17

17.1 Introduction

LEARNING OBJECTIVES

- Learn when a partnership exists.

- Understand the rights and duties of partners.

- Comprehend how a partnership is terminated and the priority of distributing assets.

Partnerships are the most common business form in the United States. Partnerships may be express or implied, and they are the default business organization when two or more people work together who are not legally married. People do not need to call themselves partners for a partnership to exist, so it is important for business professionals to understand what constitutes a partnership so they do not inadvertently form a business entity that they do not intend. And, if they do intend to form a partnership, partners should understand their rights and duties towards each other.

17.2 Types of Partnerships

A partnership is a voluntary association of two or more people who jointly own and carry on a business for profit. Under the Uniform Partnership Act, a partnership is presumed to exist if the parties agree to share proportionally the business’s profits or losses.

There are only two required elements to form a partnership:

- A common interest to conduct business together; and

- An understanding to share profits and losses.

A general partnership is a partnership in which all partners participate fully in running the business and share equally in profits and losses, even if the partners’ monetary contributions vary.

A limited partnership is composed of one or more people who control the business and are personally liable for the partnership’s debts. These partners are called general partners and they have the power to make all types of business decisions and manage all aspects of the partnership. A limited partnership also has one or more people who contribute capital and share profits but who cannot manage the business and are liable only for the amount of their contribution. These partners are called limited partners. The main purpose of a limited partnership is to allow people to invest in a business without having to manage the business, and without risking more than the invested sum.

Partnerships may also have silent and secret partners. A silent partner is a partner who shares in the profits, has no active voice in management of the business, and whose existence is not publicly disclosed. A secret partner is a partner whose connection to the business is concealed from the public but may participate in the management of the business. The difference between a silent and secret partner relates to whether the partner may make management decisions.

A partnership by estoppel is an equitable doctrine in which a partnership is implied when one or more people represent themselves as partners to a third party who relies on that representation. A person who is deemed a partner by estoppel becomes liable for any credit extended to the partnership by the third party.

17.3 Partnership Agreements

A written partnership agreement is not required to form a partnership, but it is a best business practice. Given the variety of different types of partnerships, it is understandable that no formal requirements for a partnership agreement exist. However, the following provisions are ones that should be considered when writing a partnership agreement.

- Name of partnership. Partnerships may choose almost any name they would like. However, partnerships may not use the word “company” or any other word that would imply the business is a corporation. If partners choose a name that does not include their names, the fictitious name statement requires that they must give public notice as to the identities of the partners.

- Purpose and duration. Is the partnership for a limited time or for a specific purpose? Is it a joint venture between businesses that grants partners only limited authority and property rights? Is it a general partnership with the flexibility to grow the business as the market allows?

- Capital contributions. Partners may contribute cash, intellectual property rights, real and personal property, and goodwill to the partnership. Capital contributions do not include the partners’ business experience. An individual may also become a partner without making a capital contribution as long as the other partners agree to it.

- Methods of sharing profits and losses. Without this provision, the default rule is that each partner shares equally in the profits and losses of the partnership. These provisions often include any credit for capital contributions partners may receive in the event of dissolution.

- Effects of advances. If the partnership is short of cash and a partner agrees to advance money to the partnership, that cash advance could be considered either a personal loan or a capital contribution to the partnership. Determining in advance how that money will be spent, repaid, and/or credited within the partnership helps facilitate these types of transactions.

- Compensation. If general partners receive any salary or additional compensation for their management of the business, the terms of compensation should be clearly defined. In addition, the procedure for setting the amount and type of compensation should also be addressed.

- Fiscal year and accounting methods. How a partnership will handle accounting and tax liabilities are important to clearly define, especially because partnerships are flow-through tax entities.

- Property. Partnerships often use personal property of partners as well as property of the business. The default rule is that all property brought into the partnership or acquired by it becomes partnership property. If a partner does not want to lose property rights to the partnership or its creditors, he or she should specify that it remains personal property.

- Dispute resolution. If partners are unable to agree on how to manage the business, how will the deadlock be resolved? These provisions are especially helpful when there are an even number of partners to avoid dissolution when deadlock occurs.

- Modification. How may the partners modify the partnership agreement? Is unanimous consent required to add new partners or add new terms to the contract?

- Rights and obligations at dissolution. Partners should think about what will happen if a partner chooses to leave the partnership or dies. Can the remaining partner(s) buy out that partner’s share of the business? If so, under what terms or process?

It is important to remember that partnership agreements exist between partners in a business, not between the partners and third parties. Partnership agreements are contracts between individuals who want to work together. Therefore, provisions that help facilitate that business relationship within the particular industry may be appropriate.

17.4 Rights and Duties of Partners

Rights of Partners

Figure 17.1 Rights of Partners

All general partners have an equal right to manage the partnership’s business. This does not mean that partners cannot divide up responsibility for the day-to-day management of the business. Rather, partners have the right to enter into contracts on behalf of the partnership, hire employees, and engage in business transactions.

Partners also have a right to compensation for services on behalf of the partnership if they have an agreement for compensation beyond profit sharing. Compensation provisions are particularly common in limited partnerships where some partners are active in the management of business and others are not.

Partners also have the right to receive interest on cash advances made to the partnership. Similar to a loan, an advance is not automatically considered a capital contribution unless determined to be so under the partnership agreement.

Every partner is entitled to full and complete access to inspect the business records of the partnership. Each partner has the right to receive notices and information from all other partners regarding the business. Therefore, partners must notify other partners about material information related to the business and business interests.

Similarly, partners are entitled to an accounting when another partner has withheld profits from the partnership, when there are legal proceedings against the partnership, or upon dissolution.

Partners also have the right to indemnification from the partnership for actions of other partners. For example, if the partnership is sued because a partner commits a tort, the other partners may lose their monetary investment in the partnership but their personal assets are not at risk.

Partners are co-owners of partnership property. Unless altered by a partnership agreement, partners have an equal right to possess partnership property for business purposes.

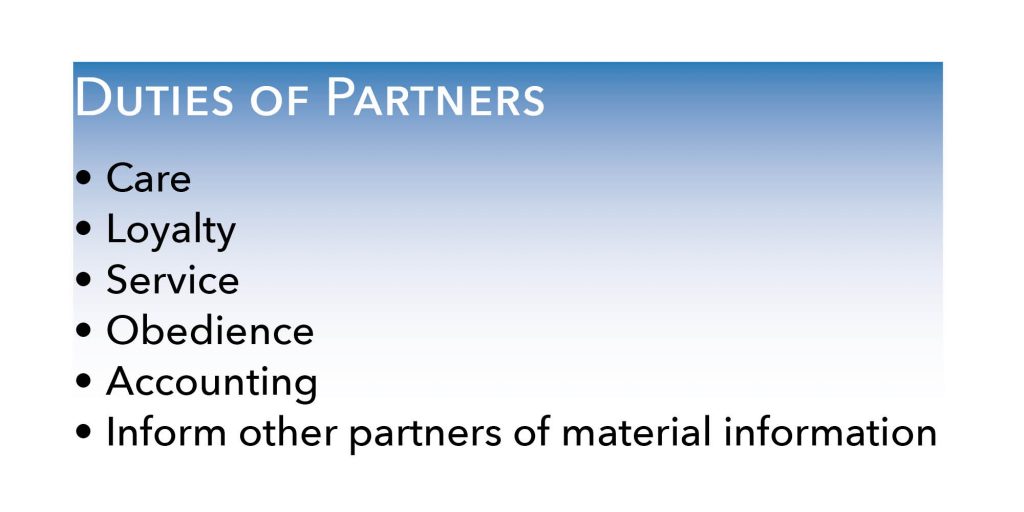

Duties of Partners

Figure 17.2 Duties of Partners

A partnership is a fiduciary relationship. Therefore, partners owe each other duties as a result of their relationship of trust and confidence.

Partners owe each other a duty of care. In a partnership, this generally means refraining from intentional and reckless misconduct. A partner is not liable to the other partners for simple negligence. Thus, the duty of care for partnerships is not particularly burdensome.

Partners also owe each other the duty of loyalty, which requires the partner to put the interests of the partnership before his or her own personal interests. Self-dealing and taking business opportunities away from the partnership are examples of breaches of the duty of loyalty.

From the duty of loyalty rise the remaining duties that partners owe each other: the duty of service, obedience, accounting, and to inform other partners of material information. When loyal to the partnership, a partner will work in service of the partnership, follow reasonable directions of other partners, provide an accounting of business assets, and inform the other partners of material information that affects the business.

17.5 Termination of a Partnership

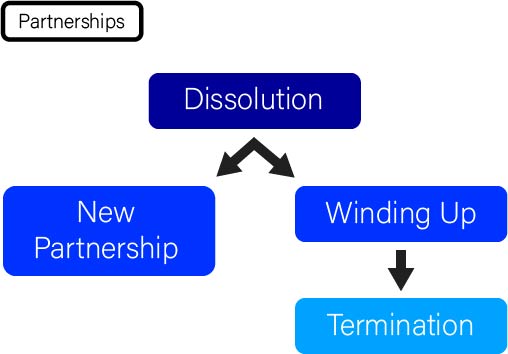

The legal end of a partnership is called dissolution. Dissolution may occur when partners mutually agree to stop working together, a partner dies or withdraws from the partnership, or a new partner is added. A new partnership is formed when there is a change in partners, whether an existing partner leaves or a new partner is added. Often, these types of changes do not impact the day-to-day operations of the business significantly. However, a new partnership agreement, and sometimes a new partnership name, is necessary.

If the partnership ceases to operate, then winding up occurs. Winding up is the process in which a partnership is liquidated. Partnership assets are reduced to cash, creditors are paid off, and any remaining profit and assets are distributed to the partners. Partial winding up occurs when the partnership has insufficient cash to operate its business and needs to sell its assets to pay off debts. Complete winding up occurs when the partnership is no longer viable or the partners decide not to work together any more. Termination is when the process of winding up is finished and the partnership no longer exists.

Figure 17.3 Dissolution of Partnership

Many factors can determine whether there is partial or complete winding up. For example, bankruptcy of a partner or the partnership, change in laws that make the subject matter of the business illegal, the death or incapacity of a partner, change in economic circumstances, or litigation.

During winding up, there is a priority of distributing the partnership assets. In general, all creditors other than partners are entitled to be paid before the partners divide up the partnership’s assets.

The priority of distributing the partnership assets is:

- Third party creditors;

- Partnership advances;

- Partnership capital; then

- Remaining profits to partners.

If the partnership does not have enough assets to cover its debts, then the priority of paying creditors is governed by the state law where the partnership exists. State laws vary regarding the priority of distributing assets, but most states follow a process called marshaling of assets. Marshaling of assets is an equitable doctrine for a fair distribution of a debtor’s assets among multiple creditors.

17.6 Concluding Thoughts

Partnerships are the most common business form in the United States, in large part because of their flexibility and ease of creation. However, if individuals want to create a partnership, a best practice would be to create a partnership agreement that identifies the rights and obligations of the partners. Partnerships are fiduciary relationships in which the law creates certain rights and obligations even if there is not a partnership agreement.