Lesson 1 What is Finance

Figure 1.1 Finance is the linchpin that connects and directs many parts of a business or organization. (credit: modification of work “Finance behind the Glass” by Max London/flickr, CC BY 2.0)

Why It Matters

Finance is essential to the management of a business or organization. Without good financial protocol, safeguards, and tools, running a successful business is more difficult. In 1978, Bacon Signs was a family- owned, regional Midwestern sign company engaged in the manufacture, sale, installation, and maintenance of commercial signage. The company was about to transition from the second to third generation of family ownership. Bacon Signs, established in 1901, had weathered the Great Depression, World War II, the Vietnam War, and the oil embargo and was working its way through historically high rates of inflation and interest rates. The family business had successfully struggled through the ebb and flow of the regional and national economy by providing quality products and service to its regional clients.

In the early 1980s, the company’s fortunes changed permanently for the better. The owner recognized that the custom signs built by his firm were superior in quality to the signs it installed for national franchises. The owner worked with the company’s banker and vice president of finance and operations to develop a production, sales, and financing plan that could be offered to the larger national sign companies. The larger companies agreed to subcontract manufacturing of midsize orders to Bacon Signs. The firm then made a commitment to build and deliver these signs on time and under budget. As Bacon Signs’ reputation for quality grew, so did demand for its products. The original financing plan anticipated this potential growth and was

designed to meet anticipated capital requirements so that the firm could expand how and when it needed to.

Bacon Signs’ ability to manufacture and deliver a high-quality product at a good price was the true value of the firm. However, without the planning and ability to raise capital facilitated by the financing plan, the firm would not have been able to act on its strengths at the critical moment. Financing was the key to expansion and financial stability for the firm.1

In this book, we demonstrate that business finance is about developing and understanding the tools that help people make consistently good and repeatable decisions.

What is Finance?

Learning Objectives

Learning Outcomes

By the end of this section, you will be able to:

- Describe the main areas in finance.

- Explain the importance of studying finance.

- Discuss the concepts of risk and return.

Definition of Finance

Finance is the study of the management, movement, and raising of money. The word finance can be used as a verb, such as when the First National Bank agrees to finance your home mortgage loan. It can also be used as a noun referring to an entire industry. At its essence, the study of finance is about understanding the uses and sources of cash, as well as the concept of risk-reward trade-off. Finance is also a tool that can help us be better decision makers.

Basic Areas in Finance

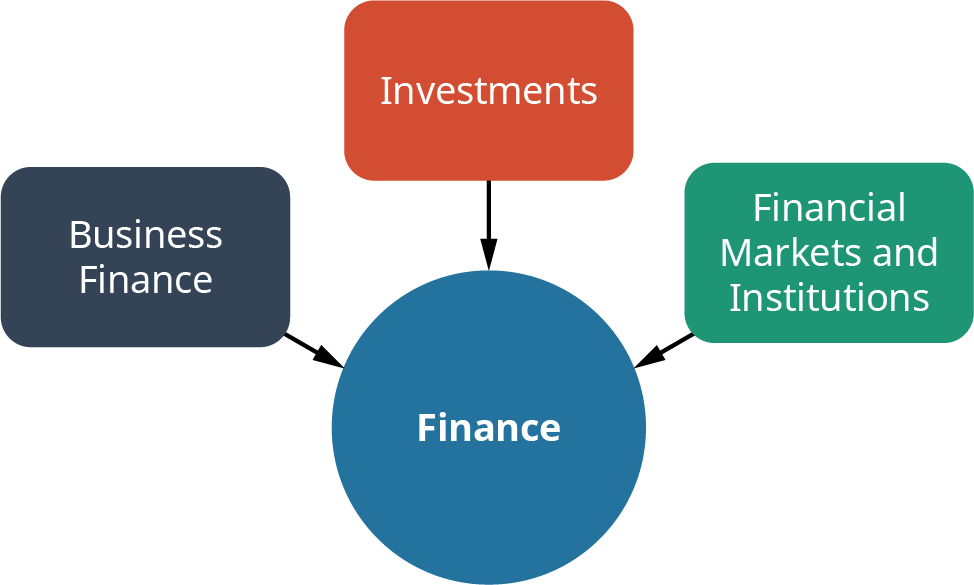

Finance is divided into three primary areas in the domestic market: business finance, investments, and financial markets and institutions (see Figure 1.2). We look at each here in turn.

Figure 1.2 The Three Basic Areas of Study in Finance

Business finance looks at how managers can apply financial principles to maximize the value of a firm in a risky environment. Businesses have many stakeholders. In the case of corporations, the shareholders own the company, and they hire managers to run the company with the intent to maximize shareholder wealth.

Consequently, all management decisions should run through the filter of these questions: “How does this decision impact the wealth of the shareholders?” and “Is this the best decision to be made for shareholders?”

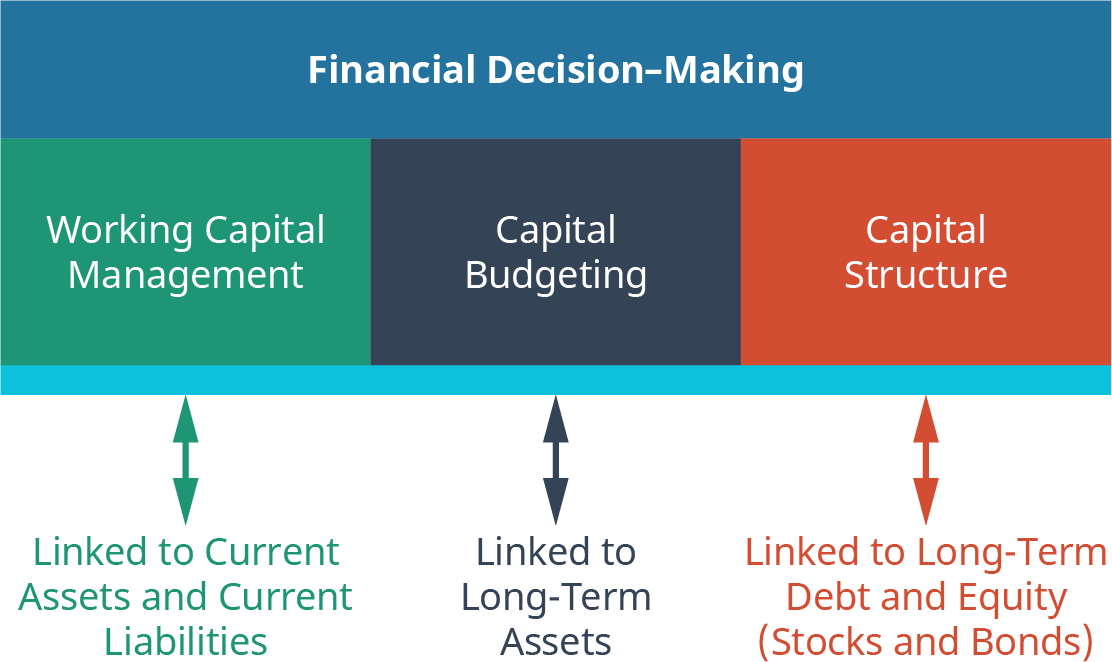

In business finance, managers focus on three broad areas (see Figure 1.3).

- Working capital management (WCM) is the study and management of short-term assets and liabilities. The chief financial officer (CFO) and the finance team are responsible for establishing company policy for how to manage WCM. The finance department determines credit policy, establishes minimum criteria for the extension of credit to clients, terms of lending, when to extend, and when to take advantage of short- term creditor financing. The accounting department basically implements the finance department’s policies. In many firms, the accounting and finance functions operate in the same department; in others, they are separate.

- Capital budgeting is the process of determining which long-term or fixed assets to acquire in an effort to maximize shareholder value. Capital budgeting decisions add the greatest value to a firm. As such, capital budgeting is thought to be one of the most important financial functions within a firm. The capital budgeting process consists of estimating the value of potential investments by forecasting the size, timing, and risk of cash flows associated with the investments. The finance department develops and compiles cash flow estimates with input from the marketing, operations, accounting, human resources, and economics departments to develop a portfolio of investment projects that collectively maximize the value of the firm.

- Capital structure is the process by which managers focus more specifically on long-term debt and increasing shareholder wealth. Capital structure questions require financial managers to work with economists, lenders, underwriters, investment bankers, and other sources of external financial information and financial capital. When Bacon Signs developed its financial plan, the executives included each of these three aspects of business finance into the plan.

Figure 1.3 How Corporate Finance Decision-Making Activities Relate to the Balance Sheet

Figure 1.3 demonstrates how the three essential decision-making activities of the financial manager are related to a balance sheet. Working capital management focuses on short-term assets and liabilities, capital budgeting is focused on long-term assets, and capital structure is concerned with the mix of long-term debt and equity financing.

- Dun & Bradstreet. “Bacon Signs, Inc.” D&B Business Directory. https://www.dnb.com/business-directory/company- profiles.bacon_signs_inc.90df737e33956dd7c76717a20e9d56ad.html#financials-anchor

Investments

Investments are products and processes used to create and grow wealth. Most commonly, investment topics include the discussion and application of the different types of financial instruments, delivery vehicles, regulation, and risk-and-return opportunities. Topics also include a discussion of stocks, bonds, and derivative securities such as futures and options. A broad coverage of investment instruments would include mutual funds, exchange-traded funds (ETFs), and investment vehicles such as 401k plans or individual retirement accounts (IRAs). In addition, real assets such as gold, real estate, and commodities are also common discussion topics and investment opportunities.

Investments is the most interesting area of finance for many students. Television programs such as Billions

and movies such as Wall Street make investing appear glamorous, dangerous, shady, or intoxicating,

depending on the situation and the attitude of the viewer. In these programs, the players and their decisions can lead to tremendous wealth or tremendous losses. In reality, most of us will manage our portfolios well shy of the extremes portrayed by the entertainment industry. However, we will need to make personal and business investment decisions, and many students reading this material will work in the investment industry as personal investment advisers, investment analysts, or portfolio managers.

Financial Markets and Institutions

Financial markets and institutions are the firms and regulatory agencies that oversee our financial system. There is overlap in this area with investments and business finance, as the firms involved are profit seeking and need good financial management. They also are commonly the firms that facilitate investment practices in our economy. A financial institution regulated by a federal or state agency will likely handle an individual investment such as the purchase of a stock or mutual fund.

Much of the US regulatory structure for financial markets and institutions developed in the 1930s as a response to the stock market crash of 1929 and the subsequent Great Depression. In the United States, the desire for safety and protection of investors and the financial industry led to the development of many of our primary regulatory agencies and financial regulations. The Securities and Exchange Commission (SEC) was formed with the passage of the Securities Act of 1933 and Securities Exchange Act of 1934. Major bank regulation in the form of the Glass-Steagall Act (1933) and the Banking Act of 1935 gave rise to government- backed bank deposit insurance and a more robust Federal Reserve Bank.

These regulatory acts separated investment banking from commercial banking. Investment banks and investment companies continued to underwrite and facilitate new bond and equity issues, provide financial advice, and manage mutual funds. Commercial banks and other depository institutions such as savings and loans and credit unions left the equity markets and reduced their loan portfolios to commercial and personal lending but could purchase insurance for their primary sources of funds, checking, and savings deposits.

Today, the finance industry barely resembles the structure your parents and grandparents grew up and/or worked in. Forty years of deregulation have reshaped the industry. Investment and commercial bank operations and firms have merged. The separation of activities between investment and commercial banking has narrowed or been eliminated. Competition from financial firms abroad has increased, and the US financial system, firms, and regulators have learned to adapt, change, and innovate to continue to compete, grow, and prosper.

The Financial Industry Regulatory Authority (FINRA) formed in 2007 to consolidate and replace existing regulatory bodies. FINRA is an independent, nongovernmental organization that writes and enforces the rules governing registered brokers and broker-dealer firms in the United States. The Securities Investor Protection Corporation (SIPC) is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that declare bankruptcy. SIPC is an insurance that provides brokerage customers up to

$500,000 coverage for cash and securities held by the firm.

The regulation of the financial industry kicked into high gear in the 1930s and for those times and conditions was a necessary development of our financial industry and regulatory oversight. Deregulation of the finance industry beginning in the 1970s was a necessary pendulum swing in the opposite direction toward more market-based and less restrictive regulation and oversight. The Great Recession of 2007–2009 resulted in the reregulation of several aspects of the financial industry. Some would argue that the regulatory pendulum has swung too far toward deregulation and that the time for more or smarter regulation has returned.

CONCEPTS IN PRACTICE

The Great Recession

The Great Recession of 2007–2009 exposed many of the weaknesses of our financial system. The ease with which banks could lower credit standards to allow ill-prepared consumers to purchase real estate and the resulting speed with which the world economy plunged into recession is astounding.

Regulation to address the economic crisis was also swift. Fortunately, Ben Bernanke, chairman of the Federal Reserve at the time, had throughout his career conducted extensive research into the causes of and potential resolution of the Great Depression of the 1930s.2 He was uniquely qualified to lead the economic response to the crisis. Some resulting laws moved to address the immediate needs and others to correct the underlying causes of the recession.

One immediate fix was the Troubled Asset Relief Program (TARP). TARP authorized the Treasury to buy illiquid assets in order to save the financial institutions so important to lubricating our economy. Politically this was a tough decision, as it appeared that the government bailed out greedy bankers. In the end, however, the program was justified because the economy immediately began a slow but steady recovery, most financial institutions did not fail, and the Treasury recouped all of its investment used in the bailout. However, individual homeowners suffered greatly.

The Dodd-Frank Act of 2008 attempted to address many of the underlying causes of the Great Recession by reorganizing and toughening the regulatory framework, including tighter oversight of critically important financial institutions. Dodd-Frank also created the Consumer Financial Protection Bureau (CFPB) to protect consumers from harm caused by unscrupulous banking activities. Today, the hope is that financial institutions will be stopped short of the gross negligence evident prior to 2007 and consumers won’t be left out in the cold due to actions beyond their control.

Sources: History Channel. “Here’s What Caused the Great Recession.” YouTube. May 15, 2018. https://www.youtube.com/watch?v=yM0uonkloXY. Accessed April 18, 2021; Randall D. Guynn, Davis Polk, and Wardwell LLP, “The Financial Panic of 2008 and Financial Regulatory Reform.” Harvard Law School Forum on Corporate Governance. November 20, 2010. https://corpgov.law.harvard.edu/2010/11/20/the- financial-panic-of-2008-and-financial-regulatory-reform/. Accessed April 18, 2021; Sean Ross. “What Major Laws Were Created for the Financial Sector Following the 2008 Crisis?” Investopedia. Updated March 31, 2020. https://www.investopedia.com/ask/answers/063015/what-are-major-laws-acts-regulating-financial-institutions-were-created-response-2008-financial.asp. Accessed April 18, 2021.

Why We Study Finance

Finance is the lubricant that keeps our economy running smoothly. Issuing a mortgage can be profitable for a bank, but it also allows people to live in their own homes and to pay for them over time. Do MasterCard, Venmo, and PayPal make money when you use their product? Sure, but think how much more convenient and safer it is to carry a card or use an app instead of cash. In addition, these services allow you to easily track where and how you spend your money. A well-regulated and independent financial system is important to capital-based economies. Our smoothly functioning financial system has removed us from the days of strictly bartering to our system today, where transactions are as simple as a tap on your mobile phone.

There are any number of professional and personal reasons to study finance. A search of the internet provides a long list of finance-related professions. Interviews with senior managers reveal that an understanding of financial tools and concepts is an important consideration in hiring new employees. Financial skills are among

- Brookings Institution. “Ben S. Bernanke.” Brookings Institute. https://www.brookings.edu/experts/ben-s-bernanke/; Ben S. Bernanke. “On Milton Friedman’s 90th Birthday.” The Federal Reserve Board. November 8, 2002. https://www.federalreserve.gov/ boarddocs/speeches/2002/20021108/

the most important tools for advancement toward greater responsibility and remuneration. Government and work-guaranteed pension benefits are growing less common and less generous, meaning individuals must take greater responsibility for their personal financial well-being now and at retirement. Let’s take a closer look at some of the reasons why we study finance.

There are many career opportunities in the fields of finance. A single course in finance such as this one may pique your interest and encourage you to study more finance-related topics. These studies in turn may qualify you for engaging and high-paying finance careers. We take a closer look at financial career opportunities in Careers in Finance.

A career in finance is just one reason to study finance. Finance is an excellent decision-making tool; it requires analytical thinking. Further, it provides a framework for estimating value through an assessment of the timing, magnitude, and risk of cash flows for long-term projects. Finance is important for more immediate activities as well, such as the development of budgets to assure timely distribution of cash flows such as dividends or paychecks.

An understanding of finance and financial markets opens a broader world of available financial investment opportunities. At one time, commercial bank deposits and the occasional investment in stocks, bonds, real estate, or gold may have provided sufficient coverage of investment opportunities, portfolio diversification, and adequate returns. However, in today’s market of financial technology, derivative securities, and cryptocurrencies, an understanding of available financial products and categories is key for taking advantage of both new and old financial products.

LINK TO LEARNINGJob InformationThe internet provides a wealth of information about types of jobs in finance, as well as reasons to study it. Investigate the Occupational Outlook Handbook (https://openstax.org/r/bls-gov) issued by the Bureau of Labor Statistics to see how many of the career opportunities in finance look interesting to you. Think about the type of people you want to work with, the type of work-related activities you enjoy, and where you would like to live. Read “5 Reasons Why You Should Study Finance” at Harvard Business School Online (https://openstax.org/r/why-study-finance) to gain a better understanding of why finance offers a broad career path and is intellectually stimulating and satisfying.

Risk and Return in Finance

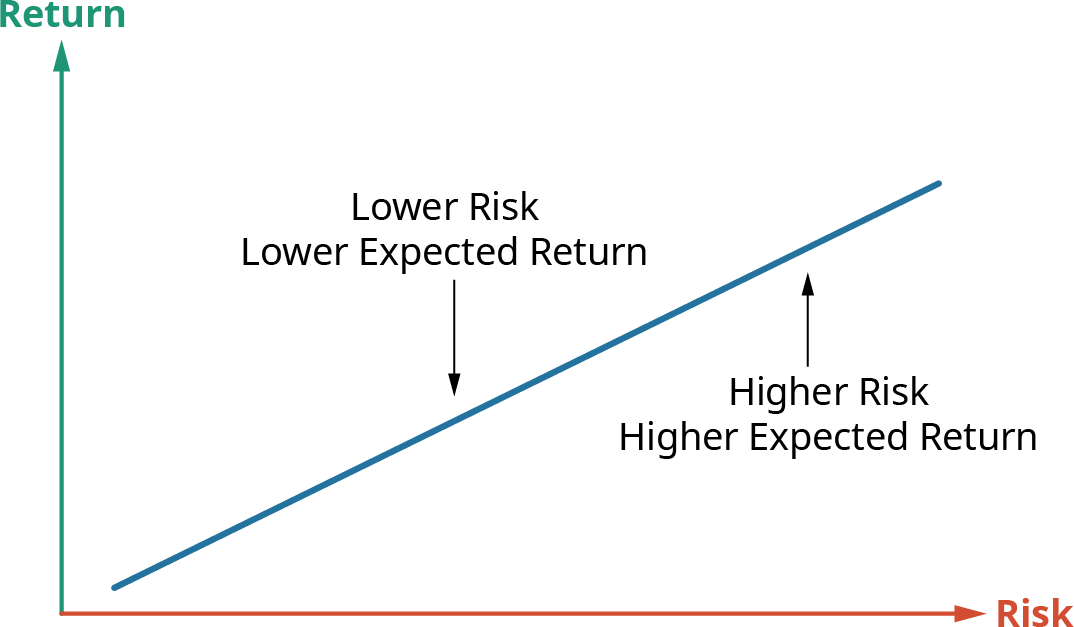

Finance tells us that an increase in risk results in an increase in expected return. The study of historical financial markets demonstrates that this relationship generally holds true and that riskier investments over time have provided greater returns. Of course, this is not true all the time and under all conditions; otherwise, where’s the risk?

At its most basic level, risk is uncertainty. The study of finance attempts to quantify risk in a way that helps individuals and organizations assess an appropriate trade-off for risk. Risk-return tradeoffs are all around us in our everyday decision-making. When we consider walking across the street in the middle of a city block or walking down to the marked intersection, we are assessing the trade-off between convenience and safety.

Should you buy the required text for your class or instead rely on the professor’s notes and the internet? Should you buy that new-to-you used car sight unseen, or should you spend the money for a mechanic to assess the vehicle before you buy? Should you accept your first job offer at graduation or hold out for the offer you really want? A better understanding of finance makes these types of decisions easier and can provide you, as the decision maker, with statistics instead of just intuition.

Return is compensation for making an investment and waiting for the benefit (see Figure 1.4). Return could be

the interest earned on an investment in a bond or the dividend from the purchase of stock. Return could be the higher income received and the greater job satisfaction realized from investing in a college education. Individuals tend to be risk averse. This means that for investors to take greater risks, they must have the expectation of greater returns. Investors would not be satisfied if the average return on stocks and bonds were the same as that for a risk-free savings account. Stocks and bonds have greater risk than a savings account, and that means investors expect a greater average return.

The study of finance provides us with the tools to make better and more consistent assessments of the risk- return trade-offs in all decision-making, but especially in financial decision-making. Finance has many different definitions and measurements for risk. Portfolios of investment securities tend to demonstrate the characteristics of a normal return distribution, or the familiar “bell-shaped” curve you studied in your statistics classes. Understanding a security’s average and variability of returns can help us estimate the range and likelihood of higher- or lower-than-expected outcomes. This assessment in turn helps determine appropriate prices that satisfy investors’ required return premiums based on quantifiable expectations about risk or uncertainty. In other words, finance attempts to measure with numbers what we already “know.”

Figure 1.4 Risk and Expected Return This describes the trade-off that invested money can bring higher profits if the investor is willing to accept the risk of possible loss.

The overall uncertainty of returns has several components.

- Default risk on a financial security is the chance that the issuer will fail to make the required payment. For example, a homeowner may fail to make a monthly mortgage payment, or a corporation may default on required semiannual interest payments on a bond.

- Inflation risk occurs when investors have less purchasing power from the realized cash flows from an investment due to rising prices or inflation.

- Diversifiable risk, also known as unsystematic risk, occurs when investors hold individual securities or smallish portfolios and bear the risk that a larger, more well-rounded portfolio could eliminate. In these situations, investors carry additional risk or uncertainty without additional compensation.

- Non-diversifiable risk, or systematic risk, is what remains after portfolio diversification has eliminated unnecessary diversifiable risk. We measure non-diversifiable risk with a statistical term called beta. Subsequent chapters on risk and return provide a more in-depth discussion of beta.

- Political risk is associated with macroeconomic issues beyond the control of a company or its managers. This is the risk of local, state, or national governments “changing the rules” and disrupting firm cash flows. Political risk could come about due to zoning changes, product liability decisions, taxation, or even nationalization of a firm or industry.

The Role of Finance in an Organization

Learning Outcomes

By the end of this section, you will be able to:

- Describe the finance function.

- Explain the role of finance and its importance within an organization.

The Finance Function

Finance has many functions within an organization, and there are many job titles to reflect the varied job responsibilities. The comptroller, or more commonly a controller, in a for-profit business relies heavily on a knowledge of accounting. Controllers are in charge of financial reporting and the oversight of the accounting activities necessary to develop those reports. Controllers are concerned with payroll functions, accounts receivable, and accounts payable including taxes, inventory control, and any number of short-term asset and liability tracking and monitoring activities. They aid internal and external auditors and are responsible for monitoring and implementing the day-to-day financial operations of the firm.

In most organizations, the treasurer might assume many of the duties of the controller. However, the treasurer is also responsible for monitoring cash flow at a firm and frequently is the contact person for bankers, underwriters, and other outside sources of financing. A treasurer may be responsible for structuring loan and debt obligations and determining when and from whom to borrow funds. Treasurers are also responsible for investing excess funds. Where a controller may face inward toward the organization, the treasurer often faces outward as a representative to the public.

The vice president of finance (VP-F) is an executive-level position and oversees the activities of the controller and treasurer. The chief responsibility of the VP-F is to create and mentor a sufficient and qualified staff that generates reports that are timely, accurate, and thorough.

The chief financial officer, or CFO, is in a “big picture” position. The CFO sets policy for working capital management, determines optimal capital structure for the firm, and makes the final decision in matters of capital budgeting. The CFO is also forward looking and responsible for strategic financial planning and setting financial goals. Compared to a VP-F, a CFO is less of a “hands-on” manager and engages more in visionary and strategic planning.

Financial Planning

Financial planning is critical to any organization, large or small, private or public, for profit or not-for-profit. Financial planning allows a firm to understand the past, present, and future funding needs and distributions required to satisfy all interested parties. For-profit businesses work to maximize the wealth of the owners. These could be shareholders in a publicly traded corporation, the owner-managers of a “mom and pop” store, partners in a law firm, or the principal owners of any other number of business entities. Financial planning helps managers understand the firm’s current status, plan and create processes and contingencies to pursue objectives, and adjust to unexpected events. The more thoughtful and thorough the financial planning process, the more likely a firm will be able to achieve its goals and/or weather hard times. Financial plans typically consider the firm’s strategic objectives, ethical practices, and sources and costs of funds, as well as the development of budgets, scenarios, and contingencies. The financial plan Bacon Signs developed was thorough enough to anticipate when and how growth might occur. The plan that was presented to commercial banks allowed the firm to be guaranteed new financing at critical moments in the firm’s expansion.

Good financial planning has a number of common features.

- It uses past, current, and pro forma (forward-looking) income statements. Pro forma income statements are created using assumptions from past events to make projections for future events. These income statements should develop likely scenarios and provide a sensitivity analysis of key assumptions.

- Cash flow statements are a critical part of any financial planning. Cash flow statements estimate the timing and magnitude of actual cash flows available to meet financial obligations.

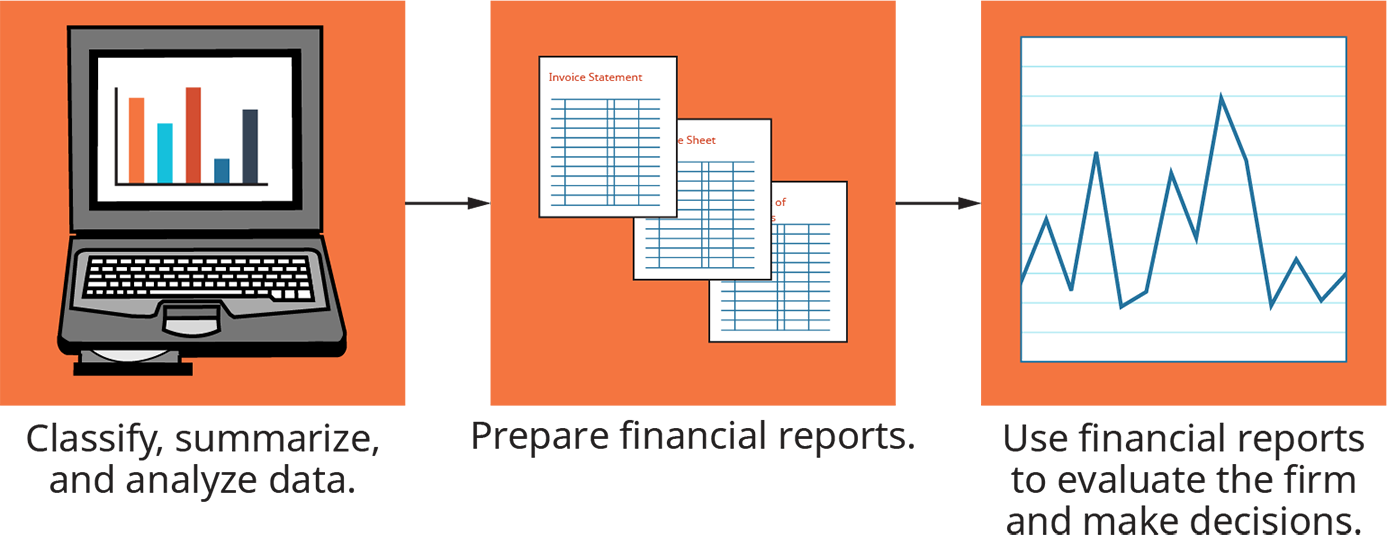

- Balance sheets are critical for demonstrating the sources and uses of funds for a firm. One of the most important aspects of business is accounting (see Figure 1.5).

- Forecasting in the form of expected sales, cost of funds, and microeconomic and macroeconomic conditions are essential elements of financial planning.

- Financial analysis including ratio analysis, common-size financial statements, and trend statements are important aspects of financial planning. Such analysis aids in the understanding of where a firm has been, how it stacks up against the competition, and the assessment of target objectives.

Figure 1.5 The Accounting System The accounting system relies on accurate data used to prepare all the financial reports that help to evaluate a firm.

Go to:https://www.sba.gov/business-guide/plan-your-business/write-your-business-plan the Small Business Administration website for Key Elements of a Business plan

Forecasting and Budgeting

Forecasting and budgeting are common practices for businesses, governmental agencies, not-for-profit firms, and individual households. As with many of the financial topics introduced in this chapter, these activities are valuable for individuals and businesses alike. Budgeting, or planning for the amount, sources, and uses of cash, occurs early in the planning process. It is common for businesses to have developed an annual budget well before the start of the year. With budgeting, a firm establishes objectives for the upcoming period by developing financial statements based on historical data and expectations, as well as aspirations for the future. The budgeting process helps the firm identify what actions need to be undertaken to achieve its objectives. However, no matter how strong the budgeting process, actual events can change the timing and magnitude of expected cash flows.

Financial forecasting addresses the changes necessary to the budgeting process. Budgeting can help identify the differences or variance from expectations, and forecasting becomes the process for adapting to those changes. We attribute to President Eisenhower the saying that “plans are worthless, but planning is everything.” That statement applies to business today as well as it did during his service in the military and government. The budgeting or planning process is a road map for organizations, and forecasting helps navigate the inevitable detours toward the firm’s objectives.

The budgeting process develops pro forma financial statements such as income and cash flow statements and balance sheets. These provide benchmarks to determine if firms are on course to meet or exceed objectives and serve as a warning if firms are falling short. Budgeting should involve all departments within a firm to

determine sources and uses of funds and required funding to meet department and firm objectives. The process should look to emulate successful processes and change or eliminate ineffective ones. Budgeting is a periodic renewal and reminder of the firm’s goals.

Financial forecasting often starts with the firm’s budget and recommends changes based on differences between the budgeted financial statements and actual results. Forecasting adjusts management behavior in the immediate term and serves as a foundation for subsequent budgets.

Importance of Data and Technology

Learning Outcomes

By the end of this section, you will be able to:

- Describe the role of data in finance.

- List and describe the various types of corporate data available.

- Explain how the various types of corporate data can be accessed and analyzed.

- Describe the impact of data digitization.

- Explain how stakeholders use data when making decisions.

Importance of Data

Financial data is important for internal and external analysis of business firms. More accurate and timely data leads to better business and financial decision-making. Financial budgeting and forecasting rely on the creation of several types of financial statements including income statements, the statements of cash flow, and balance sheets, as well as the notes and assumptions used to create the financial statements. Insiders such as executive and middle managers use financial data to evaluate and reevaluate decision-making. Having current and accurate data is key to making consistent value-adding decisions for a firm. Data helps inform managers about how and when to finance projects, which projects to undertake, and necessary changes to make regarding physical, financial, and human resource assets. “Gut feelings” and “seat-of-the-pants” decision-making tend to be inconsistent with value maximization.

Outsiders also use publicly available data about firms to make purchasing, investment, credit, and regulatory decisions. Customers, investors, lenders, suppliers, and regulators must be able to access a firm’s financial information. Investors need to determine how much they are willing to pay for a share of stock, banks need data to determine if a loan should be made, suppliers need financial information to determine if they should supply trade credit, and customers need to know that a firm has priced its products appropriately.

Basic Data Types

Financial statements provide some of the data needed for decision-making. Firms summarize data and develop at least three essential financial statements or reports.

- The income statement summarizes the flow of revenues and expenses over a specified period. Income statements for publicly traded companies are available quarterly.

- Statements of cash flow identify actual receipt and use of cash over a period.

- Balance sheets show the existing assets, liabilities, and equity as of a particular date.

These statements represent book values and reflect historical costs and accounting adjustments such as accumulated depreciation. Book values often differ significantly from market values. Market values look forward and reflect expectations, whereas book values represent what has occurred.

In addition to the internal data summarized on financial statements, firms and outside stakeholders also seek external sources of information. External data gathering includes surveys of customers and suppliers, market research, new product development, statistical analysis, agreements with creditors, and discussions with government officials. Broader macroeconomic data is also valuable as it applies to expected market demand, unemployment, inflation, interest rates, and economic growth.

The Impact of Digitization

Data digitization makes the storage and transmission of data easier and more cost effective. Some data starts out as digital data, such as that from a Microsoft Suite product. The Excel files and Word documents we create are ubiquitous and easily stored and transmitted. Cloud storage and video conferencing are now the norm.

Emails and Zoom meetings are quick, easy, and inexpensive ways to share and store information. Businesses now create an e-trail, or virtual paper trail, to document, verify, and share processes. Because data is now much easier to access, firms bear the added responsibility of ensuring that it is stored and secured properly so that individuals cannot inappropriately alter or delete information.

Data storage has changed significantly in the last decade as companies have moved the storage of digital data to the cloud. The advantages include only paying for the storage actually used, reduced energy consumption, access to specialized data protection services, and software and hardware maintenance. However, the risk of data hacks and the safety of data are key concerns in the storage of digitized information.

Uses of Data

Taken together and separately, the internally generated financial statements can provide managers with a wealth of information to enable superior decision-making. Harvard Business School identifies six ways managers can use financial statements.3

- Measuring the impact of business decisions such as new software, marketing plan, or product line

- Aiding in the development of budgets by creating a starting point for future expectations

- Aiding in cost cutting or the reduction of duplicate activities

- Providing data-supported strategic planning and visioning

- Ensuring consistent data and content across departments

- Motivating teams to set, meet, and exceed goals and objectives

CONCEPTS IN PRACTICE

How and Why Managers Use Financial Statements: The Case of Peloton

Should you lease a new car or buy one? Do you opt for the more expensive high-tech production equipment or reduce your upfront investment and pay higher labor costs over time? Is it better to finance a new product by borrowing money or selling new shares of stock? Should you manufacture overseas where the production costs are lower or in your own country where political and transportation costs are lower? Once you make your choice, how do you know if you’ve made the right decision? Understanding and applying financial principles can help. For example, consider Peloton, the leader in social exercising with its bike, treadmill, and yoga platforms. In 2012, the principal founder, John Foley, was inspired to start the company because he lacked the time to attend bicycle exercise classes due to his demanding career and growing family. He enjoyed cycling classes, but they could be expensive and often did not fit into his schedule. He recognized that the most popular instructors had developed a bit of a cult following and that the music playlist was a critical component for many followers. His choice of the company name, Peloton, comes from the French word for a “pack of bike riders,” familiar to anyone who has even loosely followed the annual Tour de France bike race. The company name evokes a measure of mystique and prestige.Peloton started small and underwent five funding rounds in seven years before the company went public with an initial public offering in September 2019. Foley and his friends had the idea that they were a “purposeful music company” and needed to touch on all aspects of the workout experience including the

bike; video, audio, and music content; clothing design; competition among the riders; data gathering; and instructors for livestream and on-demand classes. They were selling an experience, not a bicycle. The equipment is expensive—a Peloton bike typically costs over $2,000. Peloton equips its studios with state-of- the-art camera and music systems and pays its instructors top dollar. Along the way, the founders made several critical financial decisions. They kept control of the firm by using private funding at the start.

How can we tell if Peloton has managed its resources well? The company started with $400,000 of funding to develop a prototype in 2012. By 2018, firm value increased to $4 billion with yet another round of private investor funding. As of April 2021, Peloton is a publicly traded company with a stock value of $34 billion. The executives are sacrificing profits in the short term to generate growth and long-term profitability. The firm uses its financial statements to identify sources and uses of funds, to test the effectiveness of advertising, and to forecast future profitability. Analysts like the firm, the stock price is up, and by many financial measures, Peloton has been a great success. Time will tell if the decisions made over the last several years will lead to long-term profitability or if the company has overinvested in marketing only to miss current and long-term profits.

(Sources: Viktor. “The Peloton Business Model—How Does Peloton Work & Make Money?” Productmint. Updated May 9, 2021. https://productmint.com/the-peloton-business-model-how-does-peloton-make- money/. Accessed May 18, 2021; John Ballard. “If You Invested $5,000 in Peloton’s IPO, This Is How Much Money You’d Have Now.” The Motley Fool. June 6, 2020. https://www.fool.com/investing/2020/06/06/if-you- invested-5000-in-pelotons-ipo-this-is-how-m.aspx. Accessed May 18, 2021; Erin Griffith. “Peloton’s New Infusion Made It a $4 Billion Company in Six Years.” New York Times. August 3, 2018. https://www.nytimes.com/2018/08/03/technology/pelotons-new-infusion-made-it-a-4-billion-company-

in-6-years.html)

Careers in Finance

Learning Outcomes

By the end of this section, you will be able to:

- Describe current job opportunities in finance.

- Describe the financial analyst role.

- Describe the business analyst role.

Job Opportunities in Finance: Market Trends

There are many career opportunities in the field of finance. The Bureau of Labor Statistics (BLS) finds that as of May 2020, the median income for finance-related positions was $72,250 versus the overall median income of only $41,950. Further, the BLS predicts that close to an additional 500,000 new finance- and accounting-related jobs will be created by 2029.4 These new employment opportunities are in addition to the many openings that will become available as baby boomers continue to retire and leave the workforce.

Several of the BLS-listed finance careers do not even have finance or associated wording in the career titles. The BLS identifies finance skills as necessary for careers such as management analysts and market research analysts and work in logistics. Of course, many careers traditionally encourage the study of finance. These include job titles and descriptions such as these:

- Financial manager: Oversees aspects of and produces reports about an organization’s financial needs, uses, and related activities

- Investment relations associate: Prepares and presents company financial data to investors and other company stakeholders

- U.S. Bureau of Labor Statistics. Occupational Outlook Handbook. https://www.bls.gov/ooh/business-and-financial/home.htm

- Budget analyst: Reviews, plans, and evaluates an organization’s financial activities

- Credit analyst: Reviews financial and related information to determine the creditworthiness of potential clients and customers; typically works at commercial and investment banks, credit unions, and rating firms such as Moody’s or Standard and Poor’s

- Financial analyst: Collects and examines data to plan future activities and evaluate past decisions

- Personal financial advisor: Provides advice to clients for short-, intermediate-, and long-term financial planning

- Loan officer: Helps individuals and organizations apply for loans and typically works for depository financial institutions such as commercial banks

- Insurance underwriter: Evaluates risk and establishes prices for insurance products such as life, property, and casualty insurance

- Financial examiner: Evaluates and monitors the activities of depository institutions in an effort to assure proper practice and behavior

- Finance professor: Teaches college classes, engages in economic and financial research, and provides community service by serving on boards and providing financial expertise

LINK TO LEARNING

Best Jobs in FinanceYou can read more about possible careers in finance (https://openstax.org/r/thebalancecareers) at the Balance Careers website.

Financial Analyst Roles

Many executive-level finance officers worked their way up via the role of financial analyst. Job descriptions vary across firms, industries, and government organizations. However, the role of financial analyst usually includes market research, financial forecasting, modeling, cost analysis, and comparative valuations. Financial analysts gather data and produce financial reports in conjunction with multiple departments within a business or organization. They rely on marketing and production personnel to provide accurate sales forecasts, and they work with accountants to create accurate financial reports.

As a financial analyst, you need strong spreadsheet skills, the ability to develop financial models and pro forma financial statements, outstanding analytical skills, and an overall understanding of business processes.

Financial analysts possess a well-diversified collection of business and communication skills, both quantitative and qualitative. Figure 1.6 lists some tasks that financial analysts must perform on a daily basis. Some firms require an MBA or several years of business experience for their financial analysts.

Figure 1.6 Financial Analyst Tasks

Internal financial analysts are important for a successful firm or organization because their work can lead to more efficient and cost-effective use of financial and nonfinancial resources. Responsibilities include keeping current with market conditions, developing financial models, reconciling variance between forecasts and outcomes, and serving as a resource for management. Financial analysts fulfill their responsibilities through the development and analysis of financial data including ratio analysis, trend analysis, in-depth discussions with division managers, and the presentation and interpretation of information at meetings and on electronic platforms.

External financial analysts use similar resources and tools to evaluate financial instruments as an aid to investment companies, investment and commercial bankers, and individual investors who rely on their published reports. Various government agencies also use financial analysts to aid in regulatory oversight and enforcement.

A report from a 2019 BLS survey determines that financial analysts earn an average salary of $81,590, and jobs are predicted to grow at a faster-than-average rate of 5% through 2029.5

Business (or Management) Analyst Roles

The job description for a business analyst looks much like that for a financial analyst. However, the strong quantitative skills required for a financial analyst are less emphasized in favor of overall strategic thinking. A successful business analyst is able to evaluate business opportunities by using analytical thinking, industry best practices, process development, team building and organization, and information technology. They then communicate optimal courses of action to executive decision makers to maximize value in alignment with the vision and goals of the firm.

Business analysts can help develop strategy and tactics to move a firm forward. They aid in identifying challenges and solutions. Data-driven solutions help get products to market more quickly, evaluate performance, and optimize production and product mix. The Bureau of Labor Statistics identifies the following as typical business analyst duties:

- Gathering information about problems to be solved or procedures to be improved

- Interviewing personnel and conducting onsite observations to determine the methods, equipment, and personnel that will be needed

- Analyzing financial data, revenues and expenditures, and employment reports, among other data

- Finding root causes for problems and proposing solutions that may include new systems, procedures, or personnel changes

- Presenting findings to decision makers

- Conferring with managers to ensure changes work

The average salary for management analysts was $85,260 in May 2019, and the BLS projects 11% growth, or about 94,000 new jobs, over the next decade.6

Markets and Participants

Learning Outcomes

By the end of this section, you will be able to:

- Identify primary and secondary markets.

- Identify key market players.

Primary and Secondary Markets

Simply put, the primary market is the market for “new” securities, and the secondary market is the market for “used” securities. Think of the primary market as equivalent to the sale of new cars and the secondary market as equivalent to the sale of used cars. In practice, many market locales trade both new and used securities. For example, the stock markets trade equity securities daily, and most of the trading takes place among individual and institutional investors who own shares in publicly traded companies. Trading a share of Amazon, Facebook, or Nike stock has little impact and no direct cash flow to the underlying firm. However, the information provided by such transactions is valuable, as it is a costly and public real-time statement by investors of their perceptions of firm’s value and a reflection of satisfaction and expectations.

Some, though many fewer, transactions in the equity market are for the purchase and sale of new securities. Firms issue new shares of stock called seasoned equity offerings (SEOs) or initial public offerings (IPOs) into the market. These are issues of new shares of stock, previously untraded, and their issuance sends cash flows directly to the underlying firms. SEOs are new shares issued by established firms, and IPOs are new shares issued by firms going public for the very first time. Once the initial transaction takes place, purchasers of these new securities may trade them. However, the second and subsequent trades are secondary, not primary, market transactions.

Extensive primary market transactions take place weekly, when the Treasury Department auctions billions of dollars of new Treasury securities. These new securities repay maturing Treasury securities and provide for the ongoing liquidity and long-term borrowing needs of the federal government. Again, subsequent trading of this government debt occurs as secondary market transactions.

Key Market Players

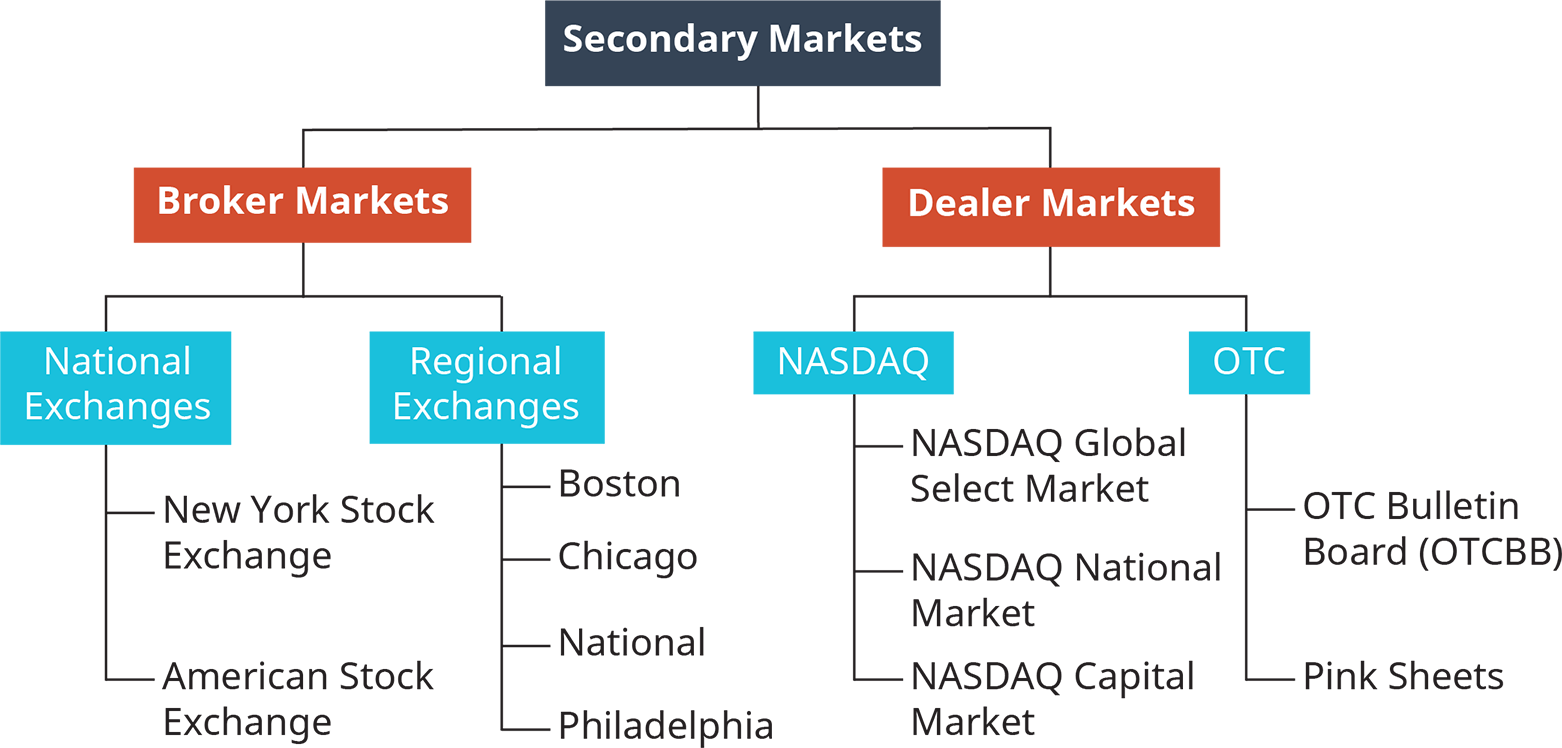

Key market players in finance include dealers, brokers, financial intermediaries, and you and me. Each of these players facilitates the exchange of products, information, and capital in different ways. The presence of these players makes financial transactions, easier, faster, and safer—essentially more efficient. You and your friends might engage in direct financial transactions, such as buying a coffee or borrowing money for a movie. These are typically small transactions. However, for transactions that are larger or more complicated, you need advanced financial entities with capital, expertise, and networks. The two segments of the secondary markets are broker markets and dealer markets, as Figure 1.7 shows. The primary difference between broker and dealer markets is the way each executes securities trades.

Figure 1.7 Broker and Dealer Markets

Financial dealers own the securities that they buy or sell. When a dealer engages in a financial transaction, they are trading from their own portfolio. Dealers do not participate in the market in the same manner as an individual or institutional investor, who is simply trying to make their investments worth as much as possible. Instead, dealers attempt to “make markets,” meaning they are willing and able to buy and sell at the current bid and ask prices for a security. Rather than relying on the performance of the underlying securities to generate wealth, dealers make money from the volume of trading and the spread between their bid price (what they are willing to pay for a security) and their ask price (the price at which they are willing to sell a security). By standing ready to always buy or sell, dealers increase the liquidity and efficiency of the market. Dealers in the United States fall under the regulatory jurisdiction of the Securities and Exchange Commission (SEC). Such regulatory oversight ensures that dealers execute orders promptly, charge reasonable prices, and disclose any potential conflicts of interest with investors.

Brokers

Brokers act as facilitators in a market, and they bring together buyers and sellers for a transaction. Brokers differ from dealers who buy and sell from their own portfolio of holdings. These firms and individuals traditionally receive a commission on sales.

In the world of stockbrokers, you may work with a discount broker or a full-service broker, and the fees and expenses are significantly different. A discount broker executes trades for clients. Brokers are required for clients because security exchanges require membership in the exchange to accept orders. Discount brokers or platforms such as Robinhood or E-Trade charge no or very low commissions on many of their trade executions, but they may receive fees from the exchanges. They also do not offer investment advice.

Full-service brokers offer more services and charge higher fees and commissions than discount brokers. Full- service brokers may offer investment advice, retirement planning, and portfolio management, as well as execute transactions. Morgan Stanley and Bank of America Merrill Lynch are examples of full-service brokers that serve both institutional and individual investors.

Financial Intermediaries

A financial intermediary, such as a commercial bank or a mutual fund investment company, serves as an intermediary to enable easier and more efficient exchanges among transacting parties. For instance, a commercial bank accepts deposits from savers and investors and creates loans for borrowers. An investment company pools funds from investors to inexpensively purchase and manage portfolios of stocks and bonds. These transactions differ from those of a dealer or broker. Brokers facilitate trades, and dealers stand ready to buy or sell from their own portfolios. Financial intermediaries, however, accept money from investors and may

create a completely different security all together. For example, if the borrower defaults on a mortgage loan created by the commercial bank where you have your certificate of deposit, your investment is still safely earning interest, and you are not directly affected.

Financial institutions usually facilitate financial intermediation. However, occasionally lenders and borrowers are able to initiate transactions without the help of a financial intermediary. When this occurs on a large scale, the process, known as disintermediation, can cause much turmoil in the financial markets. In the 1970s, inflation rose above 10% on an annual basis, and yet commercial banks were limited to offering maximum rates of 5% on their savings deposits.7 Savers bypassed banks and savings and loan associations to invest directly into Treasury securities and other short-term marketable securities. This lack of deposit funds and the subsequent behavior of the industry essentially eliminated the savings and loan industry and led to significant deregulation of commercial and investment banking in the United States.

The advantages of a robust network of financial intermediaries are many. They add efficiency to the financial system through lower transaction costs. They gather and disperse information to minimize financial abuse and fraud. They provide economies of scale and specialized knowledge. Finally, financial intermediaries are critical for the functioning of a capitalist economy.

Microeconomic and Macroeconomic Matters

Learning Outcomes

By the end of this section, you will be able to:

- Define microeconomics and macroeconomics.

- Discuss the relationship between microeconomics and macroeconomics.

- Explain the importance of macroeconomic variables in finance markets.

Microeconomics

In the business setting, finance is the intersection of economics and accounting. Financial decision makers rely on economic theory and empirical evidence combined with accounting data to make informed decisions for their organization. Economics is the study of the allocation of scarce resources. Economists attempt to understand the how and why of human and financial capital allocation to governments, businesses, and consumers.

We typically separate economics into two major areas, microeconomics and macroeconomics. Microeconomics is devoted to the study of these decisions of allocation by individual businesses, persons, or organizations.

Microeconomics helps us understand incentives and behavior, consumer choices and consumption, and supply and demand.

Our understanding of microeconomics aids in financial forecasting, planning, and budgeting by understanding how individuals are likely to respond to changes in product or service functionality, price, supply, quality, marketing, or other firm-induced stimulus. Empirical research by individuals, businesses, academics, and government provide evidence of what is going on and suggest what may change or stay the same.

Macroeconomics

Whereas microeconomics studies the decisions of individuals, macroeconomics examines the decisions of groups. Macroeconomic areas of study and concern include inflation, income, economic growth, and unemployment. When Bacon Signs developed a financial and operating plan to expand the business, the firm had to consider unemployment and inflation when estimating its price of labor and materials. Bacon Signs also had to consider interest rates when estimating the cost of borrowing money to expand the business.

Macroeconomic modeling is limited because models cannot capture every variable in testing and application.

- United States President and Council of Economic Advisers. “The 1970s: Inflation, High Interest Rates, and New Competition.”

Economic Report of the President. 1991. https://fraser.stlouisfed.org/files/docs/publications/ERP/pages/6688_1990-1994.pdf

However, financial forecasting must incorporate macroeconomic assumptions and expectations into individual firm and industry forecasts. Economic Foundations expands on our discussion of micro- and macroeconomics.

Importance of Macroeconomic Variables in Financial Markets

To make financial forecasts, managers need good information to understand the relationship among several economic variables. Working from small to large, sales forecasts estimate the likely price and quantity of goods sold. In doing so, the forecaster will consider local, regional, state, national, and international economic conditions. Inflation is an important macroeconomic variable that influences prices. Every quarter, financial information hubs, such as the Wall Street Journal (WSJ), and government agencies and regulatory bodies, such as the Treasury Department and the Federal Reserve, release estimates about expected and current inflation. This information informs policy makers how to adjust the money supply to meet target objectives. Financial forecasters pay close attention to current and expected interest rates, as they have a fundamental impact on the cost of raising money and determining the required rate of return for investment.

The unemployment rate helps inform financial forecasters about the expected cost of labor and the ability of employers to hire people if a firm plans to increase the production of goods or services. The stock market is a forward-looking macroeconomic variable and measures investor expectations about future cash flows and economic growth. Political economic variables such as changes in regulation or tax policy can also affect forecasting models.

LINK TO LEARNING

Politics and Stock Markets

Politics and stock market returns make for heated conversations. Who can run the country’s economic system better, Republicans or Democrats? Presidents often take the credit or blame for overall economic performance even though their actual influence is less than you might think. See this fun comparison chart (https://openstax.org/r/macrotrends-net) of political economic performance that measures stock market returns by each administration going back to President Warren Harding in 1920. Who had the highest overall increase in the market? What president in the 21st century oversaw an overall decline in the market? Just to get things going, who had better overall market returns after four years in office, Donald Trump or Barack Obama?

Each of the variables we have identified—inflation, interest rates, unemployment, economic growth, the stock market, and government fiscal policy—are macroeconomic factors. They are beyond the scope and influence of individual firms, but combined, they play a critical role in establishing the market in which firms compete. A better understanding of the interaction of these macro variables with each other and with individual micro or firm-specific variables can only strengthen financial forecasting and management decision-making.

CONCEPTS IN PRACTICE

Here, There, and Everywhere: Where Did Your iPhone Come From?How do international macroeconomic factors affect investment decisions for businesses and individuals? Foreign investment adds risk and potential return to the decision-making process. Macroeconomic factors such as different inflation rates, unexpected changes in currency exchange rates, and mismatched economic growth all add to the uncertainty of making investments abroad. Just as important are government regulations limiting pollution, exploitation of precious minerals, labor laws, and tariffs. Toss in a pandemic, and a bottleneck or two, and suddenly international macroeconomic factors can affect almost every aspect of commerce and international trade.

For example, how far did your new iPhone travel before it got into your hands? Apple is an American company headquartered in Cupertino, California, and worth over $2 trillion.8 However, your phone may have visited as many as six continents before it reached you. Each location touched by the Apple corporate hand requires an understanding of the financial impact on the product cost and a comparison with alternative designs, resources, suppliers, manufacturers, and shippers. This is where finance can get really fun!(Sources: Magdalena Petrova. “We Traced What It Takes to Make an iPhone, from Its Initial Design to the Components and Raw Materials Needed to Make It a Reality.” CNBC. December 14, 2018. https://www.cnbc.com/2018/12/13/inside-apple-iphone-where-parts-and-materials-come-from.html; Natasha Lomas. “Apple’s Increasingly Tricky International Trade-offs.” TechCrunch. January 6, 2019. https://techcrunch.com/2019/01/06/apples-increasingly-tricky-international-trade-offs/; Kif Leswing. “Here’s Why Apple Is So Vulnerable to a Trade War with China.” CNBC. May 13, 2019. https://www.cnbc.com/2019/05/13/why-is-apple-so-vulnerable-to-a-trade-war-with-china.html)

Relationship between Microeconomics and Macroeconomics

In the parable, a group of blind people happen upon an elephant for the first time, and they each touch one part—but one part only—of the elephant. Subsequently, when they each describe what they have discovered, the descriptions are vastly different. The group’s members become upset, accusing one another of inaccurate descriptions or worse. The parable demonstrates how individuals can make absolute truths from their own limited and subjective information. Financial decision makers run a similar risk, if they choose to recognize only their own findings and ignore other microeconomic or macroeconomic information and the interaction of these factors.

A common view to understanding economics states that macroeconomics is a top-down approach and microeconomics is a bottom-up approach. Financial decision makers need to see both the forest and the individual trees to chart a course and move toward a strategic objective. They need both the macro data, so important for strategic thinking, and the micro data, required for tactical movement. For example, the national rate of unemployment may not have been much help when Bacon Signs was searching for skilled laborers who could form neon signs. However, the unemployment rate helped inform the company about the probability of demand for new businesses and the signs they would need.

Financial Instruments

Learning Outcomes

By the end of this section, you will be able to:

- Differentiate between money and capital markets.

- List money market instruments.

- List capital market instruments.

Money Markets and Instruments

The money market is the market for short-term, low-risk, highly liquid securities. “Short-term” refers to money market securities having maturities of less than one year–sometimes as short as overnight. “Low risk” specifically means that the probability of default by the issuer in very unlikely. Defaulting on money market instruments is not unheard of, but it is very rare. “High liquidity” means that money market instruments can generally be sold in a secondary market very quickly and at or near their current market value. Finally, money market securities are homogeneous, meaning that within an issue of securities, a single

- Sergei Klebnikov. “Apple Becomes First U.S. Company Worth More Than $2 Trillion.” Forbes. August 19, 2020. https://www.forbes.com/sites/sergeiklebnikov/2020/08/19/apple-becomes-first-us-company-worth-more-than-2-trillion/

instrument is not unique. For example, if you purchase 13-week T-bills issued in the first week of January, each bill is identical to any other in the issue. Compare that to the purchase of physical assets such as a car or house, where each of the assets sold has some unique feature or measure of quality.

Financial institutions, corporations, and governments that have short-term borrowing and/or lending needs issue securities in the money market. Most of the transactions are quite large, with typical amounts in excess of $100,000. These large transactions are the norm when trading federal funds, repurchase agreements, commercial paper, or negotiable certificates of deposit. Our sample company, Bacon Signs, was much too small to participate directly in the money market. However, Bacon Signs’ borrowing rates were affected by changes in the money market. Treasury bills are also a very important component of the money market, and they trade in smaller amounts starting at $10,000 per T-bill.

Treasury bills (T-bills), are short-term debt instruments issued by the federal government. T-bills are auctioned weekly by the Treasury Department through the trading window of the Federal Reserve Bank of New York. The federal government uses T-bills to meet short-term liquidity needs. T-bills have very short maturities and a broad secondary market and are default-risk free. T-bills are also exempt from state and local income taxes. As a result, they carry some of the lowest effective interest rates on publicly traded debt securities. In addition to the regular auction of new T-bills, there is also an active secondary market where investors can trade used or previously issued T-bills. Since 2001, the average daily trading volume for T-bills has exceeded $75 billion.9

Commercial paper (CP) is a short-term, unsecured debt security issued by corporations and financial institutions to meet short-term financing needs such as for inventory and receivables. For example, credit card companies use commercial paper to finance credit card payments. Commercial paper has a maturity of one to 270 days. The short maturity reduces SEC oversight. The lesser oversight and the unsecured nature of CP means that only highly rated firms are able to issue the uninsured paper. The default rate on commercial paper is typically low, but default rates did increase into the double-digit range during the financial crisis of 2008.

Commercial paper typically carries a minimum face value of $100,000 and sells at a discount with the face value as the repayment amount. Corporations and financial institutions, not the government, issue commercial paper; thus, returns are taxable. Further, unlike T-bills, there is not a robust secondary market for CP. Most purchasers are large, such as mutual fund investment companies, and they tend to hold commercial paper until maturity.

Negotiable certificates of deposit (NCDs) are very large CDs issued by financial institutions. They are redeemable only at maturity, but they can and often do trade prior to maturity in a broad secondary market. NCDs, or jumbo CDs, are so called because they sell in increments of $100,000 or more. However, typical minimums amounts are $1,000,000 with a maturity of two weeks to six months.

NCDs differ in some important ways from the typical CD you may be familiar with from your local bank or credit union. The typical CD has a maturity date, interest rate, and face amount and is protected by deposit insurance. However, if an investor wishes to cash out prior to maturity, they will incur a substantial penalty from the issuer (bank or credit union). An NCD also has a maturity date and amount but is much larger than a regular CD and appeals to institutional investors. The principal is not insured. When the investor wishes to cash out early, there is a robust secondary market for trading the NCD. The issuing institution can offer higher rates on NCDs compared to CDs because they know they will have use of the purchase amount for the entire maturity of the NCD. The reserve requirements on NCDs by the Federal Reserve are also lower than for other types of deposits.

The market for federal funds is notable because the Federal Reserve targets the equilibrium interest rate on

- Henrik Bessembinder, Chester Spatt, and Kumar Venkataraman. “A Survey of the Microstructure of Fixed-Income Markets.” Journal of Financial and Quantitative Analysis. February 2020. https://www.sec.gov/spotlight/fixed-income-advisory-committee/ survey-of-microstructure-of-fixed-income-market.pdf

federal funds as one of its most important monetary policy tools. The federal funds market traditionally consists of the overnight borrowing and lending of immediately available funds among depository financial institutions, notably domestic commercial banks. The participants in the market negotiate the federal funds interest rate. However, the Federal Reserve effectively sets the target interest rate range in the federal funds market by controlling the supply of funds available for use in the market. Many of the borrowing and lending rates in our economy are a direct function of the federal funds rate.

Capital Markets and Instruments

The capital market is the market for longer-term financial instruments. The capital market is similar to the money market. However, maturities are longer, default risk varies to a greater degree from low to high, and liquidity is less certain, as is the homogeneity of the financial instruments. Broadly, we separate capital market instruments into debt instruments traded in the bond markets and equity securities traded on the stock markets.

The federal government issues Treasury notes and bonds to raise money for current spending and to repay past borrowing. The size of the Treasury market is quite large, as the US federal government over the years has accumulated a total indebtedness of over $28 trillion.10

Treasury notes are US government debt instruments with maturities of 2 to 10 years. The Treasury auctions notes on a regular basis, and investors may purchase new notes from TreasuryDirect.gov in the same way they would a T-bill. T-notes differ from T-bills in that they are longer term, pay semiannual coupon interest payments, and pay the par or face value of the note at maturity. Upon issue of a note, the size, number, and timing of note payments is fixed. However, prices do change in the secondary market as interest rates change. Like T-bills, T-notes are generally exempt from state and local taxes. There is an active secondary market for Treasury notes.

Longer-term Treasury issues, Treasury bonds, have maturities of 20 or 30 years. T-bonds are like T-notes in that they pay semiannual coupon interest payments for the life of the security and pay the face value at maturity. They are longer term than notes and typically have higher coupon rates.

State and local governments and taxing districts can issue debt in the form of municipal bonds (“munis”). Local borrowing carries more risk than Treasury securities, and default or bankruptcy is unlikely but possible. Thus, munis have ratings that run a spectrum similar to that of corporate bonds in that they receive a bond rating based on the perceived default risk. The defining feature of municipal bonds is that some interest payments are tax-free. Interest on munis is always exempt from federal taxes and sometimes exempt from state and local taxes. This makes them very attractive to investors in high income brackets.

Just as governments borrow money in the long-term from investors, so do corporations. A corporation often issues bonds for longer-term financing. Bond contracts identify very specific terms of agreement and outline the rules for the order, timing, and amount of contractual payments, as well as processes for when one or more of the required activities lapse. A bond contract, known as an indenture, includes both standard “boilerplate” contract language and specific conditions unique to a particular issue. Because of these non- standardized features of a bond contract, the secondary market for trading used bonds typically requires a broker, dealer, or investment company to facilitate a trade.

An important goal of business executives is to maximize the owners’ wealth. For corporations, shares of stock represent ownership. Stocks are difficult to price compared to bonds. Bonds have contracts that specify the number and amount of all payments made by the firm to the purchasers of bonds. Stock cash flows are far more uncertain than bond cash flows. Stocks might or might not have periodic dividend payments, and an investor can plan to sell the stock at some point in the future. However, no contract guarantees the size of the dividends or the time or resale price of the stock. Thus, the cash flows from stock ownership are more

- Trading Economics. “United States Government Debt.” Trading Economics. https://tradingeconomics.com/united-states/ government-debt

uncertain and risky than cash flows from bonds.

Ownership of corporations is easily transferable if a company’s stock trades in one of the organized stock exchanges or in the over-the-counter (OTC) market. Most of the trading consists of used or previously issued stocks in the over-the-counter market and organized exchanges. The two largest stock exchanges in the world are the New York Stock Exchange (NYSE) and the NASDAQ. Both exchanges are located in the United States.

Concepts of Time and Value

Learning Outcomes

By the end of this section, you will be able to:

- Explain the impact of time on saving and spending.

- Describe economic value.

Many students don’t have a choice between saving and spending. College is expensive, and it is easy to spend every dollar you earn and to borrow to meet the rest of your obligations. Businesses, however, continually make decisions about when and how much money to borrow or invest. Bacon Signs established banking relationships to borrow money when needed to expand the business or a product line. Sometimes the best decision is to invest as soon as possible to grab opportunities, and other times it is better to delay new investment in order to pay dividends to the owners of the company.

LINK TO LEARNING

The Dow Jones Industrial Average Marches On!

Once you begin to save and invest, here is a “fun fact” about the Dow Jones Industrial Average (DJIA) (https://openstax.org/r/investopedia-djia), also known as the Dow 30. It first appeared on May 26, 1896, as a quick way for stock traders to assess if the stock market had gone “up or down” each day and by how much. Here we are over 100 years later, and the Dow 30 index is alive and well. Of course, the 30 companies have changed, but the index does represent a continuous yardstick to measure stock performance over time. As Table 1.1 shows, it took from 1906 to 1972, or a little over 66 years, for the Dow 30 to increase tenfold, from a value of 100 to a value of 1,000. The next tenfold increase from 1,000 to 10,000 took only a little under 27 years from 1972 to 1999. Time will tell if or when the Dow 30 will top 100,000 at the closing bell.

|

Date |

|

|

41 |

5/26/1896 |

|

100 |

1/12/1906 |

|

1,000 |

11/14/1972 |

|

10,000 |

3/29/1999 |

|

20,000 |

1/25/2017 |

|

30,000 |

11/24/2020 |

Table 1.1 The Dow 30 Closing Milestones and Dates

Impact of Time on Saving and Spending

The choice to spend or save and invest is really a choice between consumption today versus consumption in

the future. Economists, investment advisers, your friends, and mine love to discuss the trade-off of consumption now or later—even if not in those words. We have all heard conversations that go something like this: “Let’s go grab a beer—you can study for tomorrow’s exam in the morning.” Or “My father’s investment adviser told me that if I invest $500 per month for the next 30 years and earn an annual rate of 10% on my investments, I will have invested $180,000 over time but accumulated an investment portfolio worth over $1.13 million!”

An important aspect of the trade-off between saving and spending involves your short-, intermediate-, and long-term goals. Delaying consumption until later comes with risks. Will your consumption choices still be available? Will the prices be attainable? Will you still be able to consume and enjoy your future purchases?

When saving for short-term objectives, the safety of the principal invested is important, and the value of compounding returns is minimal compared to longer-term investments. Most short-term investors have a low tolerance for risk and hope to beat the rate of inflation with a little extra besides. An example could be to start a holiday savings account at your local bank as a way to save, earn a small rate of return, and assure that you have funds set aside for consumption at the end of the year.

An intermediate investment may be to save for a new car or for the down payment on a house or vacation home. Again, maintaining the principal is important, but you have some time to recover from poor investment returns. Intermediate-term investments tend to earn higher average annual rates of return than short-term investments, but they also have greater uncertainty and risk.

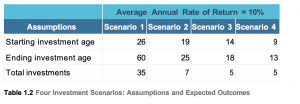

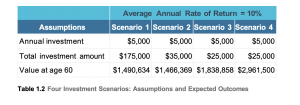

Long-term investments have the advantage of enough time to recover from temporary poor performance and the luxury of compounded returns over a long period. Further, long-term investments tend to have greater risk and higher expected average annual rates of return. Even though this is a business finance text, sometimes a personal finance example is easier to relate to. To illustrate, Table 1.2 demonstrates four different investment scenarios. In scenario 1, you invest $5,000 annually from ages 26 through 60 into an account earning an average annual rate of return of 10% per year. Over your lifetime, you invest a total of $175,000, and at age 60, you have an estimated portfolio value of $1,490,634. This is a healthy amount that has almost certainly beaten the average annual rate of inflation. In scenario 1, by investing regularly, you accumulate roughly 8.5 times the value of what you invested. Congratulations, you can expect to become a millionaire!

Compare your results in scenario 1 with your college roommate in scenario 2, who is able to invest $5,000 per year from ages 19 through 25 and leave her investments until age 60 in an account that continues to earn an annual rate of 10%. She makes her investments earlier than yours, but they total only $35,000. However, despite a much smaller investment, her head start advantage and the high average annual compounded rate of return leave her with an expected portfolio value of $1,466,369. Her total is almost as great as the amount you would accumulate, but with a much smaller total investment.

Average Annual Rate of Return = 10%

Scenarios 3 and 4 are even more dramatic, as can be seen from a review of Table 1.2. In both scenarios, only five $5,000 investments are made, but they are made earlier in the investor’s life. Parents or grandparents could make these investments on behalf of the recipients. In both scenarios, the portfolios grow to amounts greater than those of you or your roommate with smaller total investments. The common factor is that greater time leads to additional compounding of the investments and thus greater future values.

Definition of Economic Value