibits the payment of bribes by US companies and their employees to foreign officials. Violation of this law is a criminal offense. It does, however, permit grease payments, or facilitating payments. Grease payments are only allowed to individuals who are not decision makers. For example, a small payment to a clerk to process paperwork, after a project has already been approved, is a grease payment.

US citizens are also prohibited from conducting transactions with terrorists or terrorist organizations. Conducting transactions with prohibited persons, entities or businesses can result in serious criminal violations, which carry significant financial penalties and long prison sentences.

6.5 Concluding Thoughts

Tremendous opportunities exist for companies that wish to operate in international markets. However, the international legal environment requires careful planning to avoid costly mistakes associated with violations of trade regulations, the formation of international contracts, and criminal and civil liability.